With the 2022 tax season upon us, let’s take a look at IRS form 1099-MISC, also referred to as Miscellaneous Income. A 1099-MISC form is one of many in the 1099 series that taxpayers receive shortly after the end of the tax year.

In this post, you’ll find all you need to know about Form 1099-MISC. You’ll also learn:

- who needs to file Form 1099-MISC

- the difference between the 1099-NEC and 1099-MISC forms

- how to fill out Form 1099-MISC for the 2022 tax year

Let’s get started!

Table of contents

- What is Form 1099-MISC: Miscellaneous Income?

- Who needs to file the IRS Form 1099-MISC?

- When is 1099-MISC due?

- How to avoid paying taxes on 1099-MISC?

- 1099-NEC vs. 1099-MISC: Types of 1099 forms taxpayers should know about

- How to fill out 1099-MISC?

- How to submit the IRS Form 1099-MISC online?

What is Form 1099-MISC: Miscellaneous Income?

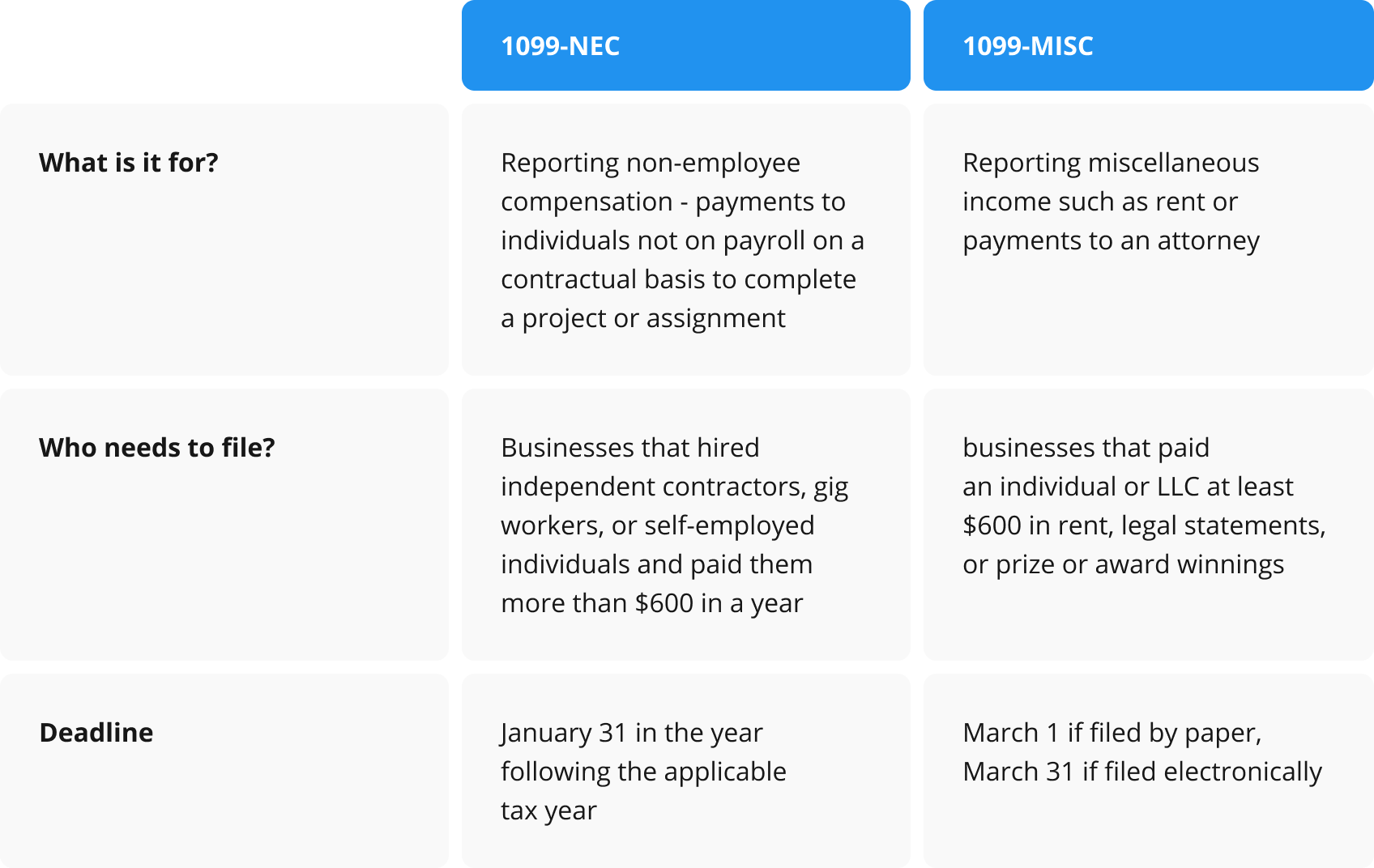

Form 1099-MISC is used to report certain types of miscellaneous income, such as rents, prizes and awards, healthcare payments, and payments to an attorney. Form 1099-MISC and Form 1099-NEC are often confused due to changes the IRS imposed after the 2020 tax year.

