Form W-12: IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal

For the majority of Americans the US tax system is very complicated. We don’t want to spend days and nights calculating taxes, completing declarations and trying not to lose our temper and mind. But if you have a knack for numbers and like solving financial puzzles, can work under pressure and you are ready to fill in a tax form on the eve of the due date – you might be interested in becoming a paid tax preparer. Working as a tax preparer has lots of advantages. Think it over: the taxpayers usually need consulting services only during the tax season. Tax preparers don’t have to pull all-nighters every day. After the 15th of April they have plenty of time and money for vacation, self-development and relaxing. So, how do the paid tax preparers start out and fill out Form W-12 Online?

Before dealing with tax returns all tax specialists must get a preparer tax identification number (PTIN) from the IRS. They can easily obtain a PTIN by completing IRS Form W-12, Paid Preparer Tax Identification Number Application and Renewal. The tax preparers usually save time and file the form with the IRS electronically.

In this blog post we’ll show you how to fill out the application entirely online with PDFfiller, skipping the time-consuming printing and scanning steps.

Who must file Form W-12?

Any paid tax return preparer must apply for and receive a preparer tax identification number (PTIN). The PTIN must be renewed annually. A tax return preparer is any individual who is compensated for preparing or assisting in the preparation of all of a tax return or claim for refund of tax.

Now when you are sure that you have to complete Form W-12, it’s time to find how to do this.

How to Fill Out Form W-12 Online:

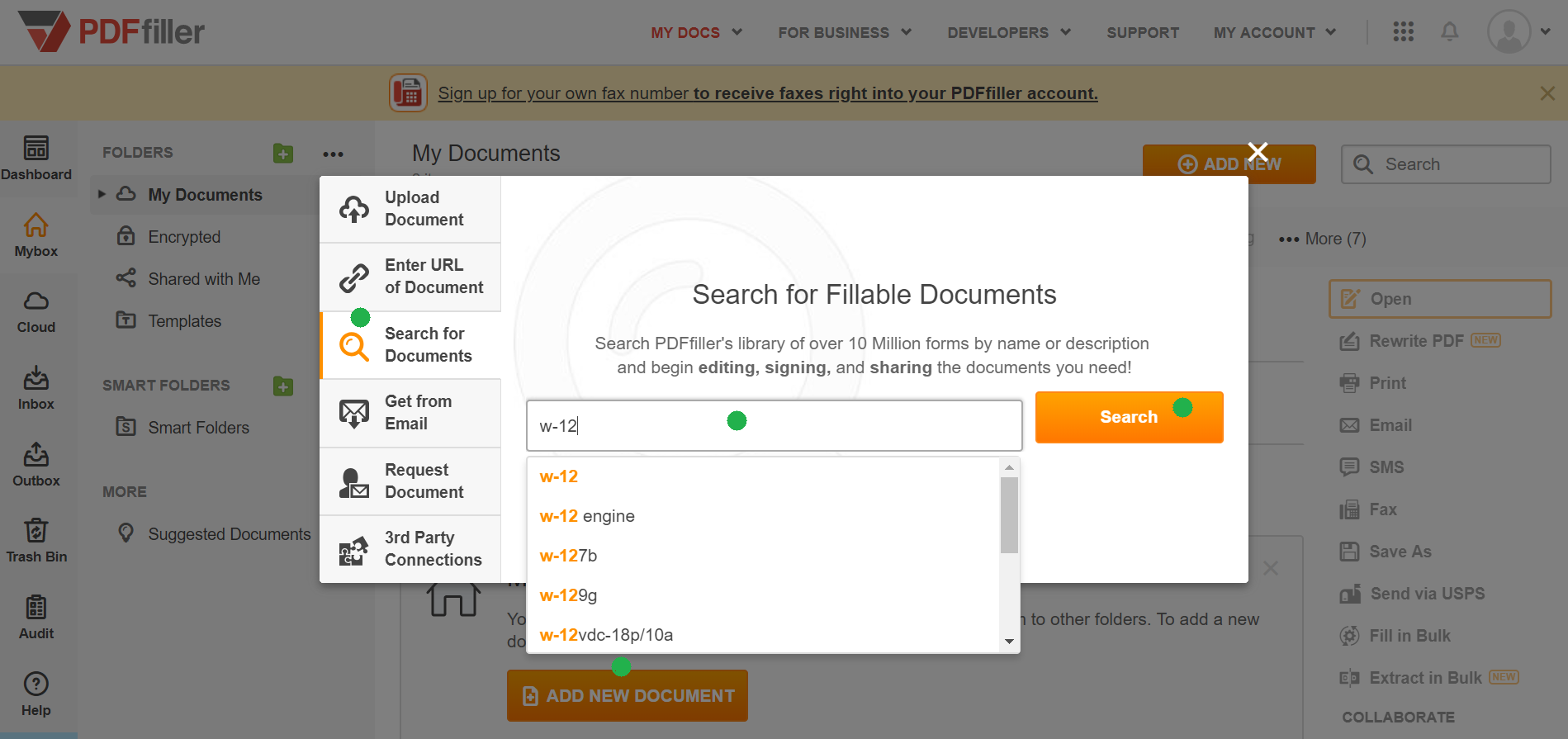

Step 1. Find Form W-12 in the PDFfiller online library of fillable documents

You can quickly find Form W-12 using the PDFfiller Search Engine. Go to MY DOCS in your PDFfiller account, click Add New Document and open the Search for Documents tab. Enter the name of the form and click the Search button.

