As a business owner with employees, you will need to file an IRS Form 940. In this guide, you can find detailed IRS Form 940 instructions along with other information about this form.

We’ll cover the following questions:

- What is FUTA?

- When to file IRS Form 940?

- How to fill out this tax form?

- Where to send Form 940?

You can use pdfFiller to fill out, print, and return IRS Form 940 for your business. It’s also possible to share your completed document via email.

Table of contents

- What is the IRS Form 940?

- Who needs to file Form 940?

- Form 940 vs. Form 941: The Differences to Consider

- Is Form 940 accompanied by other forms?

- What else do you need to send with IRS Form 940?

- How to file FUTA tax: IRS Form 940 Instructions

What is the IRS Form 940?

Let’s start with the basics — what is FUTA tax?

FUTA stands for the Federal Unemployment Tax Act and imposes a payroll tax on any business with employees. For 2023, the FUTA tax rate stands at 6% of the first $7,000 paid to each employee annually.

As a business owner, you should use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Simply saying, IRS Form 940 represents the amount of federal unemployment taxes paid to the IRS for their employees.

The FUTA tax provides funds for paying qualified workers who have lost their jobs.

Who needs to file Form 940?

Let’s make it simple — you need to file IRS Form 940 if your business paid wages of $1,500 or more to employees in a calendar quarter of the reporting year.

You will also need to complete the Form if you had more than one employee for at least some part of a day for 20 or more different weeks throughout 2022 or 2023.

If you have household employees such as maids or nurses, you’re subject to FUTA taxes if you paid total cash wages of $1,000 or more in any calendar quarter in 2022 or 2023. A household employee is an employee who performs household work in a private home, local college club, or local fraternity or sorority chapter. If this applies to your situation, you may choose to fill out IRS form 940 instead of the 1040 Schedule H.

For agricultural workers, you are required to pay taxes and complete Form 940 if you paid wages of $20,000 or more to your employees during any quarter in the current (2023) or previous calendar year (2022). You also have to fill out the IRS Form 940 if you employ ten or more farmworkers for the lesser part of the day for 20 or more weeks.

However, noncash payments for household work, agricultural labor, and service not in the employer’s trade or business are exempt from social security, Medicare, and FUTA taxes.

IRS Form 940 has several exceptions:

- There are special rules for family-owned businesses. It’s unnecessary to include wages for children under the age of 21. However, include older children and spouses if you structure your business as a corporation or partnership.

- Nonprofit organizations, including educational, religious, or charitable organizations that aren’t subject to taxation under Section 501(c)(3) of the federal tax code don’t have to pay FUTA and, as a result, don’t have to complete Form 940.

However, the question arises — do you need to file Form 940 if you have no employees? The simple answer is no. But keep in mind that every employee (even part-time) counts in the circumstances discussed above. Also, if your business is classified as a partnership, you will not count your business partners as employees.

Form 940 vs. Form 941: The Differences to Consider

Both Form 940 and 941 are IRS returns for businesses to report their payment of employment taxes. However, these Forms have several significant differences.

The main difference between these two forms is that they report the different types of employment tax. IRS Form 940 is used for federal unemployment, while Form 941 covers Medicine, Social Security, and federal income tax withholding.

| Form 940 | Form 941 | |

| Federal unemployment taxes | ✅ | |

| Medicare tax | ✅ | |

| Social Security tax | ✅ | |

| Federal income tax withholding | ✅ | |

| Due quarterly | ✅ | |

| Due annually | ✅ |

Is Form 940 accompanied by other forms?

According to the instructions provided by the IRS, if you choose to include household employees on your IRS Form 940, you must also file one of the following forms:

- Form 941, Employer’s QUARTERLY Federal Tax Return

- Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

- Form 944, Employer’s ANNUAL Federal Tax Return

They are required to report social security, Medicare, and any withheld federal income taxes for your household employees.

What else do you need to send with IRS Form 940?

The IRS Form 940 generally does not require any supporting information such as receipts or proof of payment. If the IRS needs any additional information for your tax return, they will request it through the mail.

