If you’ve ever been denied the Earned Income Credit (EIC) in a previous tax year, you may be eligible to reclaim it by completing Form 8862. This powerful form can significantly impact your tax refund and put more money back in your pocket.

In this blog, we will provide you with a concise and informative guide to 8862 Form. Whether you’re a taxpayer seeking to reclaim the EIC or a tax professional assisting clients, this guide will equip you with the knowledge needed to navigate IRS Form 8862 with confidence.

Take note: All of the previous form 8862 versions are available at pdfFiller.com.

Table of contents

- What is Form 8862?

- Who has to file the 8862 Form?

- Is there a penalty if I don’t file an IRS Form 8862?

- When is the IRS Form 8862 due?

- How do I fill out an IRS Form 8862 form?

- When is Form 8862 issued?

- What is the benefit of the 8862 Form?

- Where do I send IRS Form 8862?

- Where to put IRS Form 8862 on the tax return?

What is Form 8862?

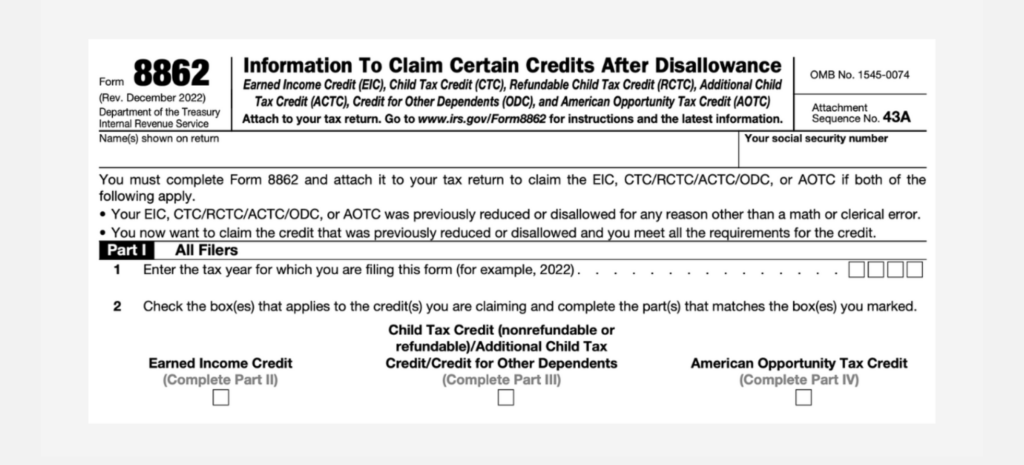

IRS Form 8862 is titled Information to Claim Certain Refundable Credits After Disallowance. This tax form is used to claim certain refundable credits like the Earned Income Tax Credit (EITC) and/or the Child Tax Credit (CTC) after the IRS has previously disallowed them. The 8862 form helps the IRS determine whether the taxpayer can still claim these credits in the current or future tax years.

Who has to file the 8862 Form?

Taxpayers who have claimed the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC), had that credit disallowed by the IRS, and wish to claim the same credit in a subsequent tax year are required to file IRS Form 8862. Form 8862 serves as a tool for the IRS to ensure that only eligible taxpayers claim these credits and prevent fraudulent claims.

Is there a penalty if I don’t file an IRS Form 8862?

If you must include IRS Form 8862 with your tax return but fail to do so, the IRS may reject your claim for the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). Without Form 8862, the IRS may view your claim for these credits as inaccurate, increasing the likelihood of errors in your tax return. In addition, the IRS may disallow any credits you claimed in subsequent years, which can result in the loss of potential tax refunds. If the IRS determines that you knowingly provide false or inaccurate information on your tax return, you may be subject to penalties and fines, including the repayment of any previously received credits.

When is the IRS Form 8862 due?

The IRS Form 8862 must be filed with the taxpayer’s tax return for each tax year in which they are claiming the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) after those credits were previously disallowed by the IRS. The form should be included in the tax return for the applicable year and filed by the applicable tax deadline, typically April 15th, unless an extension has been granted. If the taxpayer requests an extension to file their tax return, Form 8862 should be included with the extended tax return.

How do I fill out an IRS Form 8862 form?

