Form 941, or Employer’s Quarterly Federal Tax Return, is one of the key IRS forms filed by businesses. The form allows employers to withhold federal income tax and other payroll taxes from each employee’s paycheck and remit them to the IRS. An employer’s social security and medicare tax burden can also be calculated and reported via 941 Form.

In this blog, you’ll learn what the 941 Form is, when it is due, and who needs to file it. You’ll also get instructed on how to fill it out and submit 941 Form online using pdfFiller. Let’s get started!

Form 941 Updates

The revised version of Form 941 was released in March, 2023.

Here are the 941 Form updates taxpayers need to know about:

- In 2023, the Social Security Tax rate for employers and employees is 6.2% each, totaling 12.4%. Medicare tax remains at 1.45% for both with no wage base limit. Household workers paid $2,600 or more and election workers paid $2,200 or more are subject to these taxes.

- Qualified small businesses can claim up to $500,000 of research activities credit as a payroll tax credit. The credit is applied against employer’s payroll taxes and any excess carries forward.

- Forms 941-SS and 941-PR are discontinued; employers in U.S. territories will file Form 941 or Form 941 (sp) for Spanish instructions.

- Agricultural employer information will be in Pub. 15 starting in 2024.

What is Form 941: Employer’s Quarterly Federal Tax Return?

As an employer, you must report all employee wages and other related payments to the Internal Revenue Service (IRS). Form 941, or the Employer’s Quarterly Federal Tax Return, is used by employers to report tax withholding amounts for estimated income tax payments, employer payments, and FICA taxes, more commonly known as Social Security and Medicare.

The requirement for filing Form 941 four times a year is explained by the fact that payroll taxes are a standard source of revenue for the Department of Treasury. Employers who do not pay taxes for their employees may be subject to penalties. To avoid this, file your return on time and provide accurate and honest information for your employee’s wages and other related payments.

Who needs to file IRS Form 941?

Most employers have to report balances such as wages, income tax withheld, employee tips, employee and employer shares of Medicare and social security taxes (and adjustments to them), credits for improving research activities, and other compensations. Here’s a detailed list of the balances reported when filling out Form 941:

- Employee wages.

- Reported tips from your employees.

- Federal income tax withheld from employee paychecks.

- Both employer and employee portions of Social Security and Medicare taxes.

- Extra Medicare tax withheld from employee earnings.

- Adjustments for the current quarter regarding fractions of cents, sick pay, tips, and group-term life insurance under Social Security and Medicare taxes.

- Utilization of the qualified small-business payroll tax credit for enhancing research activities.

Employers submit IRS Form 941 each quarter to report and calculate employment taxes.

There are three types of businesses that don’t have to file Form 941:

- Seasonal employers when they haven’t hired employees

- Employers with household or agriculture employees

- People who hire household employees such as maids or nannies

What is the deadline for filing Form 941?

You have to file IRS Form 941 four times a year. Each filing quarter has specific deadlines:

- First quarter: April 30, covering Jan. 1 to March 31.

- Second quarter: July 31, covering April 1 to June 30.

- Third quarter: Oct. 31, covering July 1 to Sept. 30.

- Fourth quarter: Jan. 31, covering Oct. 1 to Dec. 31.

The closest deadline is January 31, 2024.

You can submit the form online using pdfFiller.

If you file Form 941 by mail, your return will be tracked according to the date of postage.

A step-by-step guide to filing IRS Form 941

There are five parts and a payment voucher at the end if you’re submitting the form by mail with payment.