Before 2020, Form 1099-MISC was used to report non-employee compensation for independent contractors, freelancers, sole proprietors, and self-employed individuals. After 2020, Form 1099-NEC: Nonemployee Compensation came into use for the same purpose. Take note, both forms report business payments, not personal ones.

Who needs to file the IRS Form 1099-MISC?

According to the IRS’s instructions, Form 1099-MISC is filled out and submitted by an individual who has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person. It’s also sent to each person to whom you paid at least $600 during the calendar year in the following categories:

- Rents

- Prizes and awards

- Other income payments

- Medical and health care payments

- Crop insurance proceeds

- Cash payments for fish (or other aquatic life) you purchased from anyone engaged in the trade or business of catching fish

- The cash paid from a notional principal contract to an individual, partnership, or estate

- Payments to an attorney

- Any fishing boat proceeds

Take note: 1099-MISC is also used to report the direct sales of at least $5,000 in consumer products to a buyer for resale anywhere other than a permanent retail establishment.

When is 1099-MISC due?

1099-MISC must be sent to its recipient by February 1 and submitted to the IRS by March 1, or March 31, if filing electronically. The form’s recipient can attach the form to their tax return.

How to avoid paying taxes on 1099-MISC?

If you want to reduce your amount of taxable 1099 income, it’s important to distinguish between tax evasion and tax avoidance:

- Tax evasion means illegally concealing income or information from the IRS — leading to penalties, fines, and even jail.

- Tax avoidance refers to legal methods that allow someone to avoid paying taxes. These include tax-advantaged accounts (401 (k)s and IRAs), claiming 1099 deductions, and tax credits.

Take note: retirement savings can help lower your taxable income. One of the most effective ways to reduce your amount of taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account (IRA).

Also, contributions to health spending accounts and flexible spending accounts can help reduce taxable income during the years in which they are made. Full-time or part-time self-employed taxpayers can look into the list of deductions available to them in order to lower their taxable income.

1099-NEC vs. 1099-MISC: Types of 1099 forms taxpayers should know about

There are two IRS forms that seem similar but actually contain several significant differences — Form 1099-NEC, or Non-employee compensation, and Form 1099-MISC, Miscellaneous Income.

There are a number of other IRS 1099 forms that the IRS defines as ‘information returns.’

- Form 1099-A (Acquisition or Abandonment of Secured Property) is an informational form used to report foreclosure on a property. The form is filed if your mortgage lender canceled some or all of your mortgage or you were involved in the short sale of your house.

- Form 1099-B (Proceeds from Broker and Barter Exchange) is an IRS form used by brokerages and barter exchanges to record customers’ gains and losses during a tax year. The form can be filed if you sold several types of securities, and/or bartering activities.

- Form 1099-C (Cancellation of Debt) is used to report various payments and transactions made to taxpayers by lenders and creditors. For instance, if your lender settled your debt for less than you owe, the amount the lender forgives is taxable income.

- Form 1099-CAP (Changes in Corporate Control and Capital Structure) is used by corporations to report a substantial change in control or capital structure. You will need to fill out and submit this form to the IRS if you hold shares of a corporation that acquired a significant change in capital structure and received cash, stock, or other property.

- Form 1099-DIV (Dividends and Distributions) is sent by banks and other financial institutions to investors who receive dividends and distributions from any type of investment during a calendar year. The form is only sent if the dividends and/or distributions a taxpayer had received exceeded $10.

- Form 1099-G (Certain Government Payments) is filed by federal, state, and local government agencies for payments made to taxpayers. The form is sent before January 31 to both the IRS and taxpayers to report unemployment compensation and payments made on a Commodity Credit Corporation (CCC) loan.

- Form 1099-INT (Interest Income) includes a breakdown of all types of interest income and related expenses and is used by taxpayers to report interest income. The form is issued by all entities that pay interest income to investors at the end of the year. Payers must issue a 1099-INT for any party to whom they paid at least $10 of interest during the year before January 31.

- Form 1099-LTC (Long-Term Care and Accelerated Death Benefits) enables individual taxpayers to report long-term care (LTC) benefits, including accelerated death benefits and/or insurance payments. These forms are typically issued in January for the previous year.

- Form 1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans) is used for reporting distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions. This form specifically concerns passive income and retirement plans.

How to fill out 1099-MISC?

