How to Fill Out a W-4 Form: Employee’s Withholding Certificate Instructions

Tax season is right around the corner. As a tax filer, you can start submitting your IRS return(s) from January 24 to April 18. So, it’s high time to discover all the details about the most popular IRS forms you’ll need this tax season.

Take note: if you request a filing extension by April 18, you’ll be able to file your tax returns until October 17.

In this blog, you can find all the required information about one of the most widely-used forms, the IRS form W-4. We’ll cover the following topics:

- what’s new in this year’s W-4 form revision

- the difference between the W-4 and W-2 forms

- how to fill out the W-4 form

Let’s get started!

Table of contents:

- What is a W-4 form: Employee’s Withholding Certificate?

- What is the W-4 form used for?

- W-4 form revision: what has changed?

- Who completes form W-4? How to claim an exemption on form W-4?

- W-4 vs. W-2 form: What’s the difference?

- When is form W-4 due?

- How to fill out a W-4 form?

- How to submit a W-4 form to the IRS?

What is a W-4 form: Employee’s Withholding Certificate?

A W-4 form, otherwise known as the Employee’s Withholding Certificate, is used by employees to tell employers how much tax to withhold from each paycheck. On the other hand, employers use the IRS form W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of the employee.

You don’t need to file an IRS form W-4 every year — you need to complete the W-4 form only when you start a new job or want to adjust your withholdings at your current job.

What is the W-4 form used for?

The primary purpose of an IRS form W-4 is to determine an employee’s federal income tax withholding amount. To determine the amount of FIT withheld from an employee’s wages, use the IRS Publication 15-T to learn the methods and tables for withholding.

The IRS Publication 15-T provides tax tables that work with W-4 forms from 2019 and earlier. Make sure you use the necessary table to determine your employee’s withholding.

It’s possible to use the IRS Tax Withholding Estimator to complete or adjust your Form W-4 or W-4P. It helps you figure out the right federal income tax to have withheld from your paycheck.

W-4 form revision: What has changed?

The main change is that the new version of the W-4 form eliminates the option of claiming personal allowances. Previously, you had to complete a Personal Allowances Worksheet with a W-4 to figure out the number of allowances to claim.

The new IRS Form W-4 only asks to record the number of dependents in your household (in step 3.2). It’s required to show whether your circumstances warrant a larger or smaller amount of withholdings. Now you can indicate whether there is an income from a second job or deductions to itemize in the tax return.

Who completes form W-4? How to claim an exemption on form W-4?

Almost every employee should complete the document and submit it to their employer. It’s essential to renew Form W-4 when you start a new job or if the status of your personal life changes – for example, when getting married or having a child.

Only certain employees are exempt from federal income tax:

- If they had no federal income tax liability in the previous year

- If they expect to have no federal income tax liability in the current year

Mind that if an employee is exempt from federal income tax, they claim it on Form W-4 by writing “Exempt” in the space below Line 4(c). They still need to complete their name, address, SSN, and signature.

Moreover, the new Tax Cuts and Jobs Act allows you to claim credit for other dependents – for example, individuals aged 17 or older and supported parents. All these factors influence the number of your withholding allowances and thus the amount withheld from your income taxes.