How to file FUTA tax: IRS Form 940 Instructions

To report FUTA payments from the previous year’s wages, you should file Form 940 on an annual basis by Jan. 31.

To complete the IRS Form 940, you can follow the instructions provided in the video below or read the instructions for more details:

It isn’t complicated to fill out the Form. You can use the Forms from previous years since much of the company information has remained the same.

Form 940 has several parts for you to fill out:

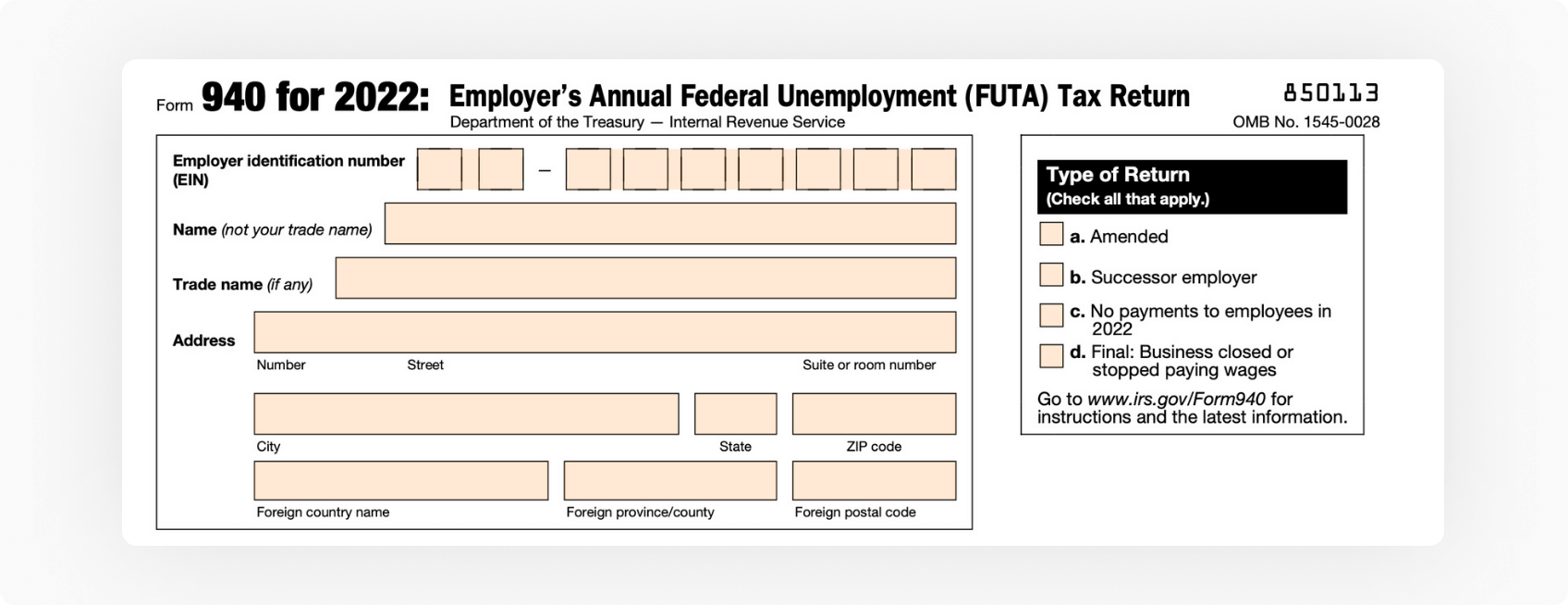

- Company information. Fill in your company’s name, your employer identification number (EIN), and address.

