Don’t Miss the Deadline for Reporting Your Shareholding Income with Form 1120S Schedule K-1

LLC members and S corporation owners are required to report their income on an annual basis. A shareholder’s share of income for a partnership or an S corporation should be presented on Form 1120S Schedule K-1. This schedule is also used to report income, losses, dividend receipts and capital gains of partners and shareholders of S corporations or from some trusts. Further, such information will be considered by the IRS for calculating income tax amounts. Note that the penalty for late filed returns is $195 for each month past the deadline. Below are some answers to various questions that concern filing this form including a list of information needed and requirements for preparation.

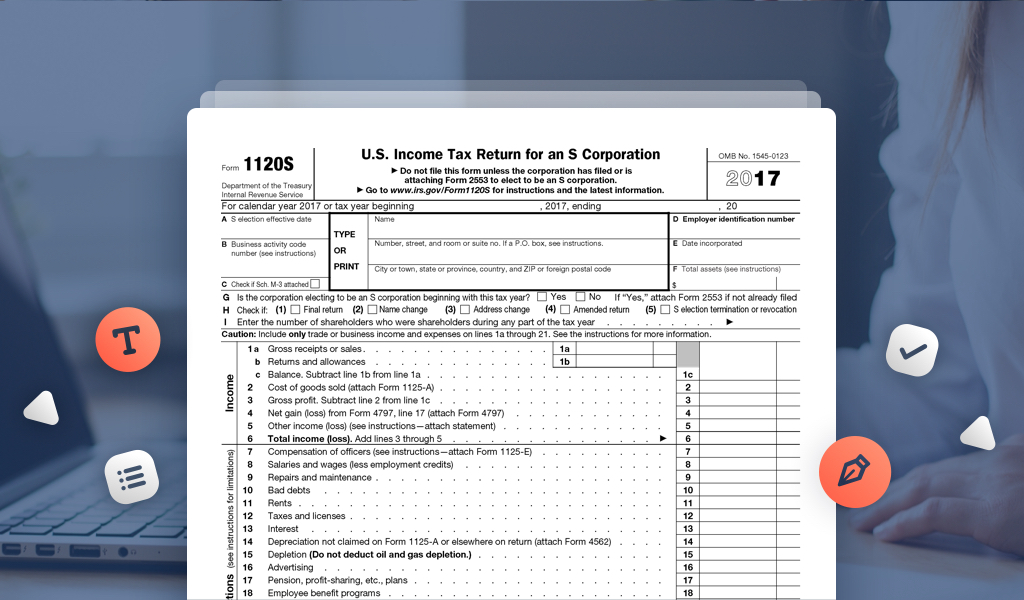

What is IRS Form 1120S Schedule K-1 ?

The Schedule K-1 Form 1120S is a document that reports the income, gains, losses, deductions and credits for a tax year to each partner holding a share of a corporate entity.

Who needs to File IRS Form 1120S Schedule K-1?

Form 1120S must be filed for a corporate entity if it has elected to be represented as an S corporation on Form 2553. While all S Corporations report their income on Form 1120S, the shareholders’ net income and loss from the corporation is reported in Schedule K-1 that will later be attached to their individual tax returns (Schedule E).

What is IRS 1120S Schedule K-1 used for?

Form 1120S Schedule K-1 is designed not only to outline the income earned or lost by a corporation but also for the accounting of other earnings and deductions as well as a shareholder’s annual stock history.

Is IRS 1120S Schedule K-1 accompanied by other forms?

Initially, Schedule K-1 is a part of Form 1120S. However, it is sent separately to every shareholder for filing their individual tax return.

When is IRS 1120S Schedule K-1 Due?

As a part of Form 1120S, Schedule K-1 has the same due date as the form itself. It should be sent to the shareholder by March 15th 2018 or by September 15th 2018 if the extended deadline is allowed. If the due date falls on Saturday, Sunday or a legal holiday, the corporation can file it on the next business day.

How to Fill out IRS 1120S Schedule K-1?

Schedule K-1 is a one-page document designed for an S Corporation to provide the following information:

- name, address and identification number

- the shareholder’s personal and contact information

- the percentage of stock the shareholder owned during the current tax year

Once the two parts of the schedule are completed, the company has to track deductions, credits and other financial data a shareholder had within the current tax year. At the top of the form each shareholder or partner should indicate whether a form is final or amended.

Where to File IRS 1120S Schedule K-1?

Once completed, Schedule K-1 must be sent to each shareholder. When the shareholders receive the schedule, they can use the information provided to file their personal income tax returns. Schedule K-1’s that have been approved by the shareholder are not filed with personal returns, but are submitted to the IRS along with Form 1120-S.