If you want to claim either the Lifetime Learning Credit or the American Opportunity Credit for educational purposes, be sure to submit your IRS Form 8863, known as Education Credits. The primary difference between the Lifetime Learning Credit and the American Opportunity Credit is that the first is not refundable while the second one is. In this blog post we’ve prepared all the important information you’ll need to know about form 8863 instructions.

Who files Form 8863?

Every student enrolled in an accredited educational institution (at least half-time) may be eligible to receive a credit for qualified expenditures. The program the student is enrolled in must be a recognized educational credential, otherwise the student will not be able to receive the credit. Here you may read more about what qualifies as an eligible institution and how to claim your educational tax refund.

What is Form 8863 used for?

Because students spend money on educational materials needed to attend classes or prepare additional tasks, it may be difficult to afford all those expenses without some extra financial help. Form 8863 is specifically created to request education credits 2018 for qualified expenses that were paid to an educational institution. Those expenses may include the required enrollment or tuition fees as well as supporting materials purchased at the institution.

With the American Opportunity Credit you may claim up to $2,500 for every eligible student. 40% of this credit may be refundable. The Lifetime Learning Credit allows you to claim up to $2,000 per return. This credit is not refundable and is available for an unlimited number of tax years.

Is IRS Form 8863 accompanied by other forms?

This document must be sent to the IRS with your 1040 or 1040A which are the documents for reporting your taxable income. When completing your 8863, you’ll have to provide some numbers from your 1040 or 1040A forms.

How to fill Form 8863?

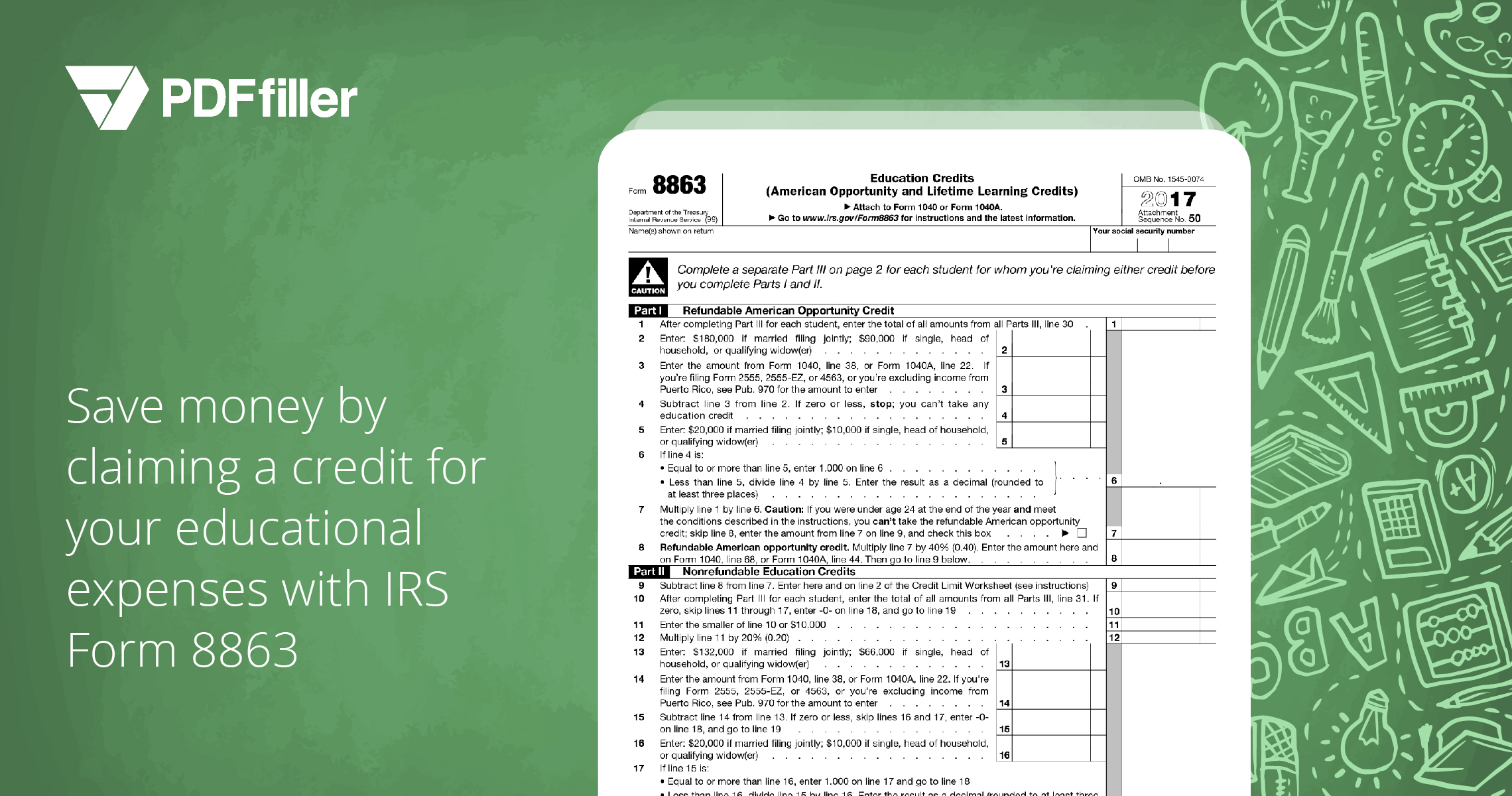

IRS Form 8863 consists of three parts. The first part is known as the Refundable American Opportunity Credit. The second part is the Nonrefundable Education Credits. In these two parts you’ll have to make some calculations to figure the sum of the credit you intend to claim.

The third part is called the Student and Educational Institution Information. Here you must indicate the following information: student’s name and social security number, name and address of the educational institution, the institution’s employer identification number and point out if the student received Form 1098-T from the educational institution. You must file a separate form for each student who claims a credit.

Where do I send Form 8863?

Form 8863 along with your 1040 or 1040A must be completed and sent to the Internal Revenue Service.