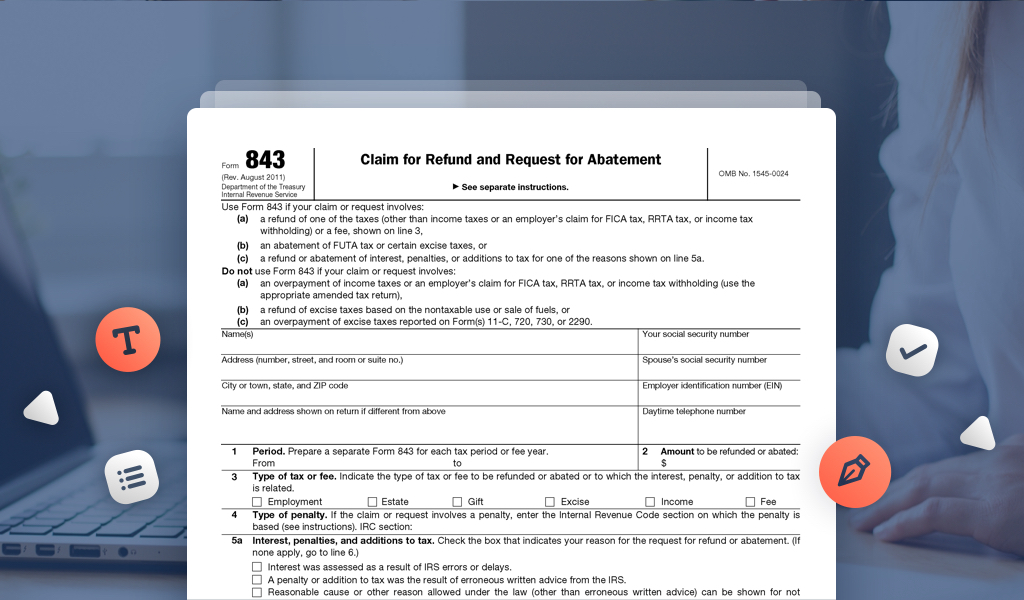

If you’ve discovered an approval delay or error on the part of your local or state tax agency when calculating your income tax, you have a right to file a refund claim. If the agency recognizes the error, you are eligible to request an abatement of interests, taxes, fees, penalties or any other additions to your tax return. For this purpose, you are required to file IRS Form 843, or the Claim for Refund and Request for Abatement.

Before submitting this document, a taxpayer has to prepare proof of the tax agency having been in error, which is no easy task. Once you’ve obtained proof entitling you to claim a refund from the agency, fill out and file your Form 843 to the IRS. You must explain in detail why you’ve decided to claim a tax refund or are requesting a tax abatement.

When to Use IRS Form 843?

The process for correcting an administrative error on your return can be complicated. You may request a tax abatement, if your return meets any of the below criteria:

- it relates to a delay or mistake the IRS has made

- you have a reasonable cause (based on all the circumstances and facts in your situation)

- a penalty you’ve already paid hasn’t been removed

You are not eligible to request an abatement for an estate, gift or income tax. For every type of fee, penalty or interest, you must submit a separate IRS Form 843.

Who Can File IRS Form 843?

A taxpayer or an authorized representative may file this form. If your representative files Form 843 for you, they must prepare Form 2848, known as the Power of Attorney and Declaration of Representative, and attach it to the claim. By signing form 2848 you are confirming that the representative is eligible to act on your behalf. If you file the claim for a decedent, you have to attach Form 1310 (Statement of Person Claiming Refund Due a Deceased Taxpayer) to your 843. Learn more about filling out these forms on the IRS website.

How to Complete IRS Form 843?

The Claim for Refund and Request for Abatement required the following information be provided:

- Name and address

- Social security number and employer identification number

- Contact information

- Amount to be refunded

- Type of fee or tax

- Type of penalty

- Original return

- Explanation why your request must be approved

- Signature

By completing IRS Form 843 with PDFfiller, you can be sure that it will look professional while guarding against mistakes or typos. Save your time by completing a form electronically using the service’s powerful features for filling, signing and editing.

Where to File IRS Form 843?

Your task is to fill out, sign and send this document to the Internal Revenue Service.