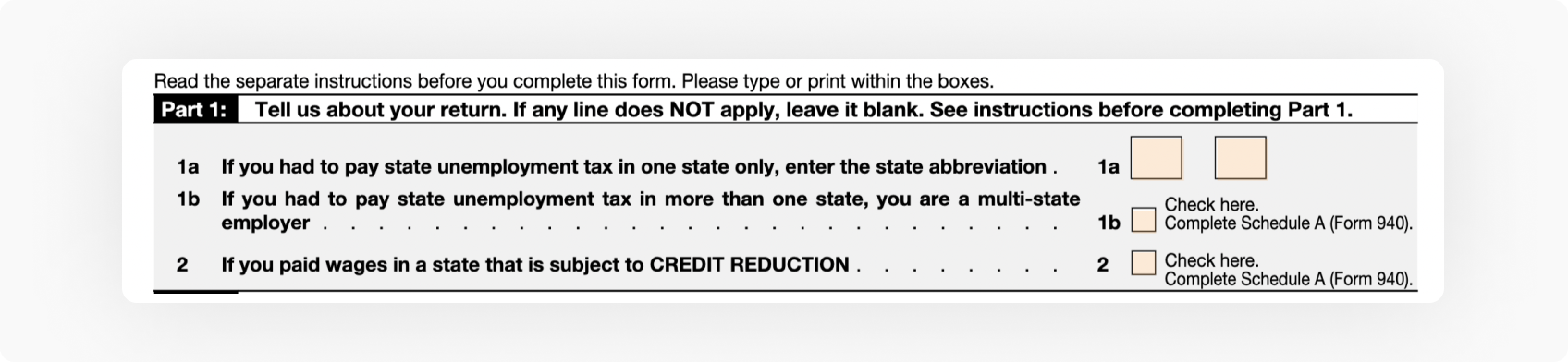

- Part 1. Check the appropriate box depending on whether you pay State Unemployment Tax (SUTA tax) in one or more states.

