If you won big, you need a form W 2G!

This tax season we are bringing you a quick summary of each tax form you’re going to need. Once you have reviewed this information, use PDFfiller to help you fill your forms, sign online, and share, print, or email your completed form. In this post we will talk about the happy circumstances in which you’ll need to fill IRS Form W 2G.

Who needs a form W-2G?

Individuals who have received

• $600 or more in gambling winnings and the payout is at least 300 times the amount of the wager (except winnings from bingo, keno, and slot machines);

• $1,200 or more in gambling winnings from bingo or slot machines;

• $1,500 or more in proceeds (the amount of winnings less the amount of the wager) from keno; OR

• Any gambling winnings subject to federal income tax withholding.

What is form W-2G for?

Form W-2G is used to report income and withholdings related to gambling.

Is form W-2G accompanied by other forms?

If you file a paper Form W 2G, you must send a Form 1096 as the transmittal document.

When is form W-2G due?

File form W-2G by February 29, 2016.

How do I fill out form W-2G?

Learn more about filling form W-2G by watching the following video.

<https://www.youtube.com/watch?v=YwNTEN8vqBEc>

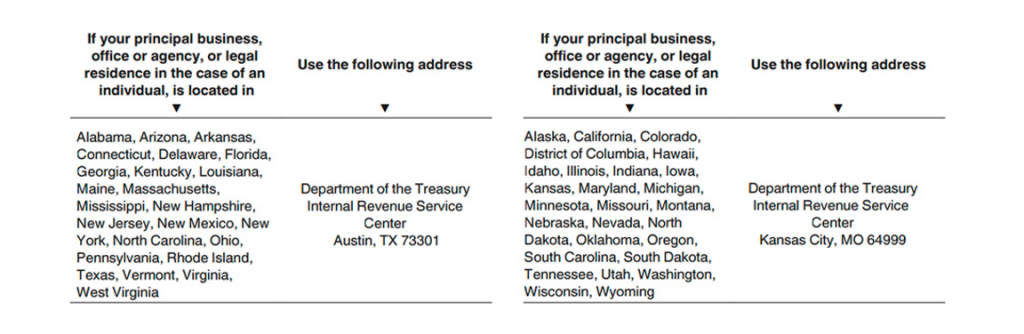

Where do I send form W-2G?

Submit your completed IRS Form W2 G to the Department of the Treasury at the following address:

Sow that you know the why and wherefore of IRS form W 2G, click here to get started yours with PDFfiller. And congratulations on your big win!