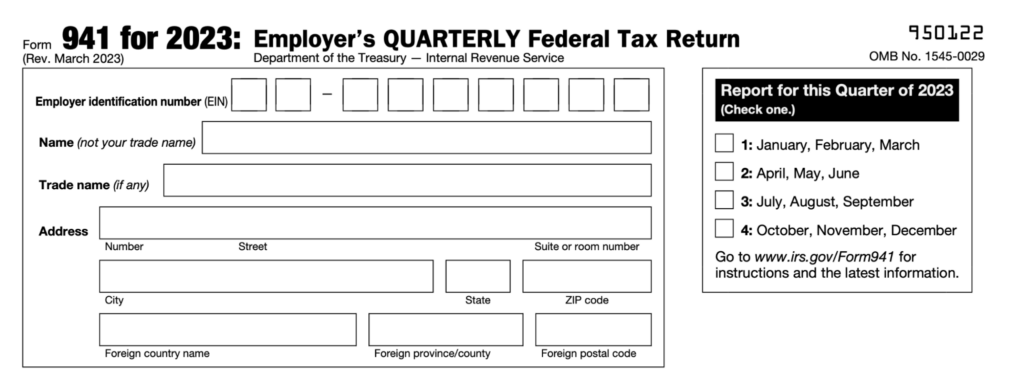

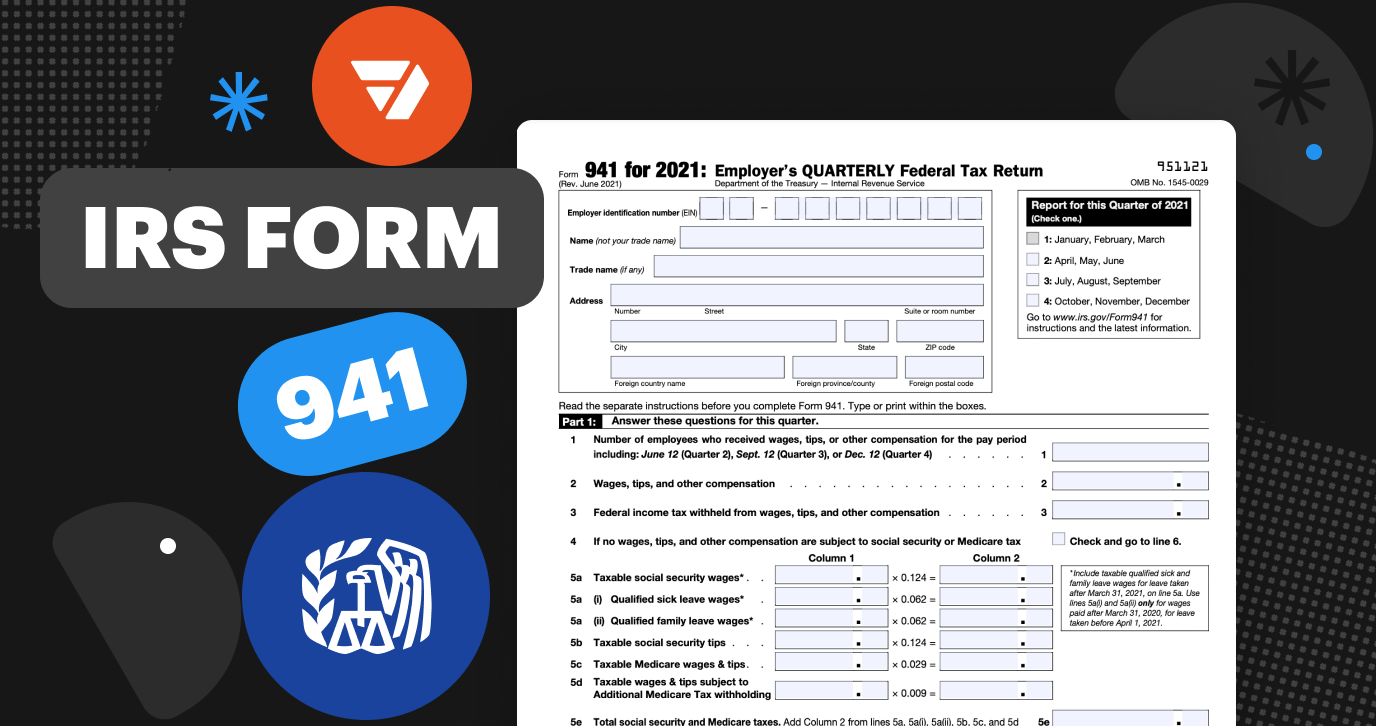

- Personal information. Start by providing the Employer Identification Number (EIN), your full name, trade name, and registration address. Indicate the quarter for which you’re filling the form out in the box on the right.