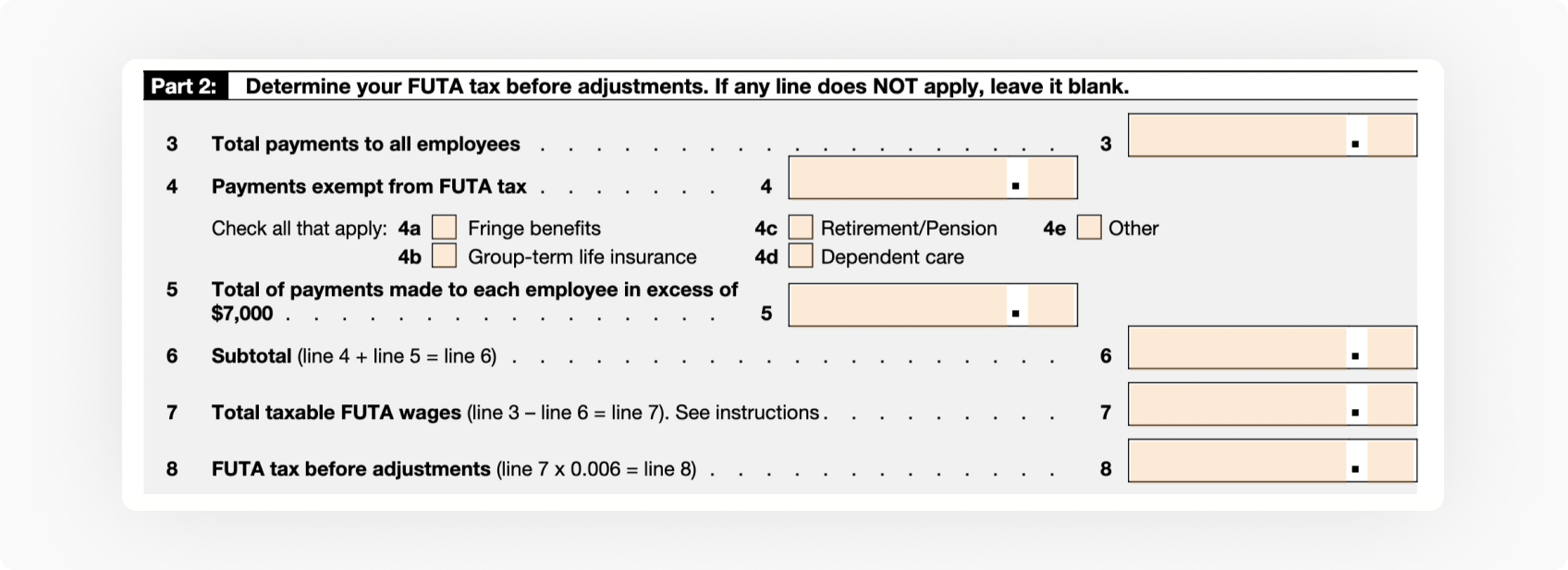

- Part 2. Calculate all the wages subject to FUTA. For example, enter the total amount of compensation your employees received during the year (including benefits, tips, and more) in line 3. As for lines 4-7, remove the exempt compensation from FUTA (like insurance or fringe benefits). In line 8, multiply the eligible FUTA wages on line 7 by the effective FUTA rate of 0.6% (6% FUTA rate – 5.4% FUTA credit).

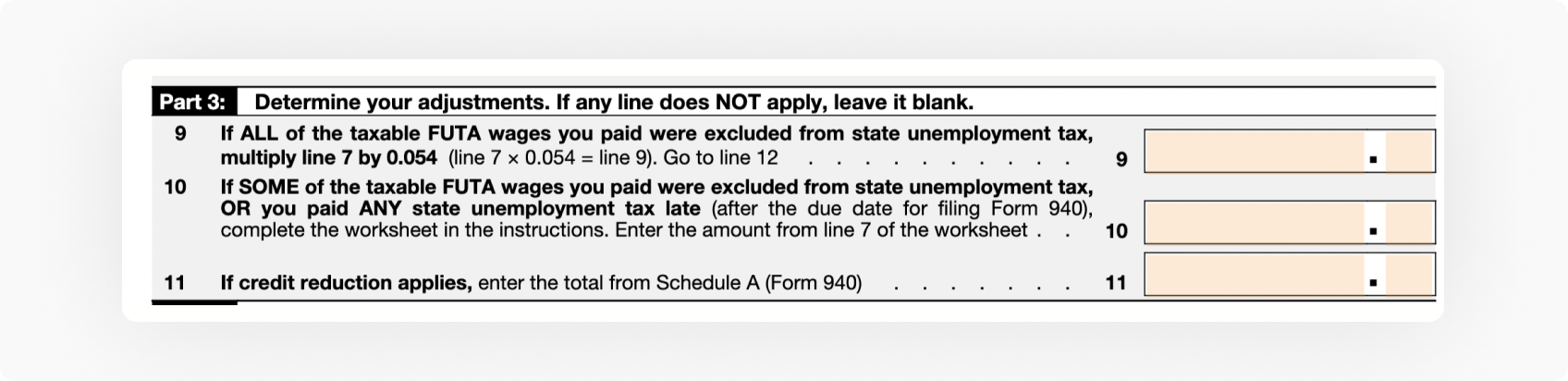

- Part 3. Make adjustments to your FUTA tax liability (if necessary).