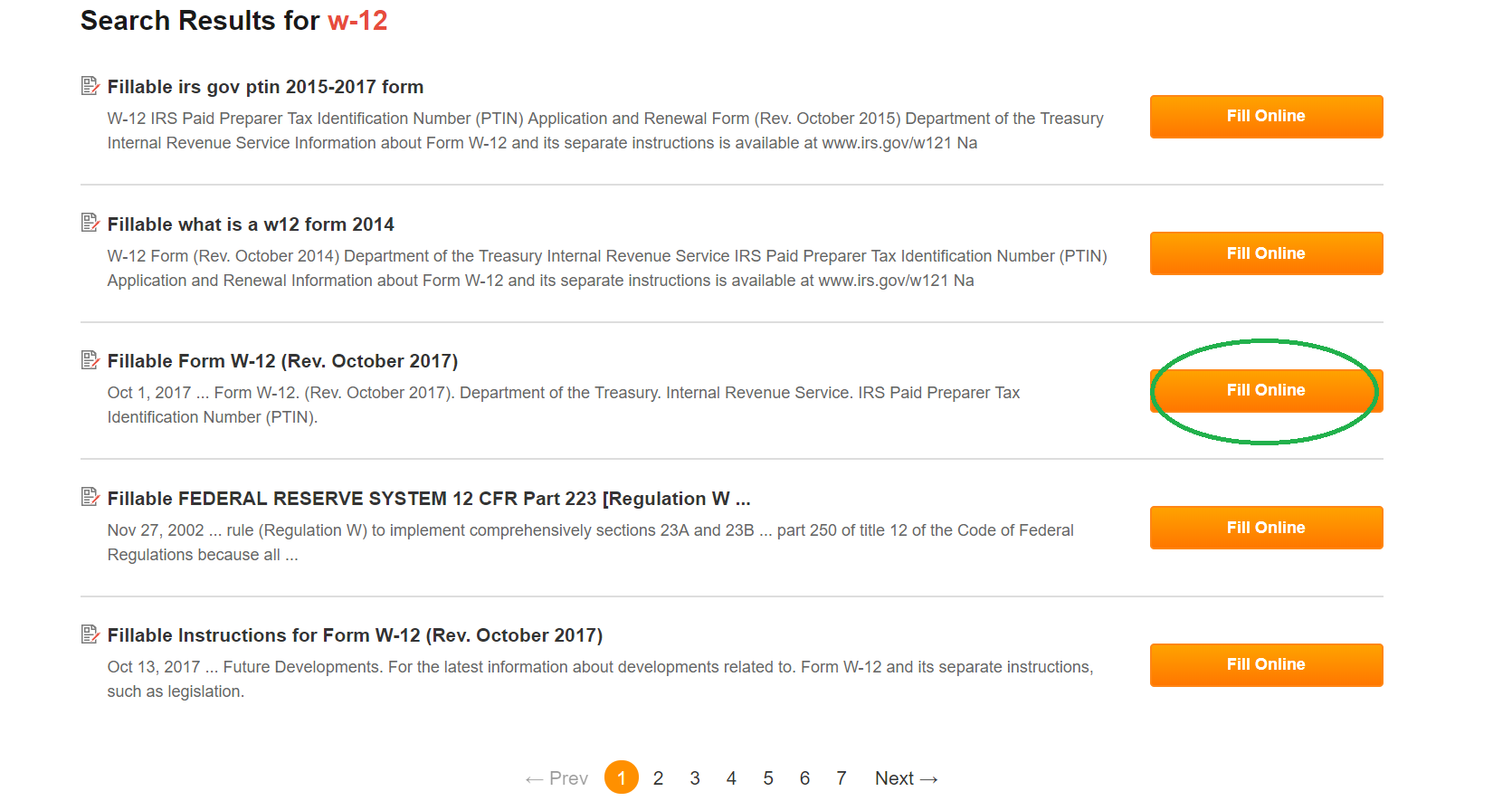

Before opening the form, you can watch a video tutorial and read a short description that will help you complete the form.

Step 2. Open Form W-12 in the PDFfiller Editor

Now you just need to select the required document from the search result (Form W-12 or Instructions) and click Fill online.