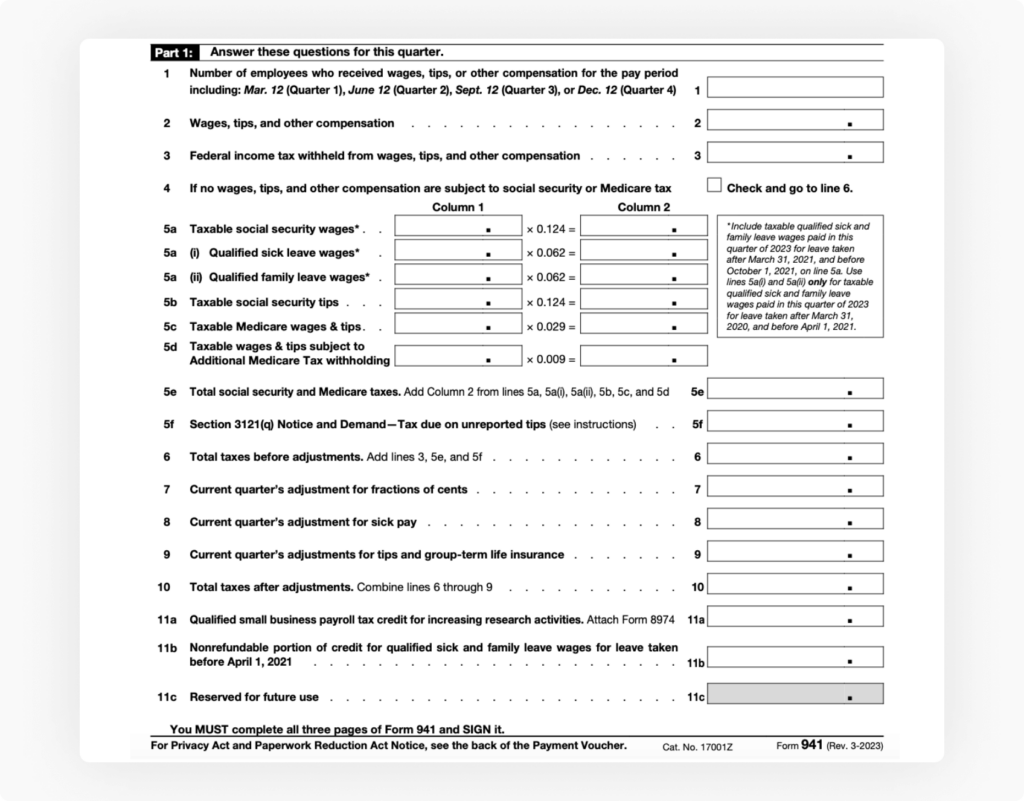

- Part 1. Provide information on employees, wages, tips, income tax withheld during the pay period, etc. Make sure to provide numbers ONLY for the quarter that the filing covers. Use Lines 5a-5d to multiply the figures by the correct indexes established for the current tax year. If there are no wages, tips, or other compensations, skip ahead to Line 6. There are no calculation boxes for Lines 6-15, so you must prepare all the related forms and reports for precise calculations.