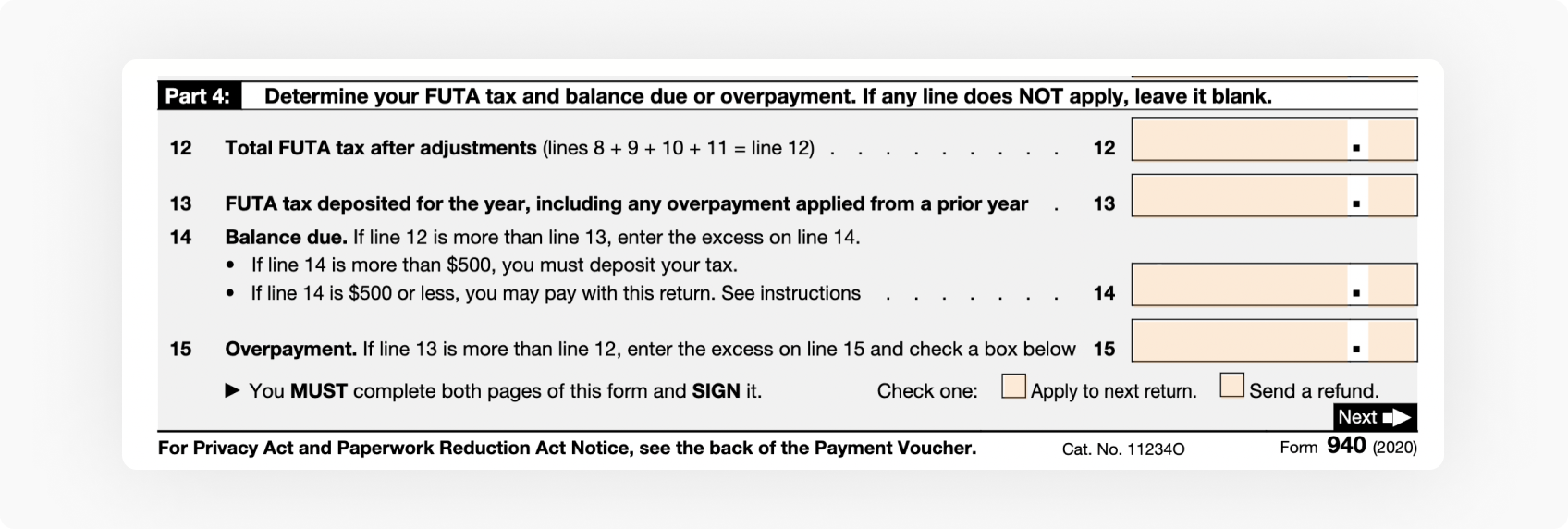

- Part 4. Mark if you overpaid, underpaid, or accurately paid FUTA taxes for the previous year.

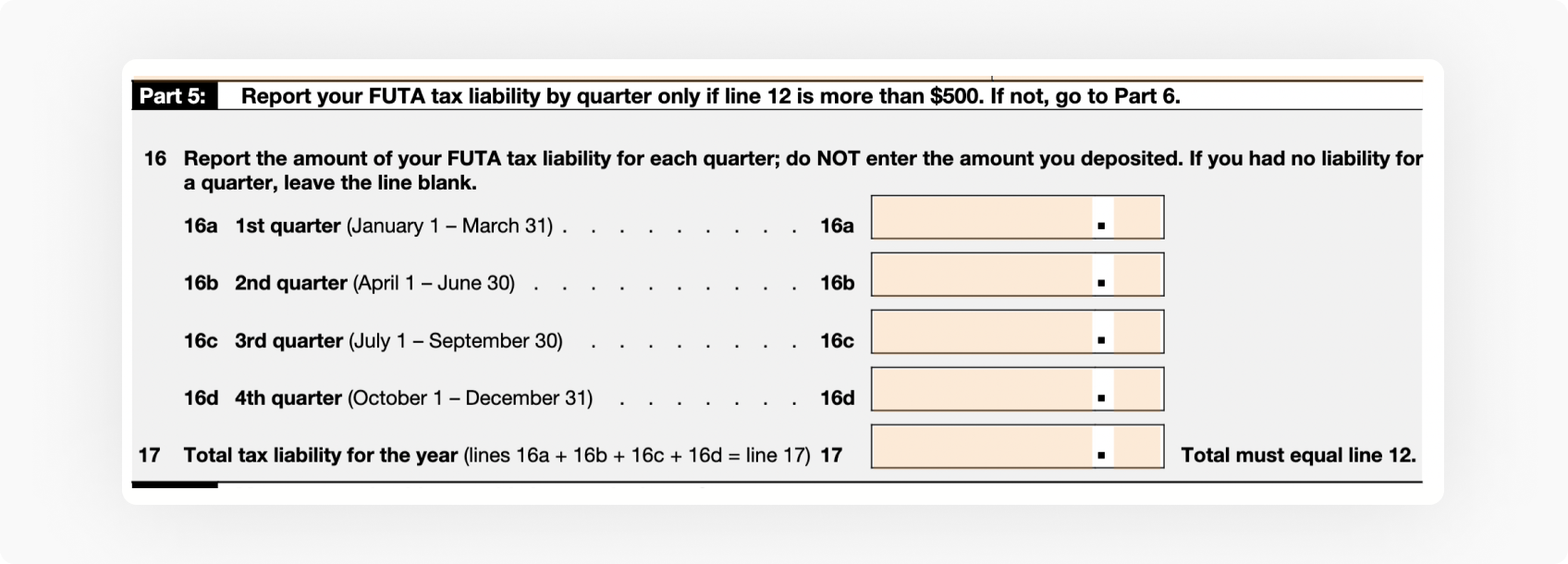

- Part 5. Enter your FUTA tax liability by quarter.

