Navigating Tax Season: A Simplified Guide to Filing the 1099-INT Form for Interest Income

Tax season often brings with it a flurry of paperwork and forms, leaving many individuals and business owners feeling overwhelmed and confused. One such form that often raises questions is the 1099-INT. If you’ve received interest income from financial institutions or other entities, it’s crucial to understand the ins and outs of this form to ensure accurate reporting and compliance with tax regulations.

In this comprehensive guide, we will delve into the details of form 1099-INT. We’ll explain what it is, who needs to file it, and the potential penalties for non-compliance. Also, we’ll provide a step-by-step breakdown of how to fill out a 1099-INT form, explore the deadlines for filing, and more. So, let’s dive in and unravel the intricacies of the 1099-INT tax form together.

Take note: All of the previous form 1099 INT versions are available at pdfFiller.com.

Table of contents

- What is 1099 INT?

- Who has to file a 1099 INT?

- Is there a penalty if I don’t include a 1099 INT?

- When is the form 1099 INT due?

- How do I fill out a 1099 INT form?

- When is 1099 INT issued?

- What is the benefit of 1099 INT?

- Which institutions are exempted from 1099 INT?

- Where do I send IRS 1099 INT?

- Where to put 1099 INT on the tax return?

What is 1099 INT?

A 1099-INT is an information return that reports interest income paid to an individual or a business entity by a financial institution or another entity. The payer sends a copy of the 1099-INT form to the recipient and to the IRS, which ensures that the recipient properly reports the income on their tax return.

Who has to file a 1099 INT?

The entity that pays interest income of $10 or more during the tax year to an individual or a business entity must file a 1099-INT form with the IRS and send a copy to the recipient. This typically includes banks, credit unions, brokerage firms, and other financial institutions, as well as some non-financial entities that pay interest such as state and local governments. In some cases, even if the interest paid is less than $10, a 1099-INT form may still need to be filed if it is part of a sequence of payments that add up to $10 or more.

Is there a penalty if I don’t include a 1099 INT?

Yes, there can be penalties for failing to file a 1099-INT form or for filing an incorrect or late form. The penalties can vary depending on the degree of lateness or error. For example, the penalty for filing a 1099-INT form correctly, but up to 30 days late, is $50 per form. If filed more than 30 days late, but before August 1st, the penalty goes up to $100 per form. If filed after August 1st or not filed at all, the penalty jumps to $270 per form. The penalties can add up quickly if you have multiple forms to file, so it’s important to make sure you file them on time and correctly.

When is the form 1099 INT due?

The deadline for filing Form 1099-INT is January 31st of the year following the tax year in which the interest was paid. This means that if you paid interest during the calendar year, the 1099-INT form is due to the recipient and the IRS on or before January 31st next year. It’s important to note that this deadline also applies to any corrections that need to be made to previously filed 1099-INT forms. If the deadline falls on a weekend or a legal holiday, the due date is the next business day.

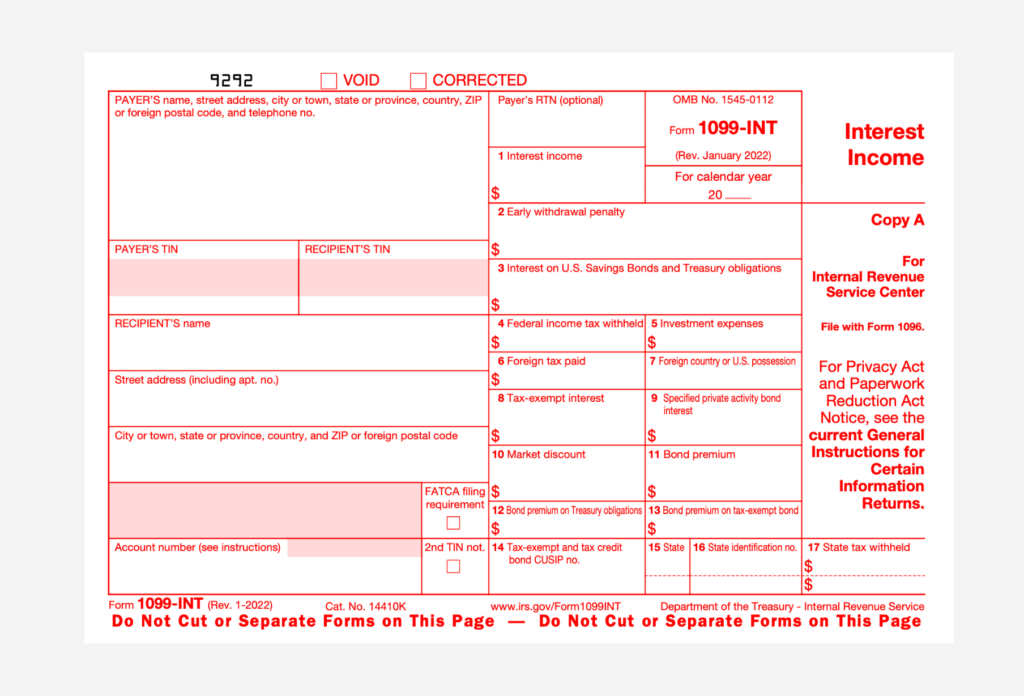

How do I fill out a 1099 INT form?