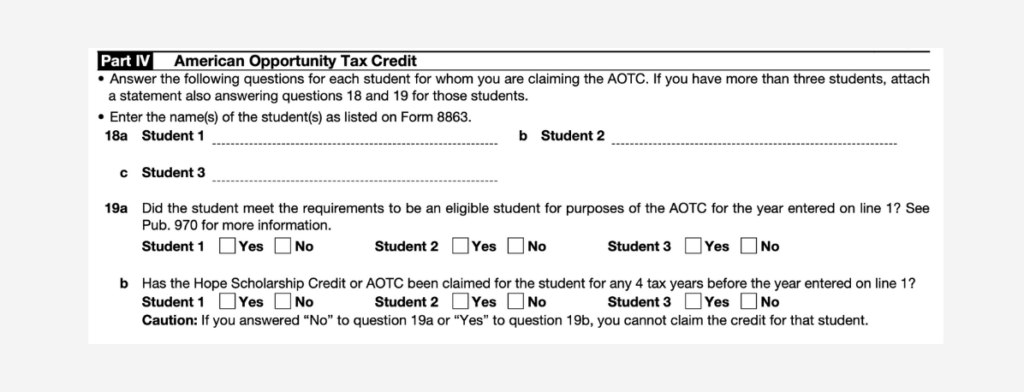

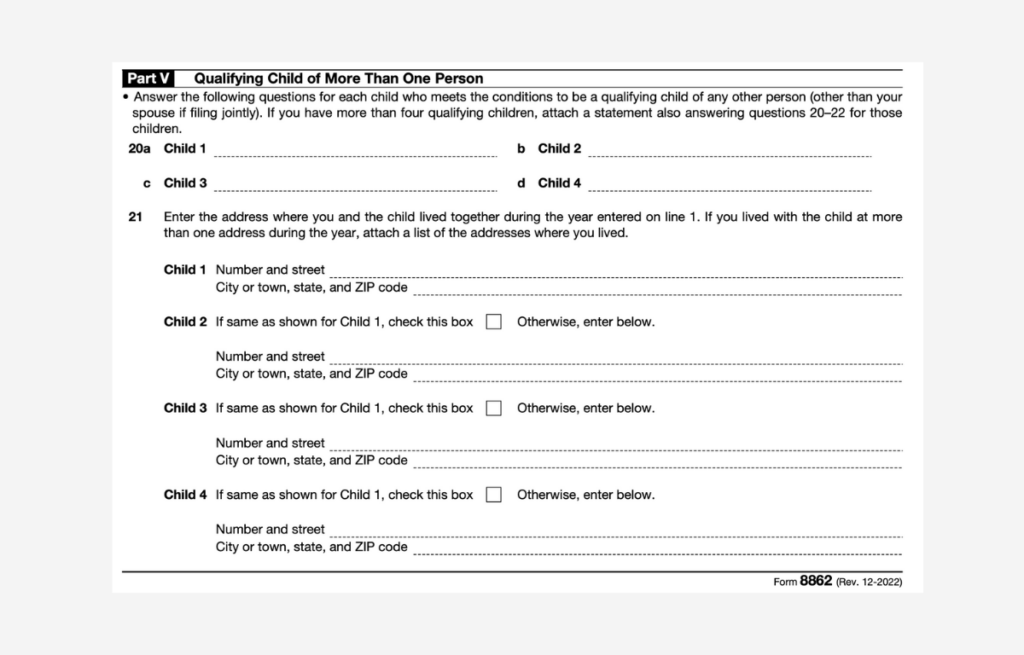

The IRS Form 8862 consists of five parts. Follow these steps to fill out the form correctly:

Part 1: This section is for taxpayer identification. Provide your name, SSN, or ITIN, and the tax year you are filing for.

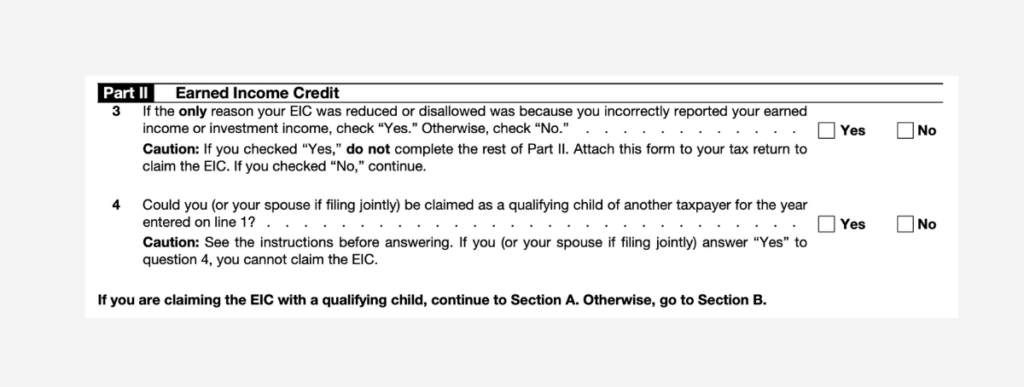

Part 2: Complete this section if you wish to claim the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) but had those credits disallowed in a prior year. You must enter the tax year when the credits were last disallowed and the reason the IRS gave for that disallowance.

