1040 Schedule A Instructions: How to Reduce Taxes with Itemized Deductions

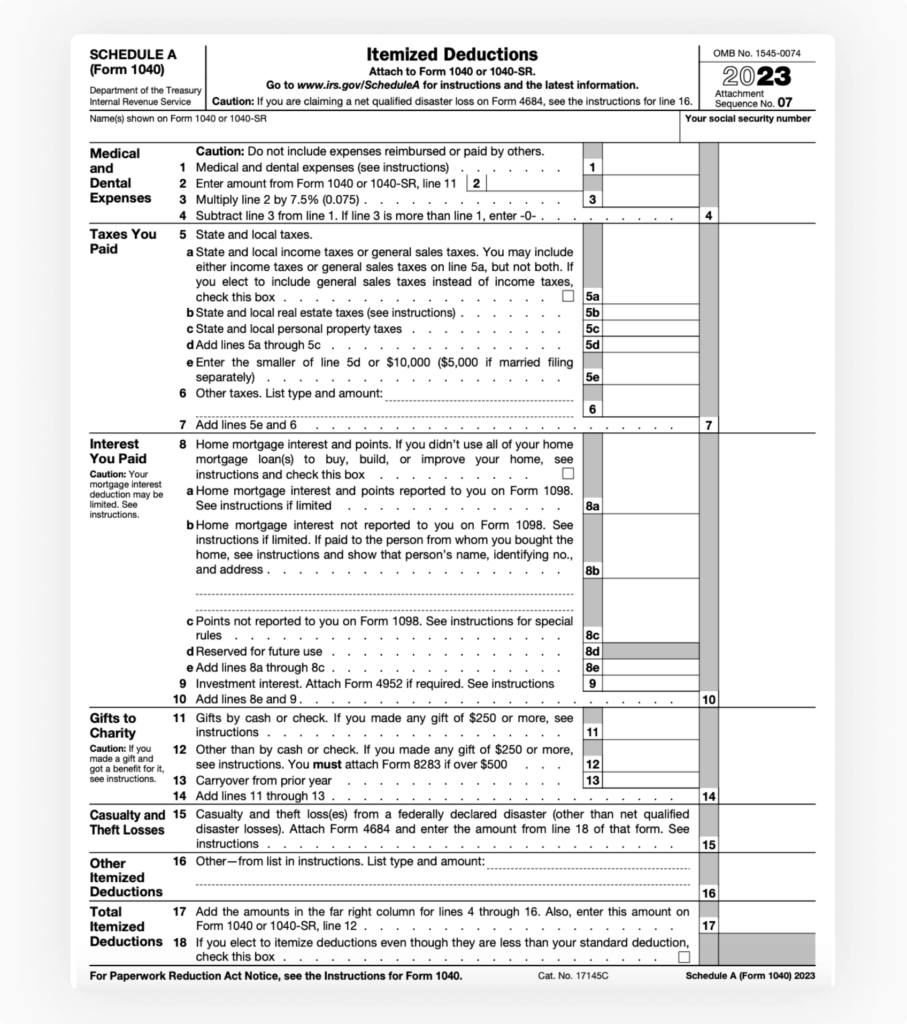

1040 Schedule A Itemized Deductions Form is a tax form used by individuals in the United States to itemize their deductions, including expenses like medical costs, mortgage interest, charitable contributions, and other eligible expenses. It allows taxpayers to reduce their taxable income by deducting qualified expenses, which can result in lower overall tax liability.

In this blog, you’ll get all the needed 1040 Schedule A instructions on how to fill out and submit this form to the IRS. Read on to find out!

What is Schedule A?

Depending on your tax situation and annual expenses, Schedule A Form 1040 may be able to qualify you for a larger tax refund. Completing the form is beneficial for you if your annual tax-deductible expenses are greater than your standard deduction. Many people ask “what does a Schedule A look like?” or “where is Schedule A on 1040 form?”

Schedule A is an optional attachment to Form 1040 used by taxpayers in the U.S. to report their annual income taxes to the IRS. The Schedule A form allows you to calculate an alternative deduction based on your accumulated annual expenses instead of taking the standard deduction, which is a fixed amount determined by the taxpayer’s filing status.

Who Needs Form 1040 Schedule A?

Anyone who plans to itemize their deductions rather than use the standard deduction needs to fill out 1040 Schedule A Form. If the total value of your itemized deductions is greater than the standard deduction, you should choose to itemize. This will help you achieve a smaller tax obligation.

For example, if you had hefty medical bills, high interest on your mortgage, or gave money to charity, you could itemize these expenses and reduce the amount of taxes you owe.

What Items Can Be Deducted on Schedule A?

