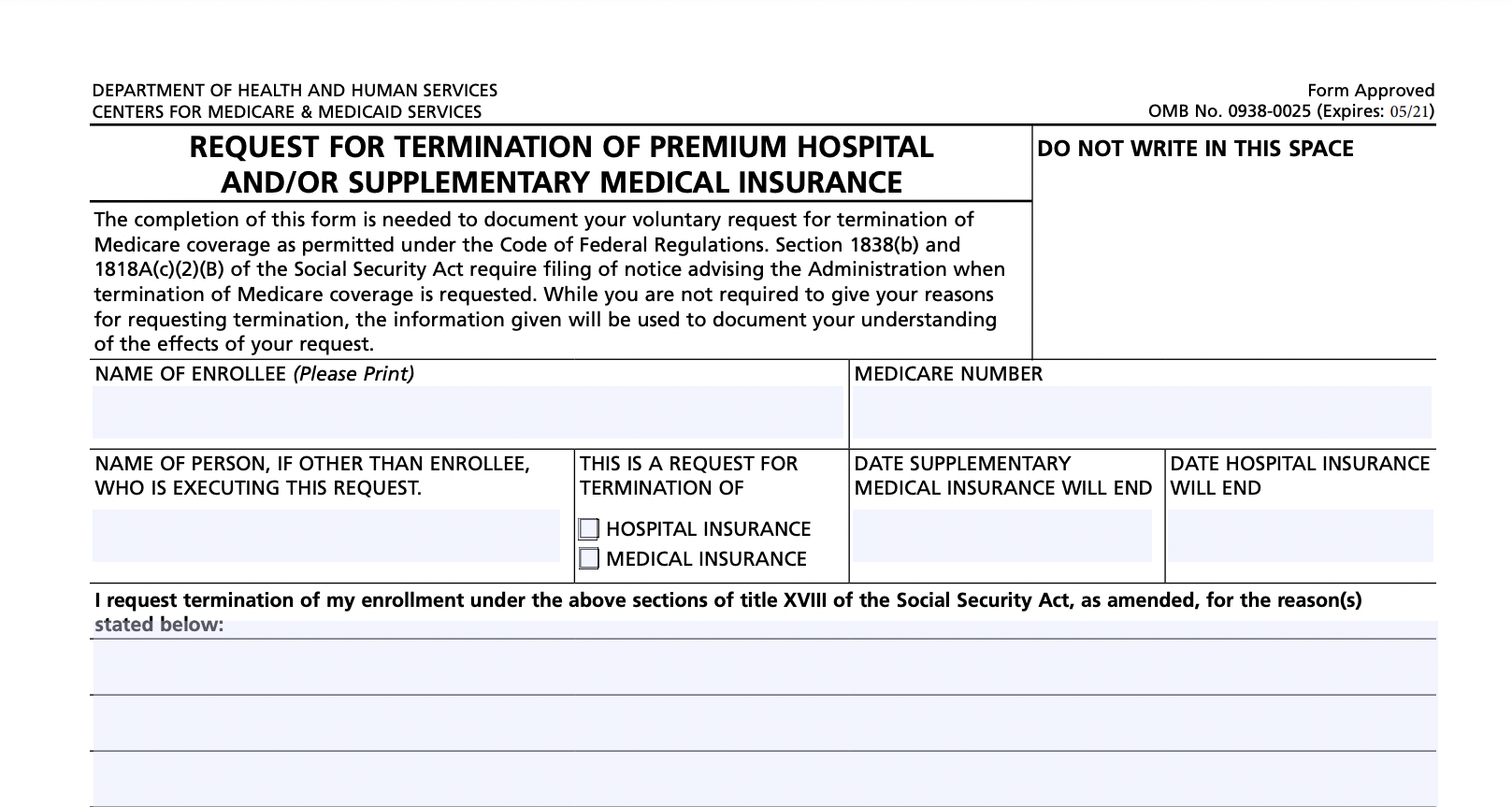

CMS 1763 Form: Request for Termination of Premium Hospital Insurance of Supplementary Medical Insurance

If you’ve decided to cancel Medicare insurance, be sure you are aware of how the cancellation process works to protect yourself from unforeseen circumstances. Today, we are providing you with the CMS 1763 Form instructions to help you streamline the medical insurance termination process.

Table of contents

- What is Form CMS 1763 for?

- Who needs a CMS 1763 Form?

- Is Form CMS 1763 accompanied by other forms?

- When is Form CMS 1763 due?

- How to fill out Form CMS 1763?

- Where should Form CMS-1763 be sent?

What is Form CMS 1763 for?

Form CMS-1763, or Request for Termination of Premium Hospital and/or Supplementary Medical Insurance, is the only way to cancel Medicare hospital insurance (Medicare Part A) and supplementary medical insurance (Medicare Part B).

Considering the seriousness of this decision, filling out the form is not the only step required. More often than not, before submitting the completed CMS-1763, the claimant will be invited to an interview with a Social Security representative. The interview can take place in person or over the phone. The claimant will need to explain the reason for terminating their plan, and the Social Security representative will, in turn, explain the procedure and results of canceling the current insurance coverage. During the interview, it’s recommended that the time is taken to ask as many questions as possible.