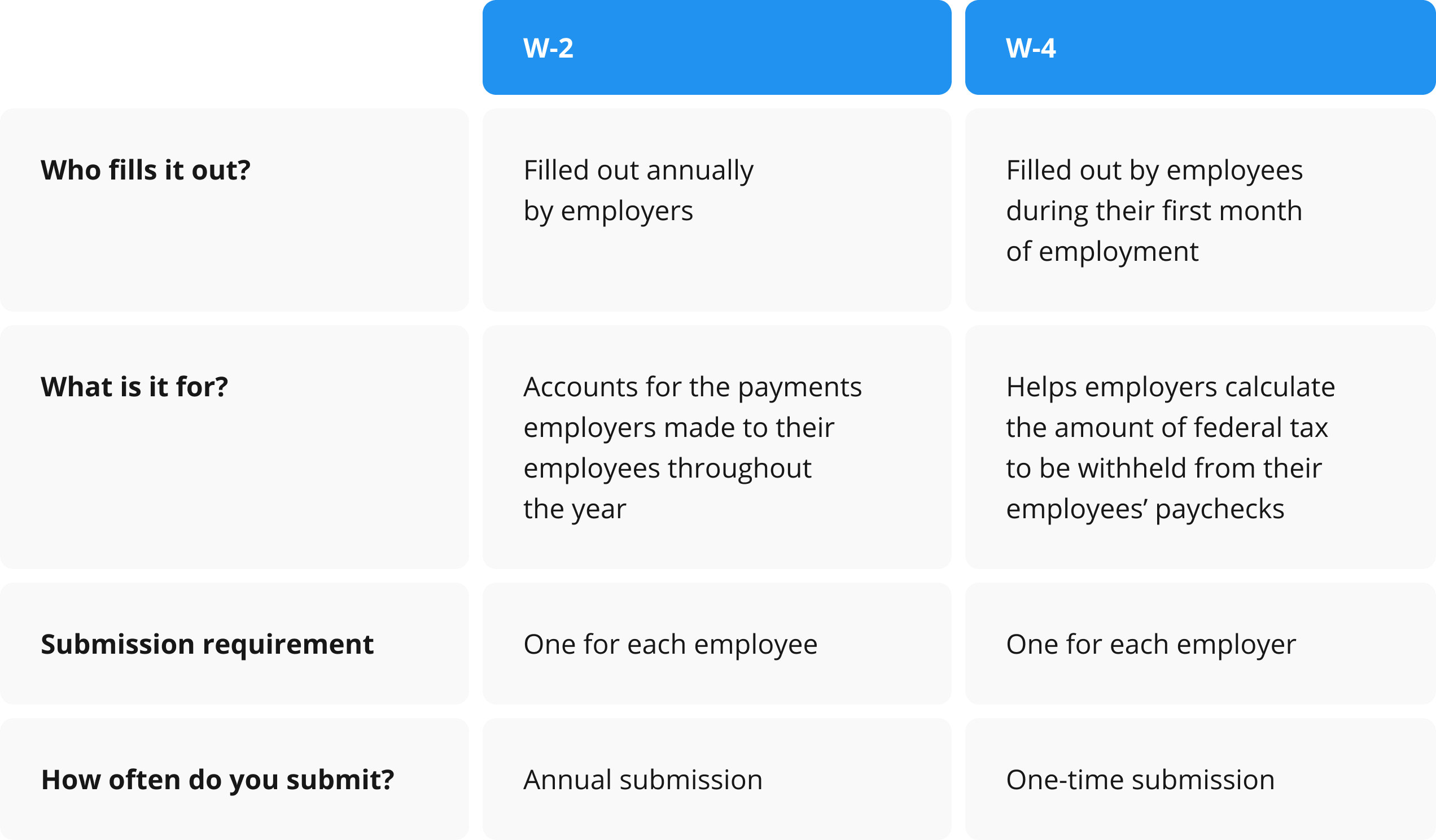

W-4 vs. W-2 form: What’s the difference?

The IRS form W-4 and the IRS Form W-2 may seem similar at first glance. But they have several significant differences.

- IRS form W-4: employees need to complete a W-4 within their first month on the job.

- IRS form W-2: employers submit a form for each employee to the IRS at the end of every year.

Discover the similarities and differences between forms W-2 and W-4 in the comparison chart below:

When is form W-4 due?

To continue to be exempt from withholding into the next year, an employee must give you a new form W-4 claiming exempt status by February 15 of that year. If the employee doesn’t give you a new form W-4, withhold tax as if he or she is single or married, filing separately with no other entries in steps 2, 3, and 4. Of course, it’s possible to mail or electronically file these forms. For example, you can file and submit these forms via pdfFiller.com.

How to fill out a W-4 form?

The new IRS form W-4 has five steps, including one that is optional.

If you are single or are married to a spouse who doesn’t work, you don’t have dependents, you only have one job, and you aren’t claiming tax credits or deductions, then completing a W-4 is simple. All you need to do is fill out your name, address, Social Security number, and filing status, then sign and date the form.