To complete a 1099-INT form, you will need to gather information about the interest payment you made and the recipient of that payment. Here are the steps to fill out a 1099-INT form:

- Obtain a blank copy of the 1099-INT form from the IRS website or from your tax software.

- In Box 1, enter the total amount of interest payments made during the year.

- In Box 2, enter the amount of any early withdrawal penalties paid due to the early withdrawal of time deposits.

- In Box 3, enter the name of the recipient of the interest payments.

- In Box 4, enter the recipient’s address.

- In Box 5, enter the recipient’s tax identification number (TIN), which is either their social security number (SSN) or employer identification number (EIN).

- In Box 6, enter any foreign tax paid on the interest income.

- In Box 7, enter the amount of tax-exempt interest paid.

- In Box 8, enter the amount of tax-exempt bond coupon interest paid.

- In Box 9, enter the recipient’s account number for the interest payments.

- If backup withholding was applied to the interest payments, enter the amount in Box 13.

- If state tax was withheld from the interest payments, enter the amount in Box 15.

- Sign and date the form.

- Send Copy A of the form to the recipient by January 31st, and file Copy A with the IRS by February 28th.

When is 1099 INT issued?

A 1099-INT form must be issued to the recipient by January 31st of the year following the tax year in which the interest income was paid. This means that if you paid interest income to a recipient during the current calendar year, the 1099-INT form must be postmarked and mailed to the recipient by January 31st next year. It is important to allow enough time for the recipient to receive the 1099-INT form before the recipient’s tax return filing deadline. For example, if the recipient is an individual filing a personal income tax return, the tax return filing deadline is April 15th, so the recipient should have received the 1099-INT form well before then.

What is the benefit of 1099 INT?

The 1099-INT form serves an important purpose by providing both the recipient and the IRS with information about the interest income paid during the calendar year. Here are some benefits of the 1099-INT:

- Helps the recipient file an accurate tax return: The recipient can use the information provided on the 1099-INT form to accurately report the interest income on their tax return, which helps to avoid errors or underreporting of income.

- Helps the IRS track taxable income: The IRS receives a copy of the 1099-INT form, which helps them keep track of taxable income and ensure that recipients are reporting all of their income accurately.

- Helps the lender with record-keeping: The lender or financial institution that issues the 1099-INT form can use it as part of their record-keeping for their own tax purposes.

- Avoids penalties for failure to report taxable interest income: Failing to report interest income on a tax return can result in penalties and additional taxes owed to the IRS. Providing accurate information on the 1099-INT form helps avoid these penalties and ensures compliance with tax laws.

Which institutions are exempted from 1099 INT?

There are some entities that are exempt from sending 1099-INT forms. Here are some examples:

- Tax-exempt organizations: Tax-exempt organizations, including charities and nonprofit organizations, are generally exempt from being required to file a 1099-INT form.

- Governments: Federal, state, and local governments are exempt from sending a 1099-INT form for interest payments made in the ordinary course of business.

- Financial institutions outside the United States: Financial institutions located outside the United States are generally not required to file 1099-INT forms with the IRS.

- Individual taxpayers: Individual taxpayers are not required to file a 1099-INT form for interest payments they receive, but they are still required to report the income on their tax return.

It’s important to note that these exemptions are subject to certain conditions and limitations, and it’s best to consult with a tax professional for specific advice on your situation.

Where do I send IRS Form 1099 INT?

Recipients of interest income should expect to receive Form 1099-INT from the payer early in the year. There’s no need to file this form separately, however, you do need to include the information on it when you file your tax return.

If you are the organization responsible for paying the interest, you must file copies of Form 1099-INT with both the IRS and the recipient’s state tax department.

Please note that if you are an individual taxpayer, the likelihood of needing to file Form 1099-INT is low, even if you have paid interest to others throughout the year.

Reporting interest on obligations issued by individuals is not required on Form 1099-INT.

Where to put 1099 INT on the tax return?

The information reported on a Form 1099-INT needs to be entered on your tax return. The specific location on the tax return can vary depending on the type of tax return you are filing. Here are some guidelines on where to put the information from a 1099-INT form on several types of tax returns:

- For Form 1040 (U.S. Individual Income Tax Return): The interest income reported on the 1099-INT form is generally reported on Line 2b of Form 1040. If you receive multiple 1099-INT forms, you will need to add up the amounts and report the total on Line 2b.

- For Form 1040A (U.S. Individual Income Tax Return): The interest income reported on the 1099-INT form is generally reported on Line 8a of Form 1040A. Again, if you have multiple 1099-INT forms, you will need to add up the amounts and report the total on Line 8a.

- For Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents): If you receive interest income and have no other income to report, you can generally use Form 1040EZ to report the income. The interest income reported on the 1099-INT form should be entered on Line 2 of Form 1040EZ.

It’s important to note that these are general guidelines, and the specific location of the interest income on your tax return may depend on your individual situation. If you are unsure of where to report the information, it is always best to consult with a tax professional.

Start your free trial to see pdfFiller in action!

Fill out your 1099-INT form online