Now let’s address the most important questions. Which items would be an itemized deduction on Schedule A of Form 1040? Are property taxes deductible? Below is the list of popular eligible deductions:

- Medical and dental expenses

- State and local income taxes

- Mortgage interest

- Donations to charities

- Theft and casualty losses in federally declared disaster areas

- Theft and casualty losses of income-generating property

- Gambling losses

- Amortizable bond premiums

- Losses related to bond investments

- Federal estate income taxes

- Social Security repayments

- Unrecovered pension investments

- Schedule K-1 losses

- Work-related expenses for the disabled

Schedule A Instructions: Revisions Taxpayers Need to Know About

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced major changes to the tax law and itemization practices. Many items that were previously considered deductible were abolished, including:

- Casualty and theft losses in non-disaster areas

- Interest on housing equity loans (unless they were used for building, buying, or improving a home)

- Tax preparation expenses

- Certain unreimbursed job-related expenses, etc.

Previously, the maximum deduction amount for state and local taxes (SALT deduction) was capped at $10,000, while the standard deduction was nearly doubled.

For 2024, the amount of standard deduction is projected to be:

- $14,600 for single taxpayers and married individuals filing separately (up by $750 from the prior year);

- $21,900 for heads of households (up by $1,100 from the prior year);

- $29,200 for married couples filing jointly (up by $1,500 from the prior year).

Considering the recent revisions, many taxpayers who used to itemize their deductions now choose the standard deduction as one that is more cost-effective and easier to claim (no need to track your expenses and collect receipts and bills throughout the year). It is also important to note that itemized deductions can be challenged by the IRS, while the standard deduction can not.

However, itemizing still makes sense for those whose expenses add up to a greater amount than the standard deduction. This is especially true for taxpayers with the highest mortgage interest rates. So, if your annual mortgage interest exceeds the standard deduction, this is already a good reason to go with itemized deductions.

For more Schedule A instructions, please see the IRS’ official guidelines.

How to Fill Out Schedule A?

Form 1040 Schedule A consists of seven sections dedicated to the different types of expenses eligible for deduction. Each section contains multiple subsections in which you can specify your deducted values.