If your situation is different, you’ll need to provide the IRS with more information.

- Step 1. Enter personal information

Complete the first part of the IRS form W-4 with your personal information such as your name, address, filing status, and SSN. Single filers with a simple tax situation only need to sign and date the form, and they are done. Complete Steps 2 through 4 only if they apply to you. Otherwise, skip to Step 5.

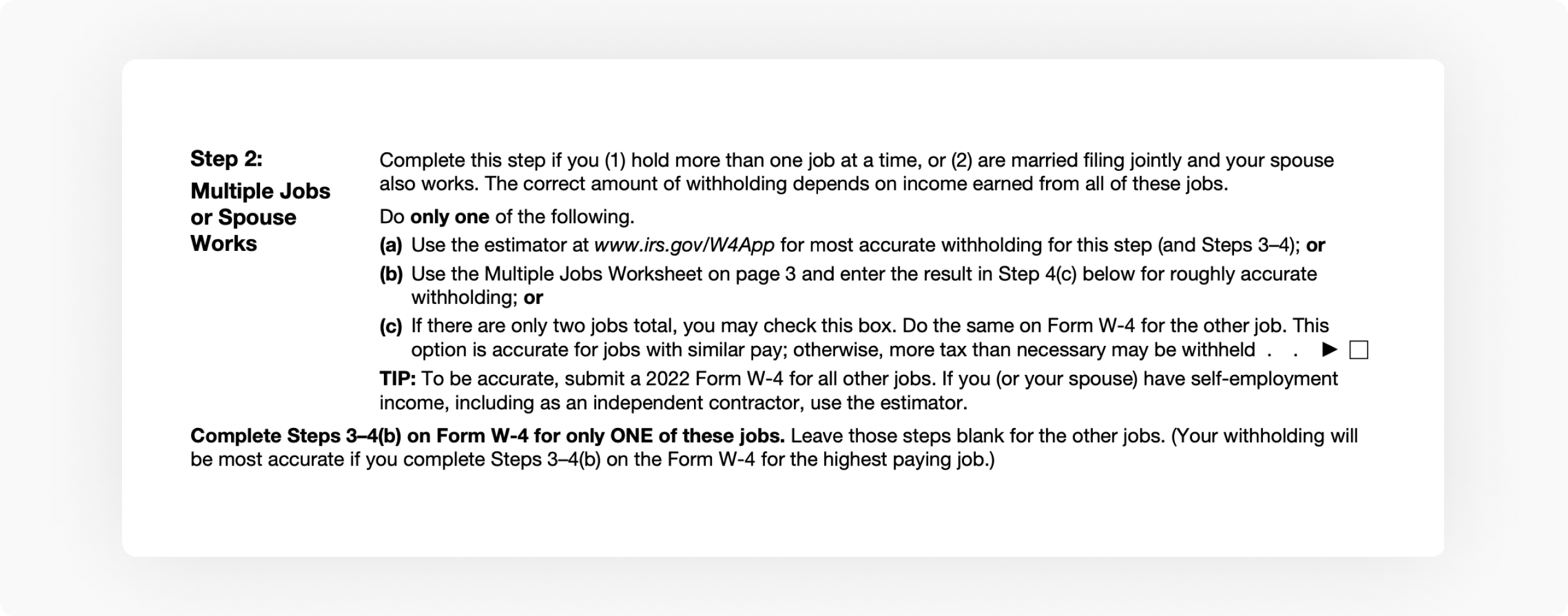

- Step 2. Multiple jobs or spouse employment

Proceed to step two if you have more than one job or your filing status is married filing jointly and your spouse works. To get a more accurate withholding result, choose to complete Option A, B, or C, depending on your number of jobs and income.