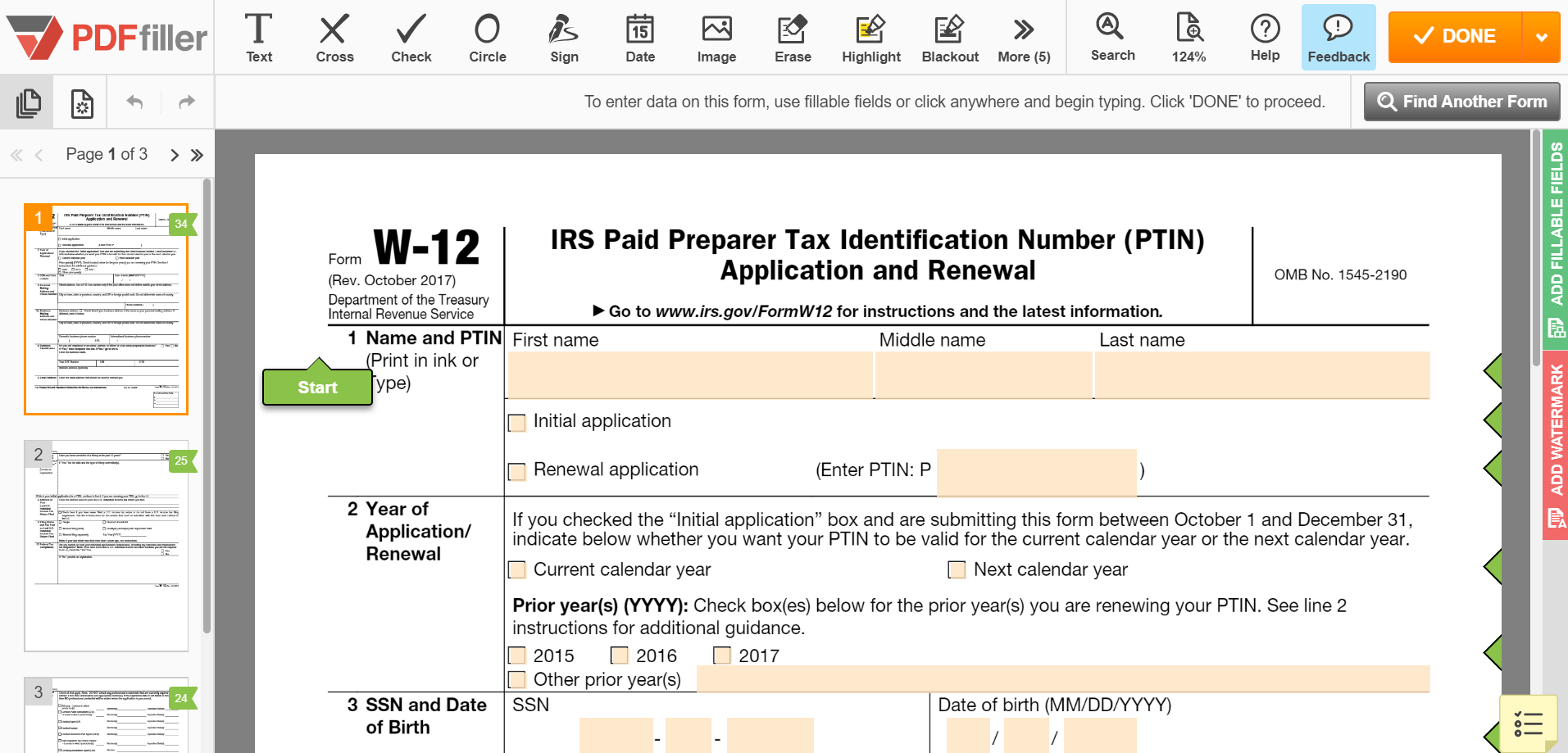

This will open Form W-12 in the PDFfiller online editor.

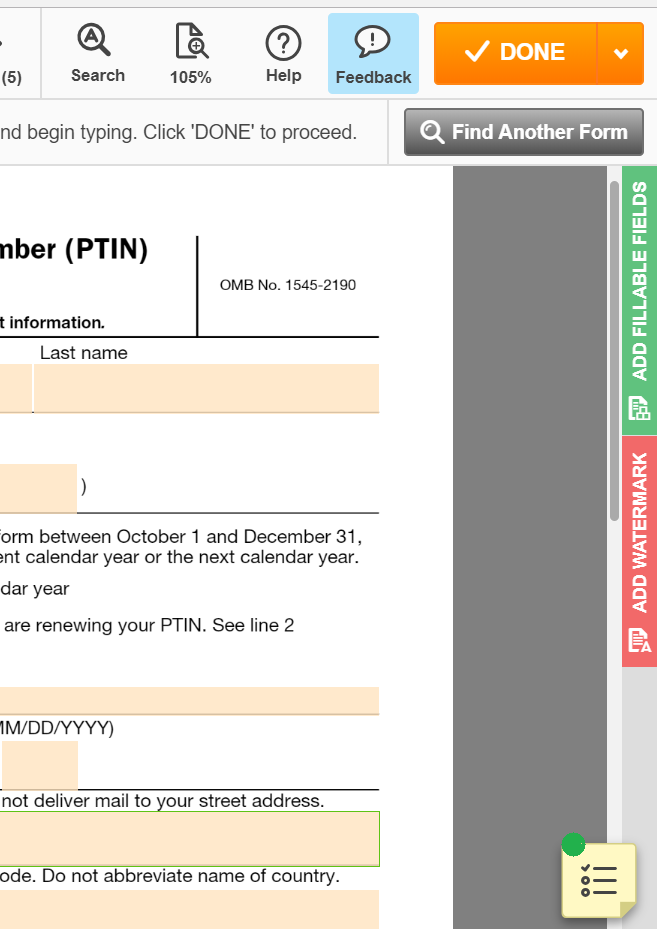

Step 3. Fill out Form W-12 online using PDFfiller editing tools

Use all the powerful PDFfiller editing tools to neatly fill out form W-12 online. Click anywhere on the document and start typing. Choose the type and size of the font, avoid mistakes with the Spelling tool, add images and checkmarks if needed.