A typical situation for completing the request is when someone or their spouse has found a job that will cover their insurance. It is crucial that you as the claimant or spouse of a claimant make sure that the primary insurance is covered under your employer’s insurance plan. In general, a small employer (20 employees or less) offers secondary insurance. In this case, Medicare remains primary and you would receive almost no coverage from other insurance. Beware, your employer can’t force you to choose Medicare instead of a group health plan. It is illegal, you have the option to switch plans, but no one can make you do it.

Who needs a CMS 1763 Form?

The Request for Termination of Premium Hospital and/or Supplementary Medical Insurance, CMS -1763, is a standard US Department of Health and Human Services form, used by the Medicare enrollee who wishes to terminate their Premium Hospital (premium Part A) and Supplementary Medical Insurance (Part B). This action is provisioned by the 1818A Section of the Social Security Act.

Anyone who has Medicare can submit Form CMS 1763 and opt out of insurance. Medicare isn’t mandatory. But if you don’t have another primary health coverage, you might get hit with a penalty.

As a reminder, Medicare is the federal social health insurance program in the United States that started in 1965 under the Social Security Administration (SSA) and is now administered by the Centers for Medicare and Medicaid Services (CMS). US citizens aged 65 and older, people with disabilities of any age, and those who suffer from end-stage renal disease and amyotrophic lateral sclerosis, who are eligible for Social Security Disability Insurance benefits (SSDI) should enroll and use it. Make sure, whether you think you need this insurance program or not, check out the Medicare resources and figure it out.

But enrolling in Medicare means you cannot contribute to the Health Savings Account (HSA). Typically, as long as you continue to work and have health coverage under an employee plan you don’t need to sign up for Medicare Part B.

Note: if you have to buy Medicare Part A or Part B, and you decline to purchase for some reason, you may have to pay a penalty. So, carefully consider all the reasons for terminating first. Then contact the Social Security Administration (SSA) at 1-800-772-1213 (TTY: 1-800-325-0778) or your local office.

Is Form CMS 1763 accompanied by other forms?

Filing the Request for Termination of Premium Hospital and/or Supplementary Medical Insurance does not require any supplementary documentation. So, all you need to do is complete the one-page CMS 1763 and speak with a Social Security representative.

Sign up for a free trial to see pdfFiller in action!

Fill out your Form CMS 1763 electronically fast & easy

When is Form CMS 1763 due?

The application for Medicare insurance has specific dates for retired Americans: the application must be filed three months before the applicant’s 65th birthday. The termination of hospital or medical insurance is not strictly regulated and can be done when considered necessary by the insured person. The termination should be expected at the end of the month that the request is filed. But money received from Social Security has to be returned in order to terminate the insurance.

After termination, you and your spouse can always return to Medicare. For example, if you lose your insurance, you can enroll again within 8 months and won’t be given the late penalty. Please keep in mind, Medicare does not recognize domestic relationships. So even if you have coverage from a spouse’s insurance, you still need to enroll in Medicare by 65. After your spouse’s insurance stops working, you won’t be able to use the free enrollment period and will have to pay the fine.

How to fill out Form CMS 1763?

The revised Form CMS-1763 is a single-page document consisting of several items:

- Name of Enrollee. Write down the enrollee’s name. If another individual executes this request, write down this person’s name in the appropriate field.

- Medicare Number. Indicate your Medicare number.

- Name of the Person, if Other than Enrollee, Who Is Executing the Request (if appropriate).

- This is a Request for Termination of Hospital Insurance/Medical Insurance. Here, you must choose the type of coverage you want to terminate. You may select either hospital insurance (Plan A) or medical insurance (Plan B), or choose to opt-out of both coverages.

- Date Hospital Insurance Will End. Indicate the date when your hospital or medical insurance coverage should end.

- Reasons for the termination request. In the input field below, elaborate on the reasons for the termination. Provide as many details as you wish. Typically, this request is made after an individual or their spouse finds a job that offers lifetime insurance. Feel free to go into as much detail as you want,. For instance, if your new job offers health insurance benefits, describe this job, indicate the type of benefits, and name your new insurance company. The information given will be used to document your understanding of the consequences of the withdrawal.

- Make sure your request is complete by providing relevant information in the Signature, Address, Phone Number, and Date fields. Sign the form. to indicate that you fully understand the consequences of insurance coverage termination.

- If an applicant signs the form by marking ‘x’ in the field on the left, then the form must be signed by two witnesses. They should provide their names and mailing addresses. Witnesses have to know you to testify that the form was filed voluntarily. They can be your friends, relatives, or neighbors.

Watch the video below to get step-by-step instructions on how to fill out CMS 1763 form:

File your taxes electronically with pdfFiller. Learn how to build paperless workflows and manage them with ease with the pdfFiller Academy.

Where should Form CMS-1763 be sent?

The CMS 1763 form must be completed during or after an interview with a representative from the Social Security Administration. Having filled it out completely, the applicant should submit it to the applicant’s local SSA office.

Although Form CMS 1763 is not available for online submission, you can find it in pdfFiller’s library, fill out and easily print it out from your account. We will help complete each field and take you through it step by step.