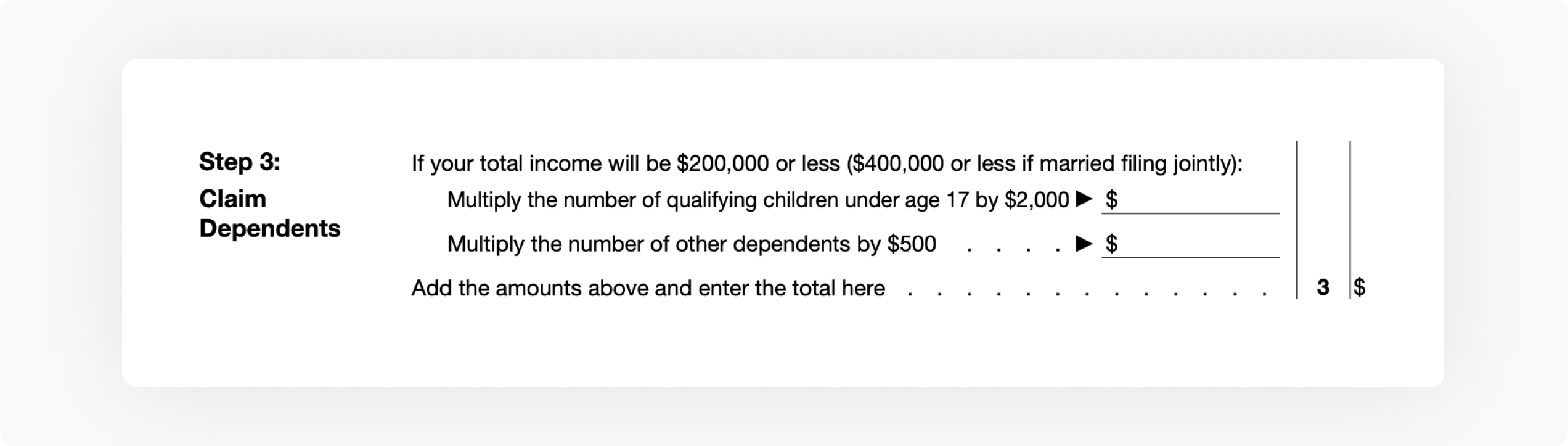

- Step 3. Claim dependents

If you have dependents, fill out step three to determine your eligibility for the Child Tax Credit and credit for other dependents.

