Filing a joint tax return allows married couples to receive tax benefits. When married taxpayers file their returns jointly, they combine their tax liabilities. Both spouses assume responsibility for all penalties, interests and additional payments that may arise from their joint tax return. In the event of a divorce, the formerly married couple are still responsible for any and all balances due for previously filed joint tax returns. Enter IRS Form 8857 or the Request for Innocent Spouse Relief form with the purpose of alleviating the financial burdens of a previous marriage which a spouse should not be responsible for bearing after a divorce has been finalized.

When to File IRS Form 8857

To qualify for relief, check to be sure you meet the proper conditions. Use IRS Form 8857 if you’ve filed a joint return with an understatement of tax that is completely the fault of your spouse. For example, if part of your spouse’s income was omitted from your joint return due to your spouse incorrectly reporting credits or deductions, you are eligible to submit the Request for Innocent Spouse Relief. Proof will need to be provided which shows that you had no knowledge of the tax understatement at the time of signing the joint return with your spouse. The IRS takes into account all such circumstances before approving Innocent Spouse Relief requests.

How to File IRS Form 8857

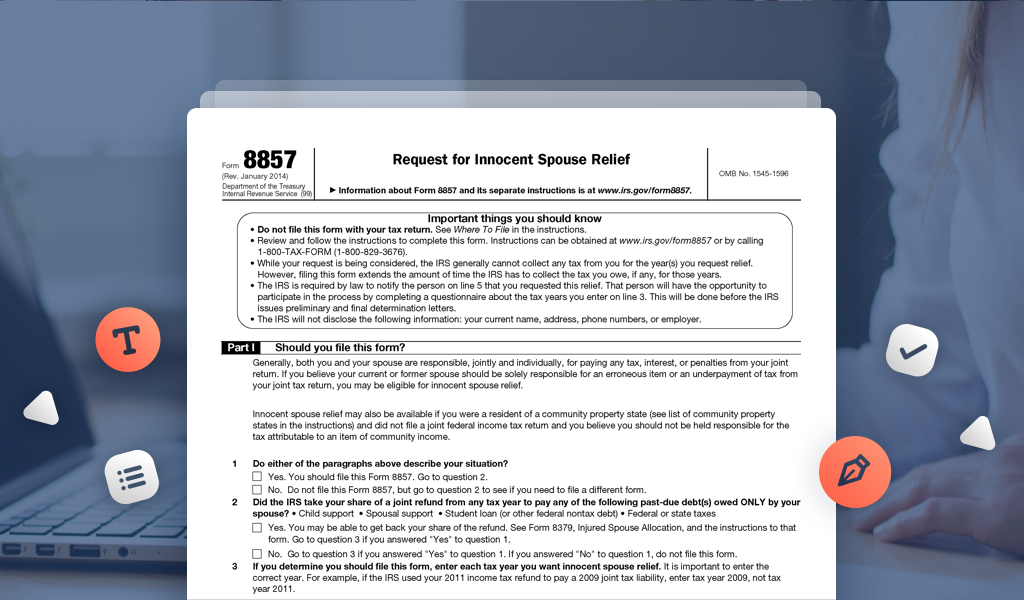

Save time filing your IRS Form 8857 online with PDFfiller. To begin, simply search for it in the document library and fill in all the required fields. Generally, the form consists of seven parts that must be completed accurately. Consider each part and what information you must provide.

- Part 1. The first part explains whether you’re eligible to file IRS Form 8857 or not. Carefully read the instructions and then answer the following three questions by checking the boxes containing the most relevant information that applies to you.

- Part 2. Here you’ll need to provide information about yourself and your spouse in accordance with the tax years you’re requesting relief for. Indicate your name, social security number, address, your spouse’s name, address and social security number. Inform the IRS of the current relationship between you and your spouse by selecting one of the five available answers.

- Part 3. Indicate if and when you agreed to file a signed joint return with your spouse. You must provide information detailing your involvement with preparing the return(s) and whether you were aware of any incorrect data your spouse provided in the return.

- Part 4. When filling out the fourth part of your request you’ll need to explain your current financial situation in some detail. Indicate all your monthly income and expenses.

- Part 5. Fill in this part only if you were (or are now) a victim of spousal abuse or domestic violence. Otherwise, skip this section.

- Part 6. This part is created for any additional information you want to include in the Request for Innocent Spouse Relief.

- Part 7. Use this part to indicate if you need a refund or not. Simply check a box and sign the document.

Once IRS Form 8857 has been signed and completed you can send it to the IRS for consideration. If all the information you provided was honest, accurate and meets the requirements for relief, your request stands a good chance of being approved.

Minimize errors and file neat and accurate forms to the IRS using PDFfiller.