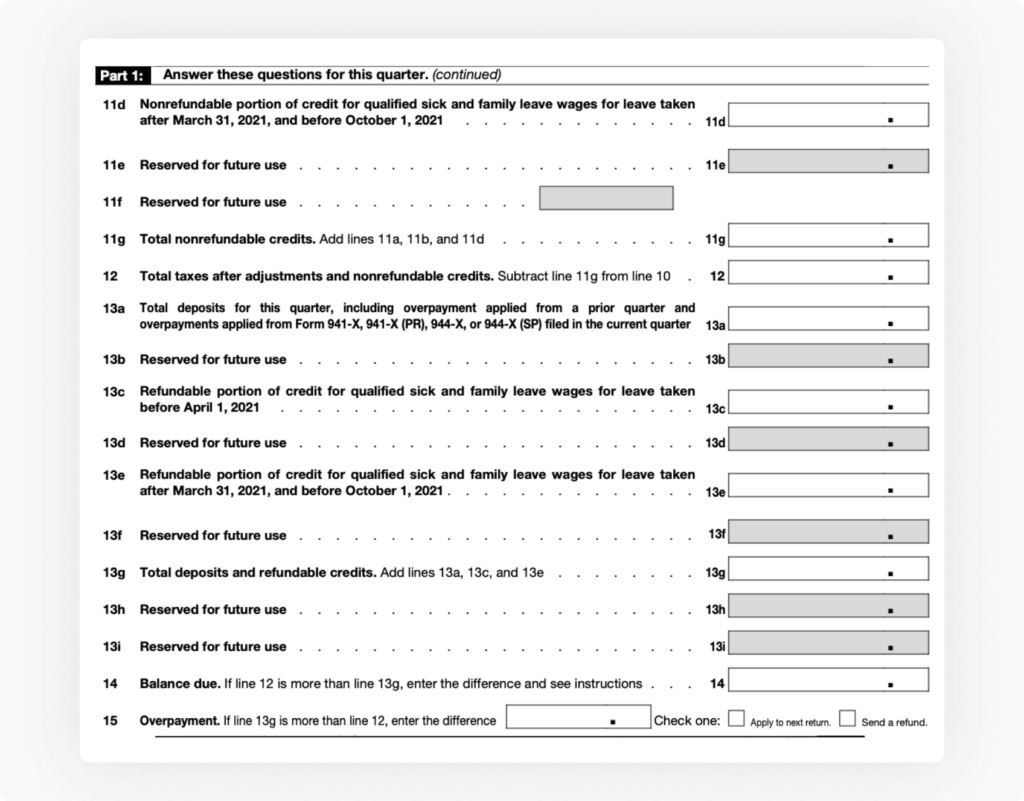

Before proceeding to Line 11d, indicate your name and employer identification number at the top of Page 2.Lines 11d-15 indicate whether an employer owes taxes (balance due) or has overpaid employment taxes. Any overpayment can be applied toward the next quarter or received as a refund. Choose the appropriate option and tick the respective box in Line 15.

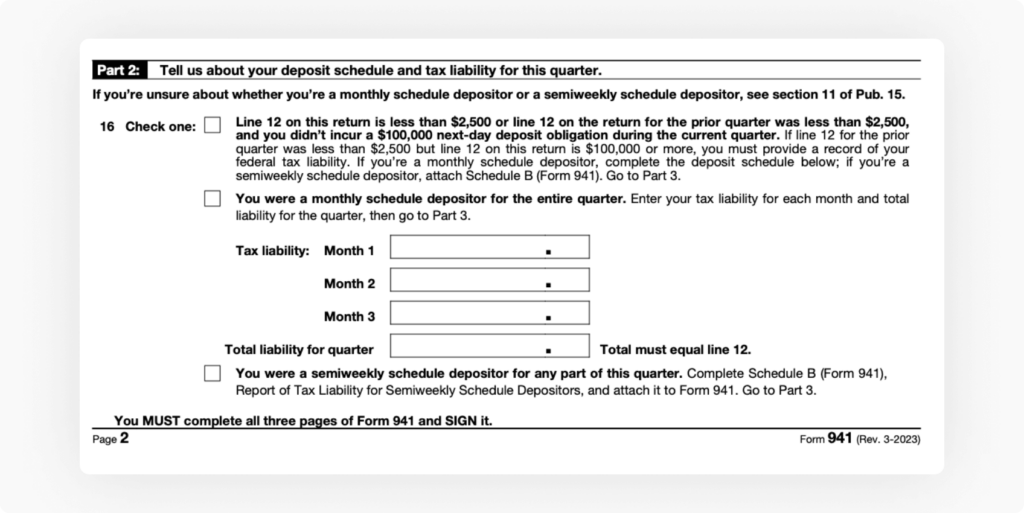

- Part 2. Check one of the boxes that match your tax situation. If you check Box 2, you should provide additional figures on your tax liability for the quarter and make sure that it’s equal to Line 12 of Part 1.Indicate your name and employer identification number at the top of Page 3.

