US foreign taxpayers use IRS Form 1042-S, officially known as the Foreign Person’s U.S. Source Income Subject to Withholding, to report state and federal income. If you are a nonresident alien earning income that is not reported on your W-2, you must file a 1042-S form. The IRS issues this form to individuals on an annual basis. Filing a 1042-S is not possible until you’ve submitted all other tax forms used for reporting your United States income. Some US foreign taxpayers are issued a 1042-S while others may receive a W-2, and some taxpayers may be requested to file both.

Who Files IRS Form 1042-S?

Form 1042-S must be filed by every withholding agent to declare income received for the previous year. Payments that must be reported are determined under the Amounts Subject to Reporting on Form 1042-S. If you are an individual withholding agent and the payment you’re making is not the part of your business or trade, you should not report it on your 1042-S.

However, if you are an employer and your institution’s employees are non-US citizens, it’s your responsibility to file on their behalf. Note, that you must also send a copy of Form 1042-S to those whose income you are reporting.

There are four copies of the form used for different types of income subject to tax withholding:

- Copy A is for use by the IRS.

- Copy B is for the recipient.

- Copy C must be attached to any federal tax return filed.

- Copy D must be attached to any state tax return filed.

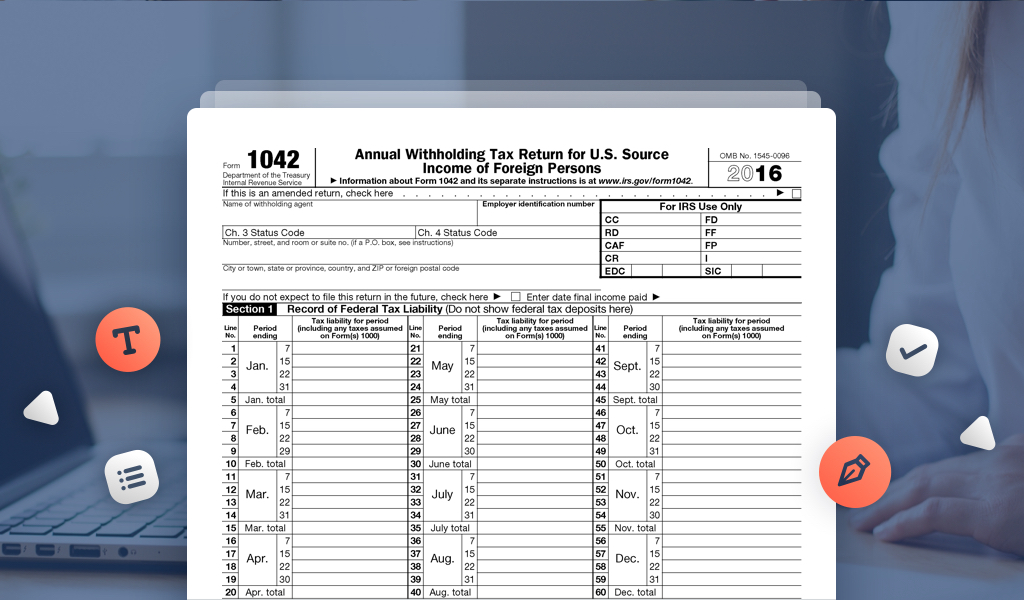

When submitting IRS Form 1042-S you must also prepare Form 1042, known as the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. Check the instructions for preparing both of these documents on irs.gov.

What type of income does IRS Form 1042-S report?

This IRS form is used to report income types such as scholarship or fellowship, award or non-employee payments, salaries paid to employees who requested some treaty benefits, payments to contractors who worked for some time in the U.S. and royalty payments made to entities or individuals.

If you’re planning to report federal payments made to foreign individuals that are subject to tax withholding, IRS Form 1042-S must be used. The form may also be used to report compensations or distributions from trusts to expatriates.

Don’t report payments for goods, inventory, equipment, facilities, or raw materials. Money received from these sources should not be included.

How to Complete IRS Form 1042-S?

On Form 1042-S, it is required to indicate the following information: income code, gross income, tax rate, net income, withholding allowance, federal tax withheld, personal information about the withholding agent, recipient’s account number, date of birth and other relevant information. To determine which income code to indicate, check the IRS website.

Where can I get my 1042-S Form?

Find your 1042-S form here. You can fill it right away and send it to the IRS’s Filing Information Returns Electronically (FIRE) system. All financial institutions (including investment funds) must file Forms 1042-S electronically. Also, the IRS encourages all other filers to file their returns online. The IRS will confirm within five business days that the transmission was successful.

How to Complete IRS Form 1042-S?

On Form 1042-S it is required to indicate the following information: income code, gross income, tax rate, net income, withholding allowance, federal tax withheld, personal information about the withholding agent, recipient’s account number, date of birth and other relevant information. To determine which income code to indicate, check the IRS website.

When to File IRS Form 1042-S?

You must submit your 1042-S to the Internal Revenue Service by March 15th of the next year. You must also provide a 1042-S copy to your payees by the 31st of January. If you need a 30-day extension, fill the Form 8809. It’s an Application for Extension of Time to File Information Returns. But remember to file it no later than the 15th of March for the next tax year.

What is the difference between Form 1042 and 1042-S?

As mentioned above, Form 1042-S is used to report payments you have made to foreign persons. A Form 1042 summarizes the information reported on 1042-S. It is concerned with determining how much income will be withheld for tax withholding purposes for the specific income of nonresident aliens and other foreign persons.

Form 1042-S vs Form 1099

A 1099 form is used to report miscellaneous income, such as gross rent for US residents and businesses only. Form 1042-S is used to report income paid to a non-resident regardless of whether the payment is taxable.

2020 instructions for Form 1042-S

The new regulations for 2020 apply to withholding and reporting for the subsequent year under Chapter 3, i.e. pursuant to the “lag method.” Thus, the conflict created by Schedules K-1 and Forms 1042-S (with different filing deadlines) has been eliminated.

“A partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner’s or beneficiary’s share of income for the prior year may designate the deposit of the withholding as attributable to the preceding year and in some cases a partnership is provided an extended due date for filing.”

Also, some boxes have been updated to clarify language. Lastly, the Limitation on Benefits (LOB) Treaty Category code for individuals (code 01) has been removed.