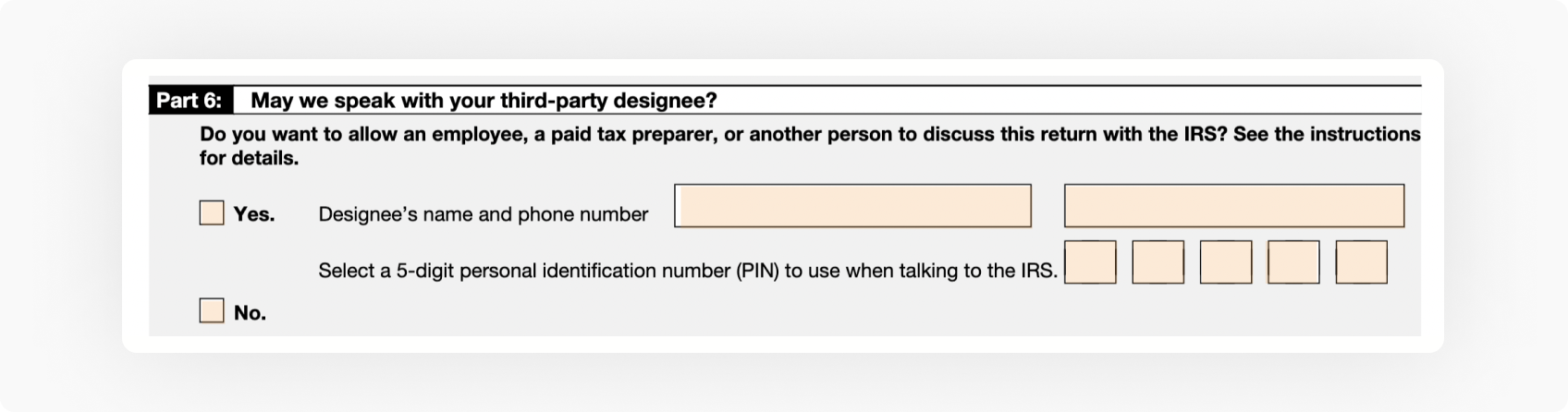

- Part 6. Designate an employee or accountant to discuss your Form 940 with the IRS, if necessary.

- Part 7. Fill out the IRS form and sign off with your signature, date, and phone number.

Where to file Form 940?

It is possible to deposit your FUTA tax before filing your return. It’s required to determine when to deposit your tax depending on the amount of your quarterly tax liability.

Simply speaking, if your FUTA tax is $500 or less for a quarter, you don’t need to file the Form. Complete the Form when your cumulative tax exceeds $500 and deposit your tax for the quarter.

| If your undeposited FUTA tax is more than $500 by: | Deposit your tax by: |

| March 31 | April 30 |

| June 30 | July 31 |

| September 30 | October 31 |

| December 31 | January 31 |

There are penalties for filing your FUTA tax late. The IRS imposes a 5% late filing penalty on unpaid tax amounts for every month delayed.

Where to send IRS Form 940?

It’s possible to send a physical copy of Form 940 to the IRS. You can find all the mailing addresses for filing your Form 940 on the IRS website.

Alternatively, you can e-file the Form. For example, fill out the IRS Form 940 with pdfFiller and send in to the IRS.

You can easily fill out any tax form on any desktop or mobile device. Once the Form is completed, it’s possible to share it in a few clicks. You can also send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.

Sign up for a free trial to see pdfFiller in action!

Fill out your 940 Form electronically

Originally published January 25, 2016, updated January 1, 2023