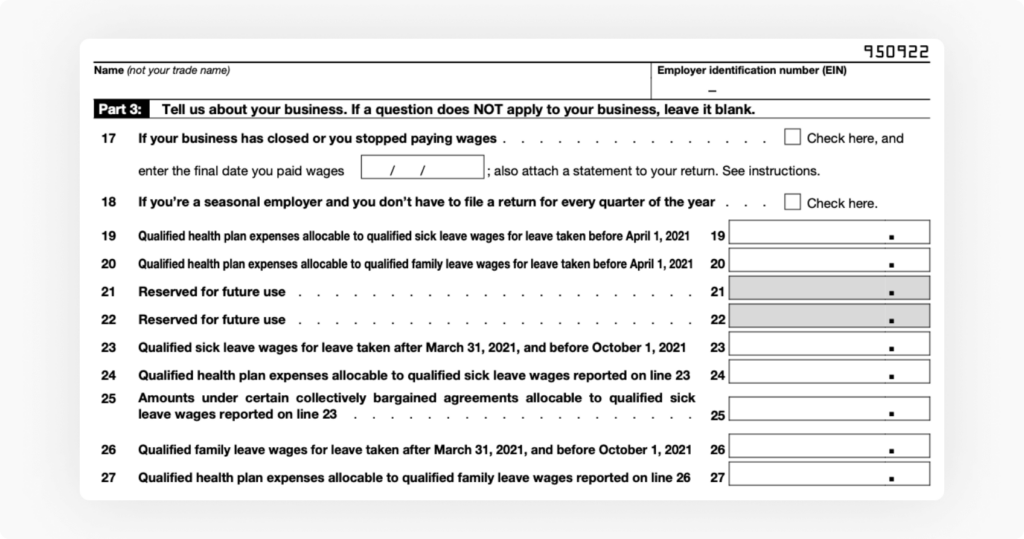

- Part 3. Provide details about your business. Supply information on whether you have closed or stopped paying wages, whether you are a seasonal employer, etc.

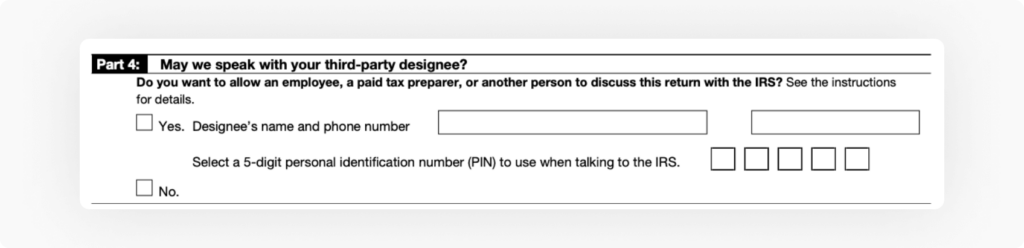

- Part 4. As an employer, choose to designate an employee, a paid tax preparer, or a Certified Public Accountant (CPA) to speak with the IRS regarding your return. Provide the designee’s name, phone number, and a self-selected five-digit personal identification number so the IRS can confirm the person’s identity.

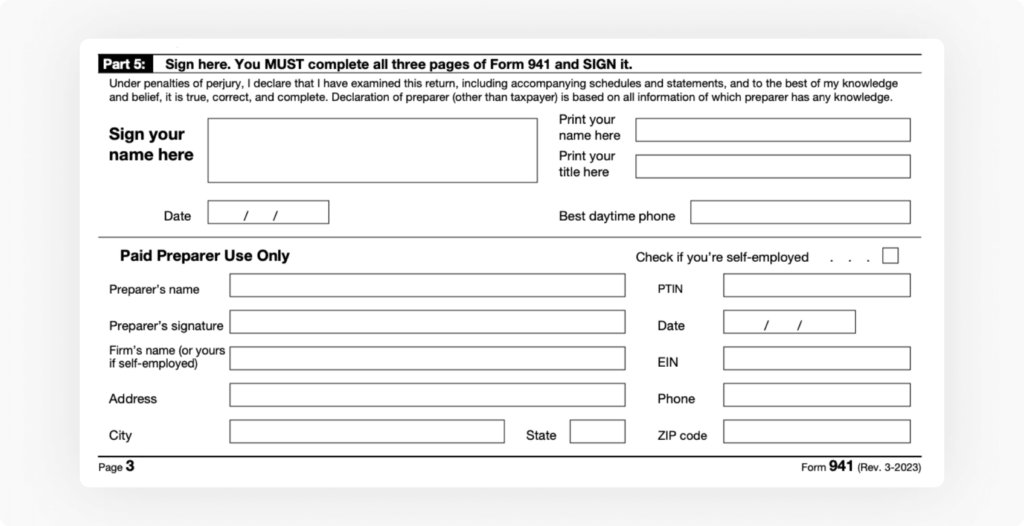

- Part 5. Indicate your name, title, and daytime phone number, and sign and date your form. If you hired someone to help you complete Form 941, they need to fill out their information in the Paid Preparer section.

Watch the video below to see the step-by-step process of filling out IRS Form 941 in pdfFiller:

Watch the video below to see the step-by-step process of filling out IRS Form 941 in pdfFiller:

How to file IRS Form 941?

Fill out and submit your 941 Form to the IRS using pdfFiller. You can complete any tax form on any desktop or mobile device. Once you have completed the document, it’s possible to share it in a few clicks. You can also send a PDF version of your tax form by email, text message, fax, USPS mail, or notarize it online — right from your account.