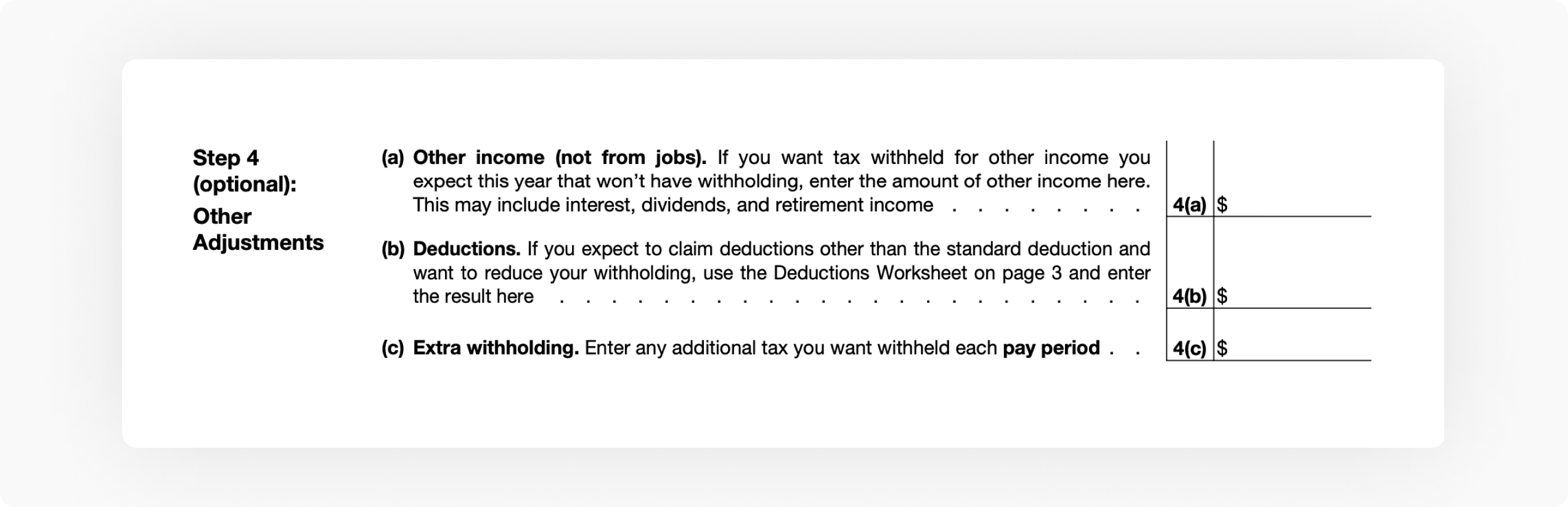

- Step 4. Add adjustments

Proceed to step four to refine your withholdings. If you want extra tax withheld or expect to claim deductions other than the standard deduction when you do your taxes, you can note that.

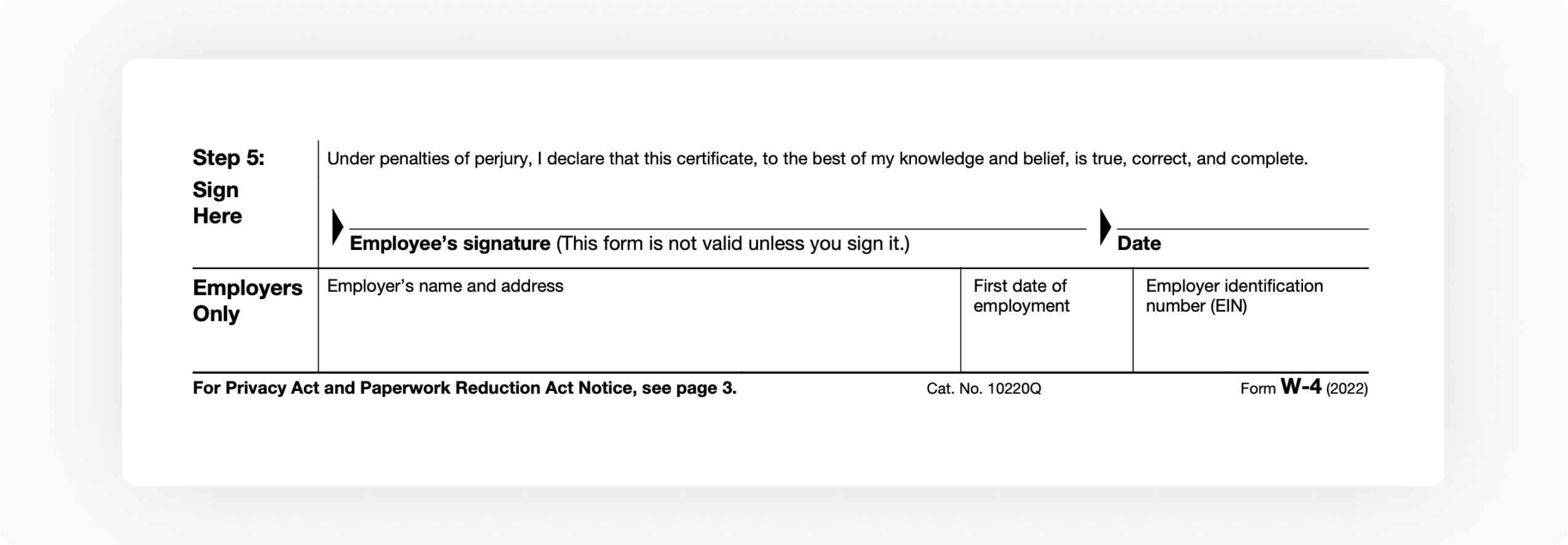

- Step 5. Sign and date the Form W-4

Once all the fields are completed and checked off, sign and date your W-4.

Watch the video below to see the step-by-step process of filling out the W-4 form in pdfFiller:

How to submit a W-4 form to the IRS?

Fill out and submit the IRS form W-4 electronically using pdfFiller. It allows you to complete any tax form on any desktop or mobile device. Once you’ve finished filing the form, share it in a few clicks. It’s possible to send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.