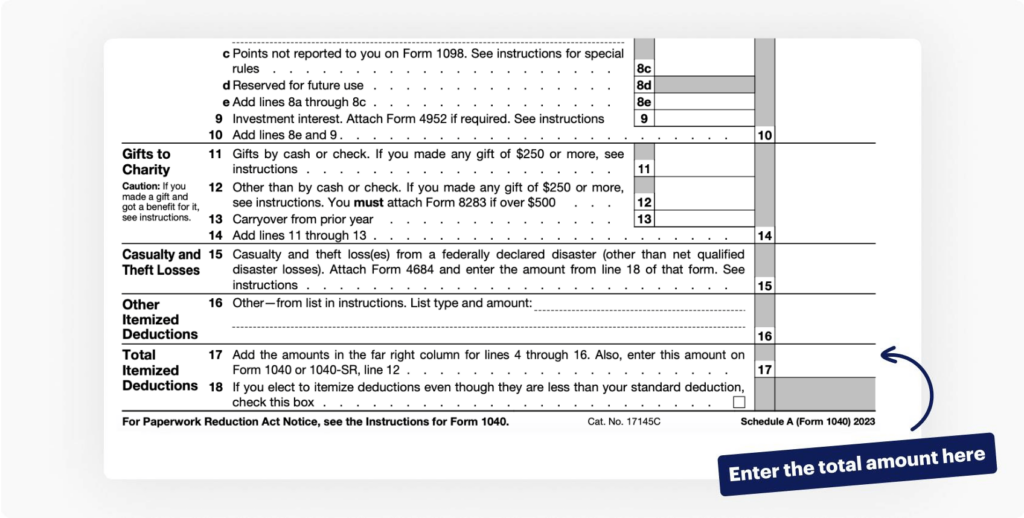

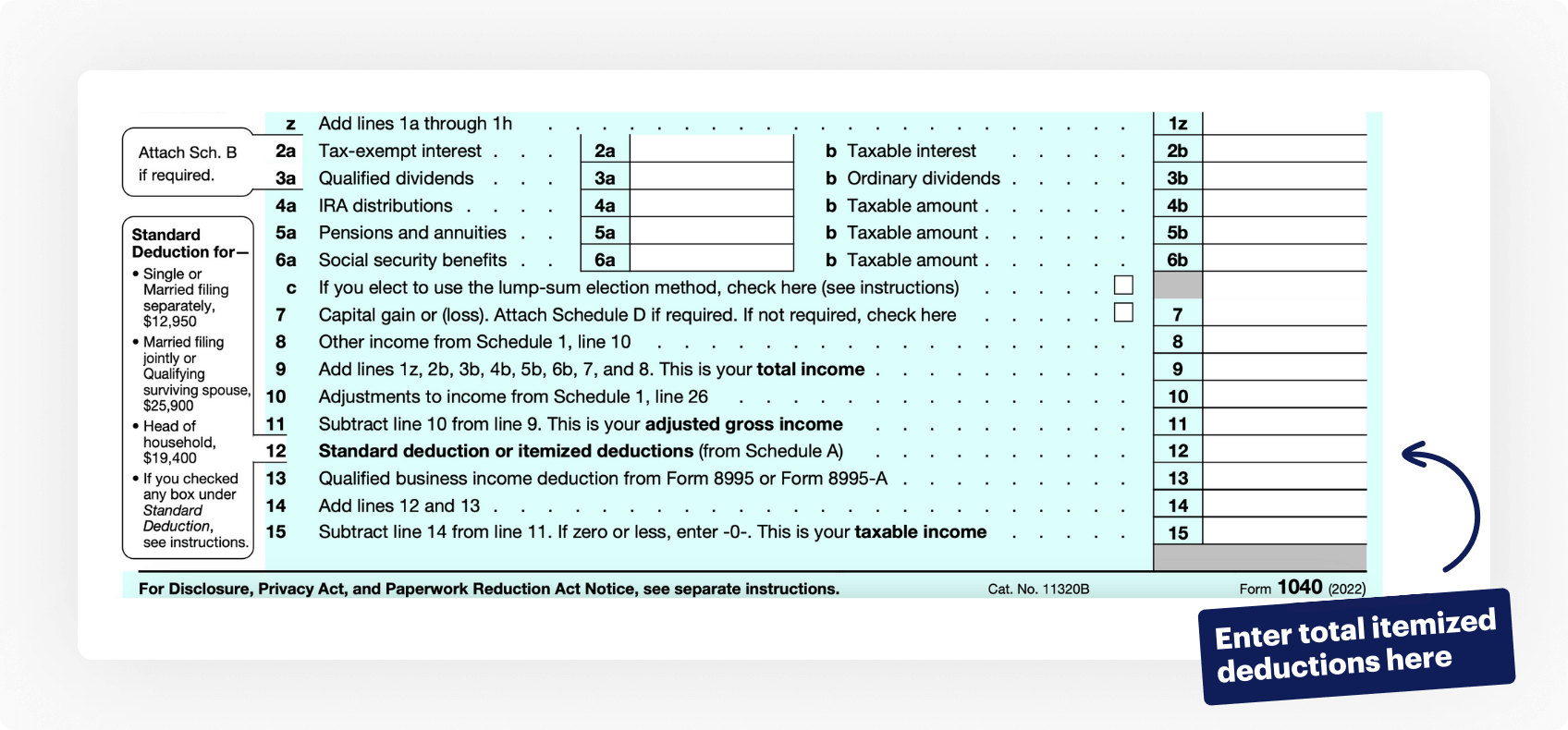

Once you have calculated your total itemized deductions, you must enter the figure in the corresponding field of Schedule A.

Then, enter the same figure in your Form 1040.

To support your Schedule A, you’ll need to provide the following attachments:

- Form 1098 approved by your mortgage lender.

- Property tax bills as well as income and sales tax records.

- Proof of your donations to charities over the reported year.

- Receipts for unreimbursed medical or dental costs.

- Receipts, bills, or other valid proof of payment for other qualifying items you wish to deduct from your taxes.

Watch the video below to learn how to fill out Form 1040 and its attachments:

Schedule A Instructions: Things You Need To Know

The following tips may help you to itemize your deductions and the filing process itself:

Some of your deductions may not be granted. Even if you qualify, the IRS may phase them out depending on your individual circumstances, adjusted gross income, and overall tax situation. It is recommended that you use professional tax software or tax services capable of identifying your eligibility for specific deductions.

Certain tax-break deductions do not require filing Schedule A. These are listed in Schedule 1 of Form 1040:

- Educator expenses

- Certain business expenses of reservists, performing artists, and fee-basis government officials

- Health savings account deductions

- Moving expenses for members of the U.S. armed forces

- Deductible part of self-employment taxes

- Self-employed health insurance deduction

- Penalty on early withdrawal of savings

- Contributions to retirement plans

- Alimony payments

- IRA deduction

- Student loan interest deduction

Missed deductions can be corrected. If you forgot to report on certain items that need to be deducted from your taxes or if you reported incorrect values, all you need to do is file Form 1040X (an amended tax return) within three years of filing your original return.

How to File Schedule A Form 1040?

Your 1040 Schedule A Form is due at the same time as your tax return (by April 15 of every tax year). Automatic six-month extensions of time to file are available for anyone for free.

The IRS encourages taxpayers to file Form 1040 together with Schedule A electronically to ensure faster return processing. If you file electronically, you are entitled to receive your refund within 3 weeks from the date when the IRS receives your return. Find the available options for electronic filing on the IRS website.

You can also send paper forms to the IRS by mail. But in this case, it may take up to 8 weeks to process your return. The relevant addresses to which you can mail your tax return are listed here.

Please keep in mind that filling out your tax forms by hand may result in unintended errors (which can lead to delayed tax refunds and even rejections) and is generally a more lengthy process. You can find both Schedule A and Form 1040 in the pdfFiller online library and complete the forms conveniently using our online PDF editor. This way, you will save precious time and avoid any possible errors before they cause any confusion in your tax filing.

Sign up for a free trial to see pdfFiller in action!

Fill out your Form 1040 Schedule A online