IRS forms are tax documents U.S. taxpayers use to report their financial activities to the federal government, calculate their tax liability, and prepare their tax returns. The Internal Revenue Service (IRS) issues different tax forms for various purposes, though it’s unlikely that individual taxpayers will need to complete more than a handful of forms each year. The IRS also reissues multiple tax forms annually to incorporate new changes in the tax code.

In this blog, we’re going to sum up the list of tax forms you need to file your tax returns in 2022.

Take note: the revised and updated IRS forms are now available on pdffiller.com

So, what are the different tax forms American taxpayers need to submit?

Table of contents:

- Form W-9

- Form W-4

- Form W-2

- Form W-3

- Form 1040

- Form 941

- Form 1099-MISC

- Form 8962

- Profit and Loss Statement

- SS-5 Form

1. Form W-9

IRS Form W-9, or the Request for Taxpayer Identification Number and Certification, is a tax form that employers use to identify their employees. In order for employers to properly withhold taxes from an employee’s pay, they need to know the employee’s identification number that is unique to each taxpayer. Form W-9 provides an employer with that identification number.

Who needs form W-9?

Businesses with employees need to prepare the W9 form to properly file their taxes. In some special cases, such as if you are an independent contractor, your client may request a W-9 from you so they can accurately prepare the 1099-NEC form and report how much they paid you at the end of the year.

What other forms accompany form W-9?

Form W-9 is usually accompanied by form W-4. The W9 form provides the employer with all of the required identification information. The W-4 helps them to calculate how much to withhold.

What is the due date for Form W-9?

Form W-9 does not have a due date. It is typically provided to employees upon their hiring date and then kept on file. Despite having no strict deadline for filing a W-9, employees should fill it out as soon as they receive one. In the event an employer fails to send someone a W-9 or sends the form containing the wrong information, they may be subject to a $50 penalty.

In one of our recent blogs, we covered how to complete an IRS Form W9 2021. For W-9 form instructions, watch the video below:

2. Form W-4

The above-mentioned Form W-4, known as Employee’s Withholding Certificate, is used:

- by employees to provide their employer with information on the amount of tax to be withheld from each paycheck

- by employers to count the payroll taxes and transfer them on behalf of the employees to the state and Internal Revenue Service

Who needs Form W-4?

Submitting Form W-4 is a must for almost any employee. However, those without a federal income tax liability for the previous year or who do not expect a federal tax liability for the current year are exempt from federal income tax.

Take note: even the exempt categories still have to fill in their name, address, SSN, signature, after which they need to write ‘Exempt’ in the space below the Line ( c ).

W-4 form 2022 revision

The updated W-4 form 2022 has no option of claiming personal allowances. The submitter will only be asked to indicate the number of dependents in their household.

What is the due date for Form W-4?

Be aware that you don’t need to submit Form W-4 every year. There are two cases when you have to submit this form:

- if you start a new job

- if you’re making adjustments to your withholdings at your current place of work

An employee must provide their employer with a new Form W-4 (claiming exempt status) by February 15. Otherwise, an employer withholds the tax as if the employee is single or married, submitting separately and skipping Steps 2, 3, and 4.

In one of our recent blogs, we covered how to fill out a W-4 form. For W-4 form instructions, watch the video below:

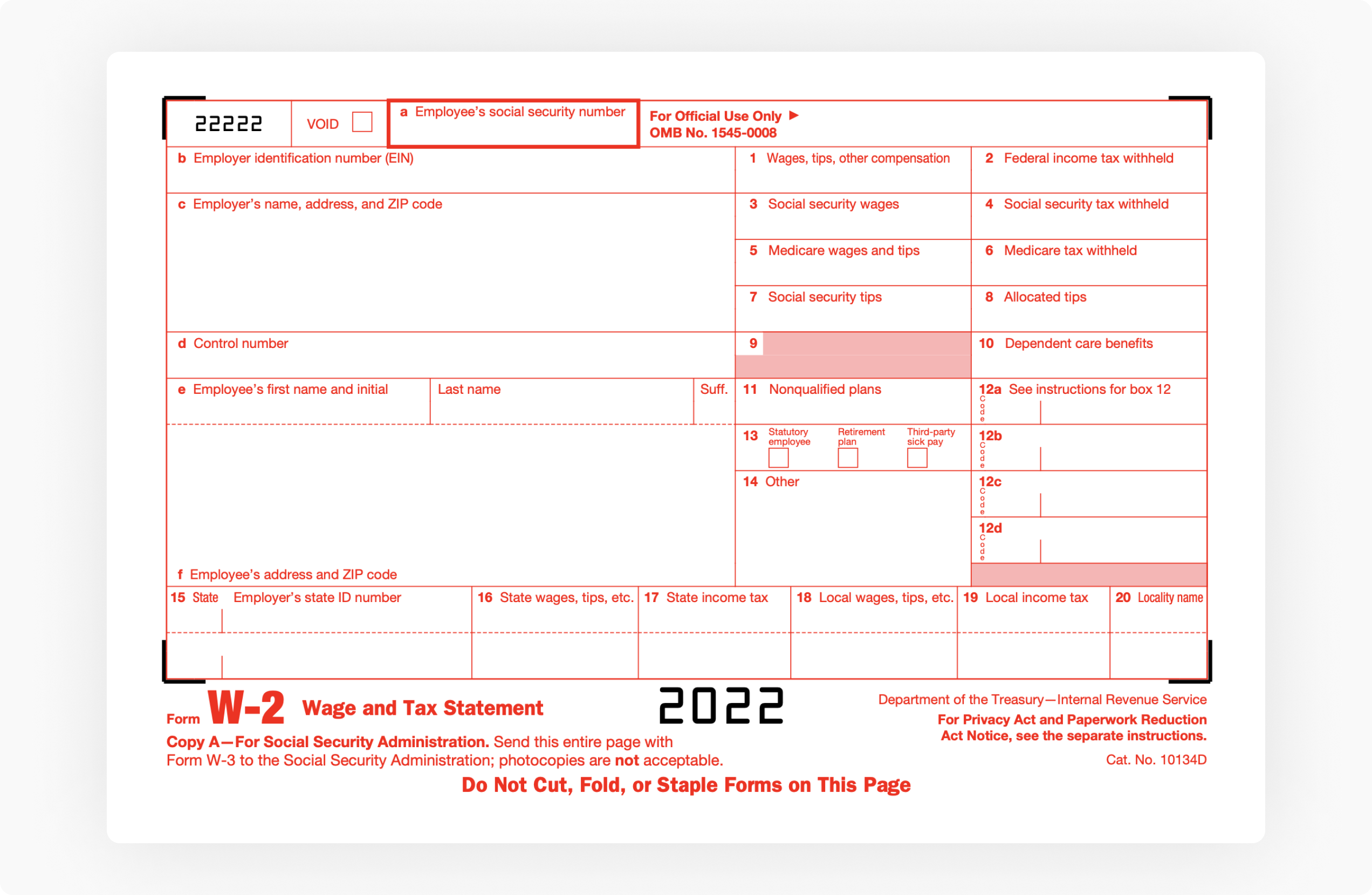

3. Form W-2

The Form W-2, or the Wage and Tax Statement, is used to track employment income during the previous year. It’s the employer’s duty to send each of their employees a W-2 Form as well as file it to the IRS at the end of the year.

Who needs Form W-2

Any employer who deals with business or trade and pays salaries is obligated to submit a Form W-2 for each of their employees. Employees themselves do not fill out the documents, they only receive the document (as well as the federal government and the state) from the employer.

W-2 form 2022 revision

Along with Form W-2, employers need to submit Form W-3. The latter must be sent to the SSA (Social Security Administration) with a copy of Form W-2.

In 2022, if the number of W-3 Forms equals or exceeds 100, they should be submitted to the SSA electronically.

What is the Form W-2 due date?

An employer has to submit Form W-2 to the SSA by January 31 of the year following the tax year. The same deadline applies to sending copies of Form W-2 to employees.

In one of our recent blogs, we covered how to fill out a W-2 Form. For W-2 form instructions, watch the video below:

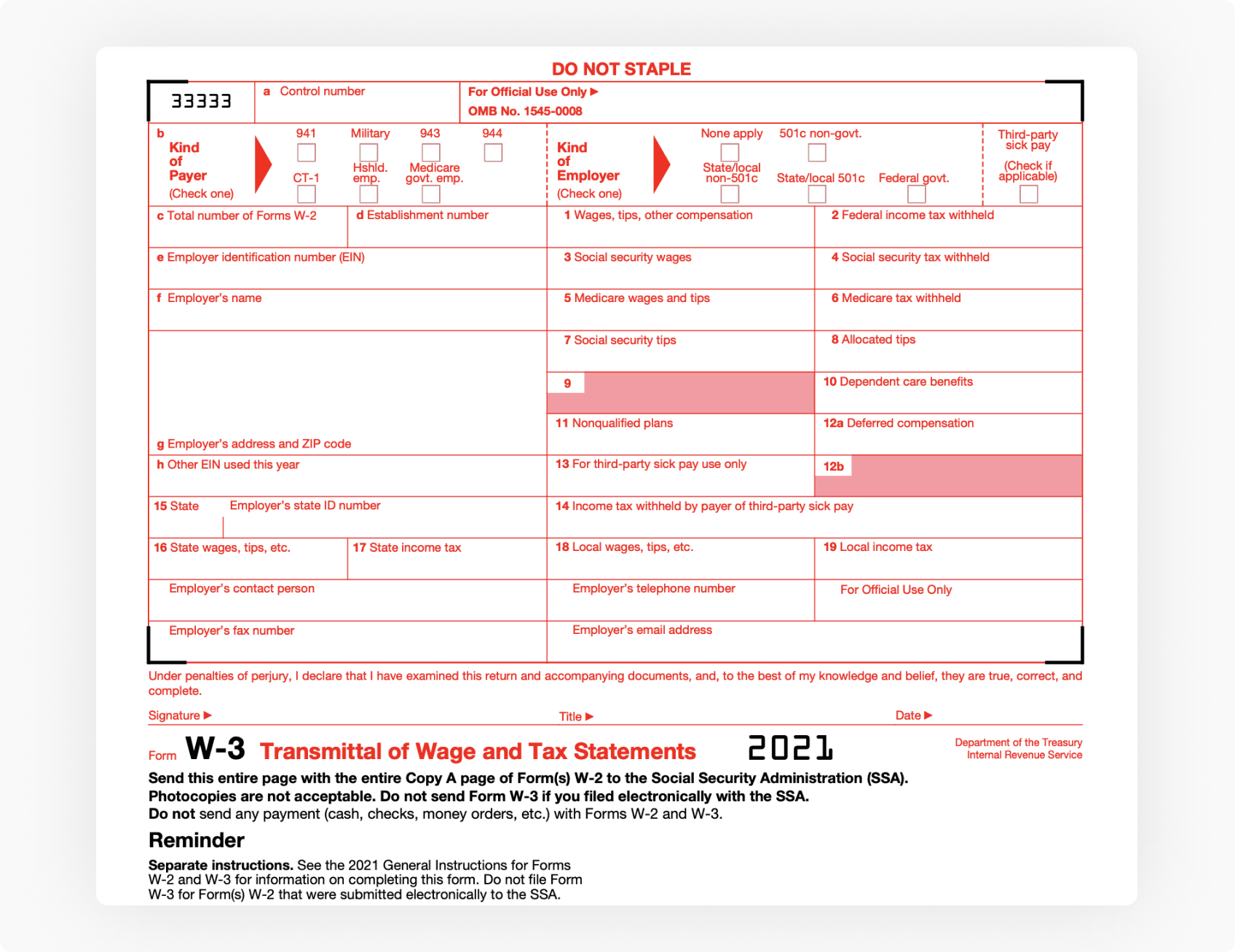

4. Form W-3

The Form W-3, or the Transmittal of Wage and Tax Statements, is used by the Internal Revenue Service and Social Security Administration to transmit Copy A of Form W-2.

The W-3 Form shows:

- employee’s total income

- medicare wages

- the total tax withheld for all employees (for the entire year)

Who needs Form W-3?

It’s the duty of employers who file the W-2 Form to also submit the W-3 Form to the Social Security Administration.

What is the due date for Form W-3?

Both the W-2 and W-3 Forms must be filed with the Social Security Administration by January 31 of the year following the tax year.

In one of our recent blogs, we covered how to fill out a W-3 Form. For W-3 form instructions, watch the video below:

To make it easier for you to not get lost in the variety of tax forms with similar names, here’s a comparison chart with a brief summary of the above-mentioned tax forms.

| Form W-2 | Form W-3 | Form W-4 | Form W-9 | |

| Submitter | Employers | Employers | Employees | Self-employed may be asked to fill out the form by their clients (or businesses) who make payments to them |

| Purpose | Accounts for the employers’ payments to employees throughout the year | Helps track the compensation employers payout (wages, salary, tips, etc.) throughout the year | Provides employers with information to determine the amount to be withheld from employees’ paychecks | Allows for sending one’s Tax Identification Number (EIN or SSN) to another person or financial institution. |

| Submission requirements | One for each employee | One for each employee | One for each employer | One for each employee |

| Submission frequency | Annual submission | Annual submission (before January 31) along with Form W-2 | One-time submission (during the first month of employment) | One-time submission (to be filled out once the form is received) |

5. Form 1040

The Form 1040 is the document that an individual US taxpayer uses to submit their annual income tax return.

Based on the information provided, the taxpayer is either subject to additional taxes or receives a tax refund.