Part 3: Complete this section to claim the EITC in the current tax year. It involves answering questions about your eligibility to claim the credit, such as your dependents’ age and residence status, earned and adjusted gross income, and whether you have investment income.

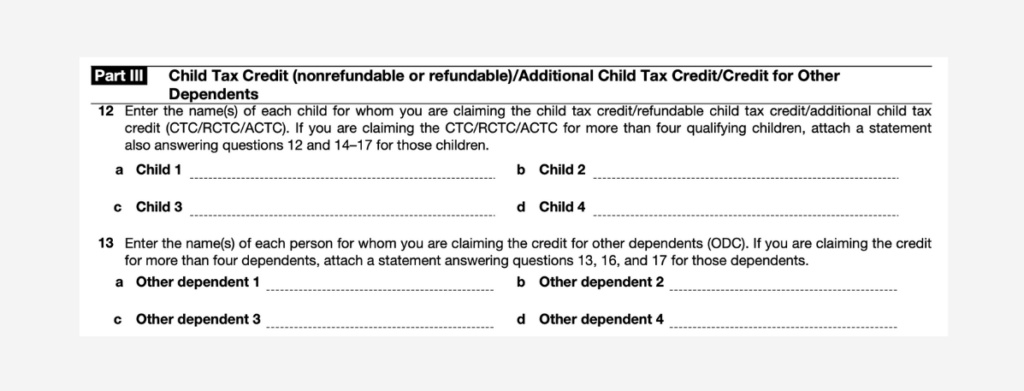

Part 4: Complete this section to claim the Child Tax Credit in the current tax year. It involves answering questions regarding your eligibility to claim the credit, such as your child’s age, residence status, relationship to you, and other factors.

Part 5: Fill out this section only if you have experienced an IRS audit or examination related to your EITC or CTC and are using the Form to provide additional information requested by the IRS or to dispute their findings.

After completing all required sections, you must sign and date the Form.

When is Form 8862 issued?

IRS Form 8862 is not typically issued to taxpayers by the IRS. Rather, it is a form that taxpayers must use if they have previously claimed the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) and had those credits disallowed by the IRS. The taxpayer should then use Form 8862 to claim the credit again in a subsequent tax year if they believe they are still eligible. So, the taxpayer is responsible for determining if they need to file Form 8862, completing the Form accurately, and submitting it with their tax return.

What is the benefit of the 8862 Form?

The benefit of IRS Form 8862 is that it allows eligible taxpayers who had previous claims for the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) disallowed by the IRS to claim these credits again in subsequent years. If the taxpayer has experienced a change in circumstances that may make them eligible for these credits, they can use Form 8862 to help prove their eligibility.

The Form also serves as a tool for the IRS to make sure that only people who are truly eligible for these refundable tax credits claim them, as the IRS often closely scrutinizes claims made for the EITC and CTC to prevent fraud. Ultimately, the benefit of Form 8862 is that it helps eligible taxpayers receive a significant refund on their tax return and encourages tax compliance by deterring fraudulent claims for these credits.

Which institutions are exempted from IRS Form 8862?

The IRS Form 8862 is intended for individual taxpayers only. However, there are certain circumstances when a taxpayer would not need to file Form 8862 even if they were previously disqualified from claiming the EITC or the CTC. One example is if the disqualification was due to a mathematical or clerical error rather than intentional wrongdoing. Another example is if the disqualification was due to the taxpayer mistakenly listing the wrong Social Security Number on the initial tax return. In both cases, the IRS may correct the error and allow the taxpayer to claim the credit without filing Form 8862.

Where do I send IRS Form 8862?

The IRS mailing address to send Form 8862 depends on your location and whether you are enclosing a payment with your Form. The form instructions provide a chart to help determine the proper address for submitting your Form. Send your completed Form 8862 with your tax return to the address listed for the state where you physically reside. However, if you submit your Form separately from your tax return or have additional questions, contact the IRS directly at 1-800-829-1040 or 1-800-829-3676 for further guidance regarding where to send your Form or any other questions about the refundable tax credits process.

Where to put IRS Form 8862 on the tax return?

If you are required to file IRS Form 8862, you should attach it to your tax return in the same envelope when you mail it to the IRS or in the electronic file if you file it electronically. The exact location on the tax return can vary depending on your specific tax software or paper form instructions.

However, generally, you would include Form 8862 with your tax return filing after completing all other required credits and schedules on your return. If you are filing a paper return, staple your Form 8862 to your completed tax return at the upper left corner of the first page. Alternatively, if you are filing electronically, your tax software should provide instructions on where to attach Form 8862 to your electronic tax return.