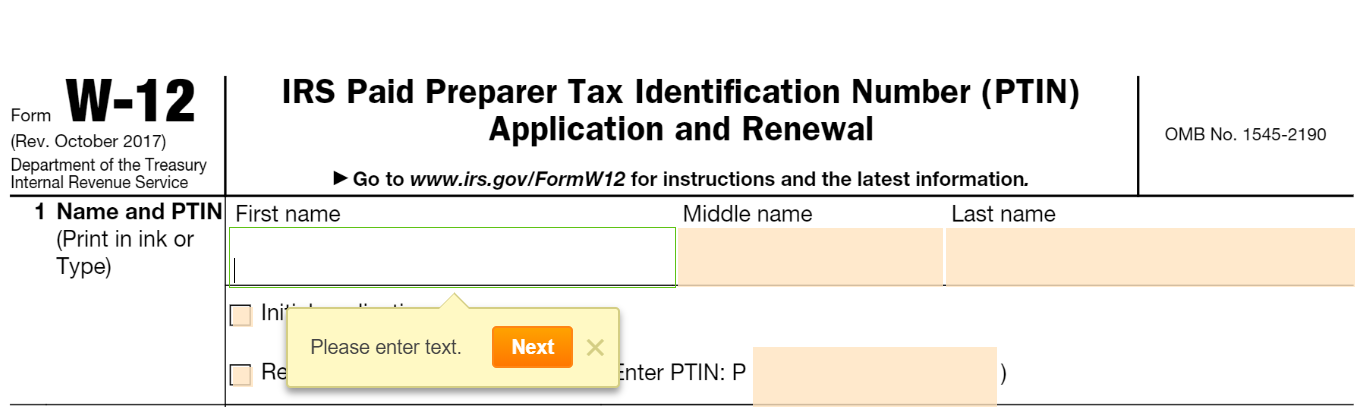

The document contains smart fillable fields. These fields will guide you through the form and make completing it fast and easy. Click Next to move to the next field.

You can always check how many fields are left by clicking on the fillable Wizard tool on the bottom right.

Click anywhere on the document and start typing.

Block 1. Type in your full name and current PTIN (if you already have one). Here you also need to indicate the purpose of the application: initial or renewal.

Block 2. Check whether you want the PTIN to be valid for the current calendar year or the next calendar year.

Block 3. Indicate your SSN and date of birth.

Block 4, 5 and 6. Type in your personal and business mailing address, phone number and email.

Block 7. Provide information about felony convictions.

Block 8 and 9. Type in the details of your last U.S. individual income tax return filed with the IRS (these blocks are applicable only for an initial application).

Block 10. Provide information about preparation of Form 1040 (skip this block if you are an attorney, public accountant or enrolled agent).

Block 11. Certify that you comply with your tax obligations.

Block 12. Check all the appropriate boxes that apply to your professional skills.

Step 4. Sign Form W-12 with a legally binding eSignature

The hardest part of the job is done. Your Form W-12 looks neat and you still have the strength to go to the end. And the end is near. Just two more steps are ahead: signature and date.

With PDFfiller’s Signature Wizard it will take you only minute to add a legally binding signature using your smartphone, keyboard, mouse or webcam. Customize the signature according to your needs and save it for future use.

To add the current date, move to the date field. It will be added automatically.

Step 5. Submit the completed Form W-12

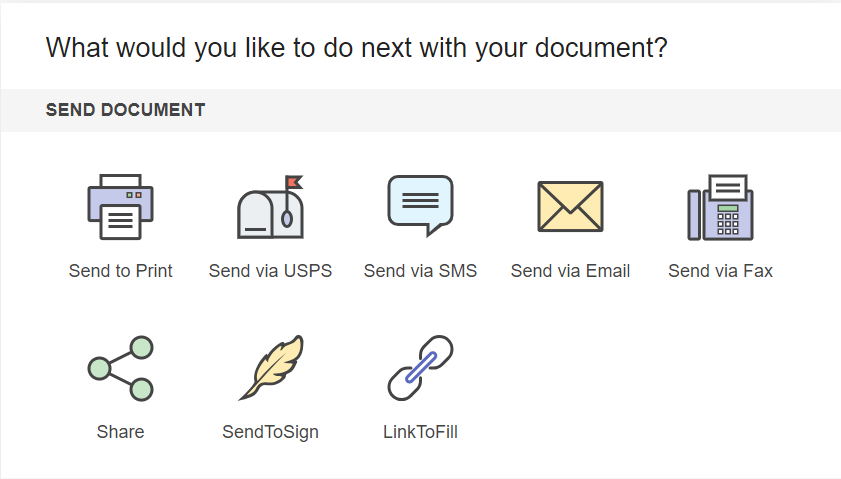

Finally, the last step of our completion quest: submission. Click DONE to save all your edits and choose what you want to do with Form W-12 next.

To view the completed form got to MY DOCS.

This step-by-step instruction shows that with PDFfiller any tax advisor, taxpayer or other professional can complete and manage their documents without additional effort and time.

Visit our website to learn more about other PDFfiller’s features.

Fill out any tax form easily with one of the most popular solutions in the web.

Get a 30-day free trial