Who needs Form 1040

Filling out a Form 1040 is a general requirement for anyone whose filing status at the end of 2019 was single and under 65 with a gross income of at least $12,200.

Schedule A: what it is and what it’s used for

Schedule A is an optional attachment to Form 1040 and allows you to calculate an alternative deduction according to your accumulated annual expenses. If the standard deduction is smaller than the aggregate value of your itemized deductions, Schedule A will help to decrease your tax obligations.

What is the due date for Form 1040?

In 2022, the deadline for submitting tax returns and conducting tax payments is April 18.

Find more detailed information on Form 1040 and Schedule A as well as how to fill them out in the following resources:

For Form 1040 instructions, watch the video below:

6. Form 941

Form 941, or the Employer’s Quarterly Federal Tax Return, is used to identify the amount of taxes that you owe. The document allows employers to report the amounts of tax withholdings for the estimated income tax and employer payments as well as for the FICA taxes (Social Security and Medicare).

Who needs Form 941

Any business or individual that pays wages to at least one employee must submit an IRS Form 941 on a quarterly basis.

What is the due date for Form 941?

Since Form 941 should be filed each quarter, there’s a separate deadline for each quarter. As a rule, the deadline is the last day of the month following the end of the quarter (e.g., the due date to file Form 941 for the 1st quarter is April 30).

In one of our recent blogs, we covered how to fill out Form 941. For 941 form instructions, watch the video below:

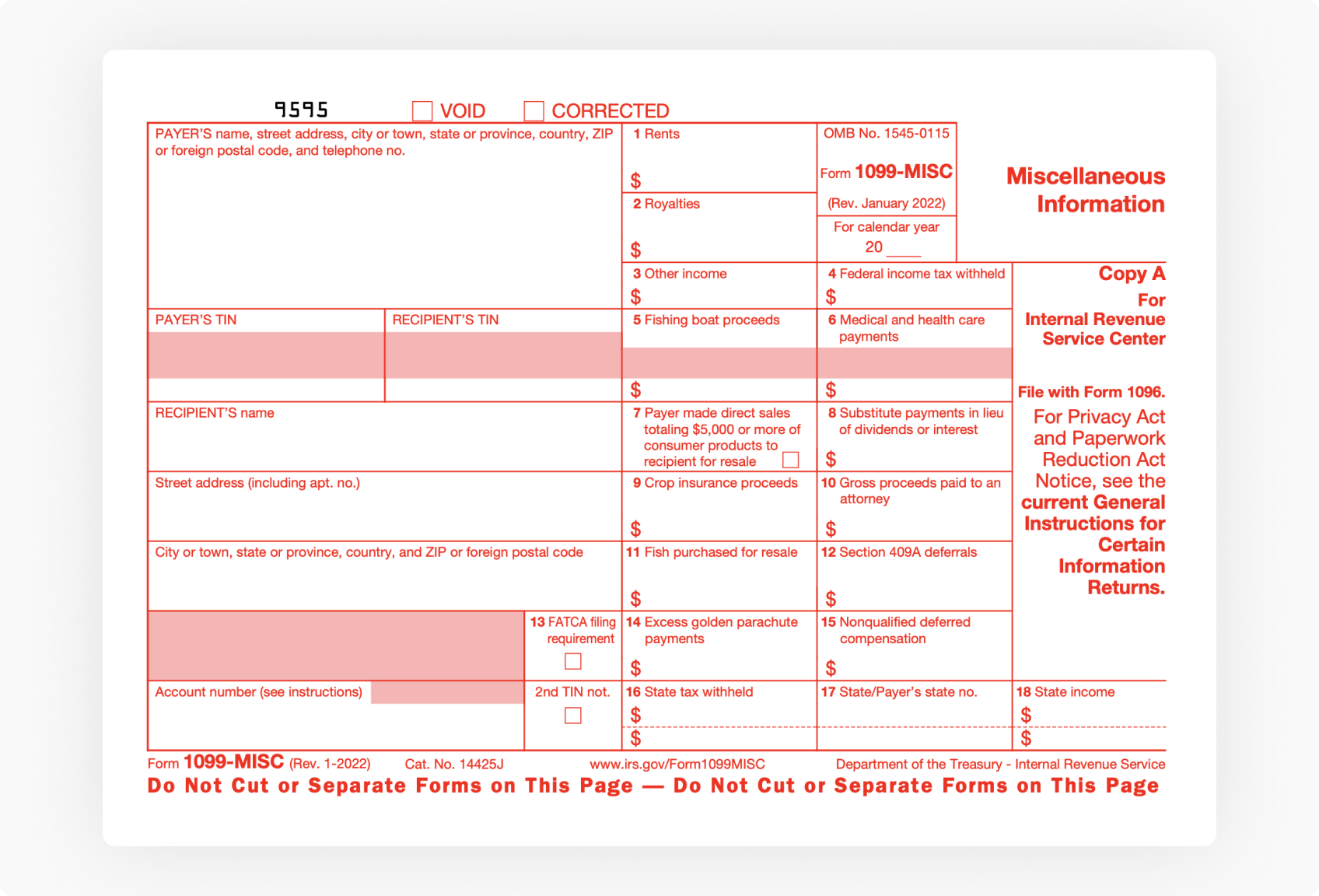

7. Form 1099-MISC

Form 1099-MISC, or the Miscellaneous Income (Miscellaneous Information), is an IRS document used to report different types of miscellaneous payments such as rents, awards, healthcare payouts, etc.

The 1099 series includes a number of other forms, among which Form1099-MISC and Form 1099-NEC (Nonemployee Compensation) are the most commonly used.

Who needs Form 1099-MISC?

A Form 1099-MISC must be filed whenever an individual pays an incorporated independent contractor (a sole proprietor/member of partnership/LLC) $600 or more within a year for work performed during the course of your business.

What is the due date for Form 1099-MISC?

January 31 is the deadline for mailing Form 1099-MISC to recipients. February 28 is the due date for submitting 1099-MISC to the IRS, while the deadline for electronic filing is March 31.

In one of our recent blogs, we covered how to fill out Form 1099-MISC. For 1099-MISC instructions, watch the video below:

8. Form 8962

Form 8962 is an IRS document used to calculate the premium tax credit and align it with the advance payment of the premium tax credit (which is taken in advance to decrease one’s monthly health insurance payment).

Who needs Form 8962?

An individual only needs to submit a Form 8962 if they have received health insurance through the Affordable Care Act’s Health Insurance Marketplace.

Take note: if your insurance company provided you with Form 1095-B or your employer sent you Form 1095-C, you don’t need to submit Form 8962.

What is the due date for Form 8962?

Form 8962 should be submitted as an accompanying document along with Form 1040. The deadline for filing these forms in 2022 is April 18.

In one of our recent blogs, we covered how to fill out Form 8962. For 1099-MISC instructions, watch the video below:

9. Profit and Loss Statement

The Profit and Loss (P&L) Statement sums up the costs, revenues, and expenses incurred during a quarter or fiscal year. The Profit and Loss Statement along with the balance sheet and the cash flow statement are the three financial statements each public company is required to issue quarterly or annually.

Who needs a Profit and Loss Statement?

When applying for a loan, any independent contractor or self-employed individual should fill out the P&L statement, thus summarizing their revenues and expenses for a specific period.

What is the due date for the Profit and Loss Statement?

The P&L Statement must be submitted once a quarter (minimum period). Depending on the creditor’s decision, the statement can be submitted less often (up to an entire fiscal year).

In one of our blogs, we covered how to fill out a Profit and Loss Statement. For step-by-step instructions, watch the video below:

10. SS-5 Form

The SS-5 form is an SSA (Social Security Administration) document used to apply for a new or replace an existing Social Security Card. A SSN (Social Security Number) is a must-have in such cases as:

- applying for a job

- using healthcare services

- opening bank accounts

- receiving social security retirement benefits

and more.

Who needs Form SS-5?

Every US resident is required to have a Social Security Number. A SSN is used to report individual wages to the government and to determine their eligibility for benefits. A person might need to apply for a Social Security card if they never received one, lost, or damaged their existing card. In this case, the individual needs to fill out an SS-5 Form.

What is the due date for Form SS-5?

Basically, there’s no set deadline for receiving an SSN and, therefore, filling out the SS-5 Form. However, parents are required to apply for an SSN for their children as soon as possible after the child’s birth. Immigrants should apply for their SSN ten days after their arrival in the United States.

For more information on the Social Security Card and how to fill out Form SS-5, watch the video below:

Key dates for the 2022 tax season

Finally, there are a couple of important dates US residents should keep in mind regarding tax payments for 2022:

- January 24

The Internal Revenue Service’s starting date for accepting and processing tax returns.

- April 18

The due date to submit one’s 2021 tax return, though it’s also possible to request a six-month extension.

- October 17

The due date to submit one’s 2021 tax return if a six-month extension was requested.

The bottom line

Filling out and submitting tax forms is a must for every taxpayer. However, the process can be completed quickly and easily when done electronically with a reliable IRS tax forms catalog.