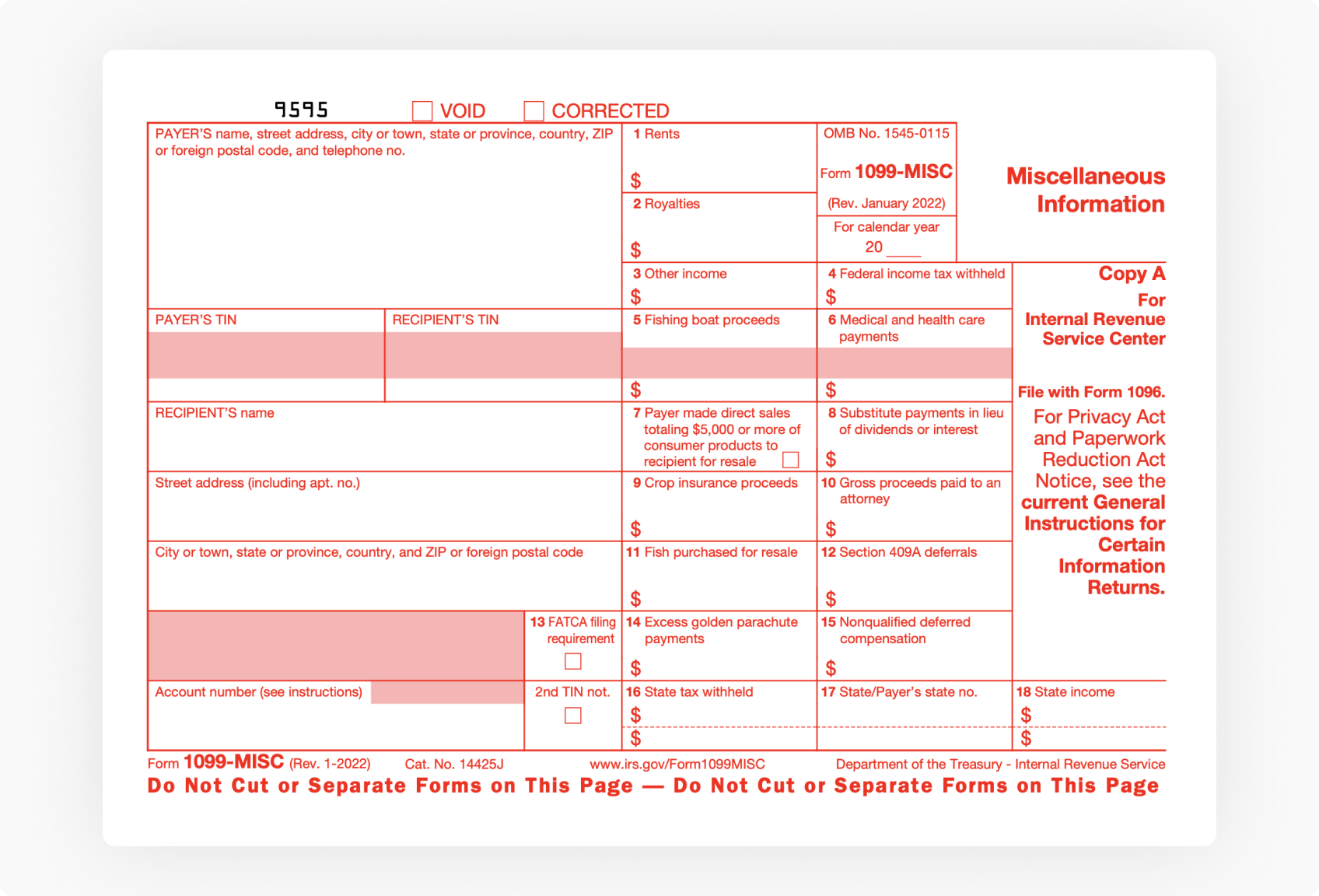

Form 1099-MISC is comprised of several parts – Copy A of Form 1099-MISC in red is intended for the IRS only. The black parts of the form can be completed and sent to other recipients.

Copy 1 goes to the recipient’s state tax department. Copy B is retained by the recipient. Copy 2 goes with the recipient’s state tax return. Copy C stays with the taxpayer.

Start by filling out your name, address, and identification number, as well as the recipient’s name, address, and Social Security Number.

The 1099-MISC form has a series of boxes in which the taxpayer will include whichever type of payment was made. This may include Rents in Box 1, Royalties in Box 2, Medical Healthcare Payments in Box 6. Other boxes that may be filled out include Box 4: Federal Income Tax Withheld, and Box 15: State Tax Withheld.

Watch the video below to see the step-by-step process of filling out a 1099-MISC form in pdfFiller:

How to submit IRS Form 1099-MISC online

The IRS offers taxpayers the possibility to submit their Form 1099-MISC electronically. However, it’s much more convenient to fill out and submit the 1099-MISC form online via pdfFiller.

Fill out any tax form on any desktop or mobile device. Once you’ve finished filing the form, you can share it with your accountant in a few clicks. It’s also possible to send a PDF by email, SMS, fax, USPS mail, or notarize it online — right from your account.