To all individuals with Individual Taxpayer Identification Numbers that will soon expire or have already expired, the Internal Revenue Service begins issuing reminders to submit their applications for renewal before the start of the year. To exclude the possibility of processing and refund delays, taxpayers should submit IRS Form W-7. The IRS has already sent more than a million emails with reminders. The IRS Commissioner, John Koskinen, kindly requests all expired ITIN holders to resolve this issue in order to make their tax-filing season easier.

What is IRS Form W-7?

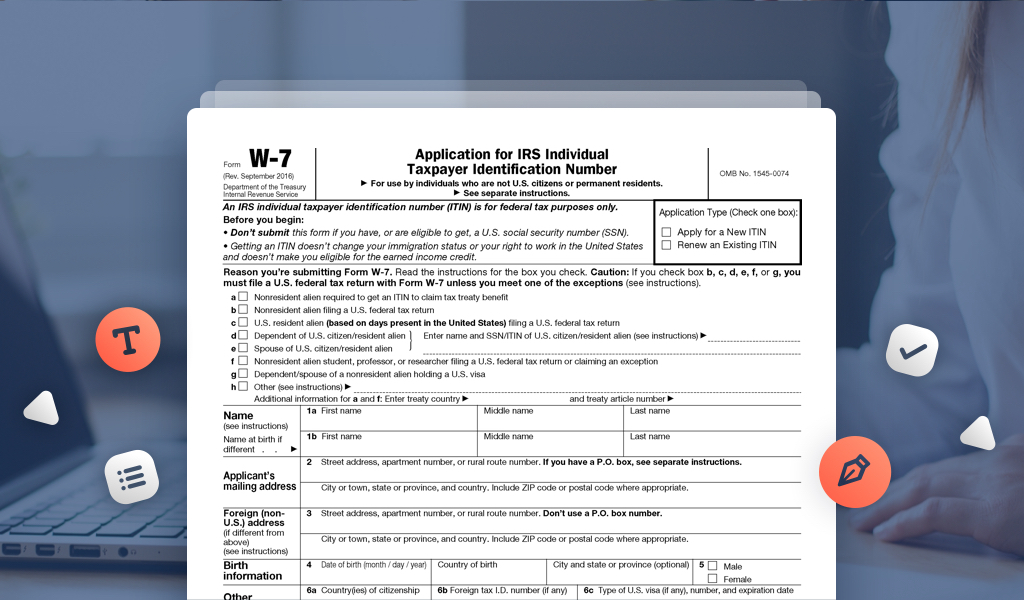

IRS Form W-7 is officially known as the Application for IRS Individual Taxpayer Identification Number. The IRS takes action to strengthen and secure the process of issuing the ITINs. The ITINs that haven’t been indicated on a federal tax return for the last three years or those containing such middle digits as 80, 72, 71, and 70 will expire on December 31st, 2017. Until this date all ITINs remain valid.

A W-7 is used not only to renew the ITIN but also to apply for being assigned a new one. Only individuals who are subject to federal tax in the U.S. may file it. Individuals who do not qualify for obtaining a social security number but at the same time must provide an ITIN for tax purposes must also file Form W-7.

How to File IRS Form W-7?

IRS Form W-7 is a one-page document. Spend 15-20 minutes filling it out and submit it on time rather than hours or days during the upcoming tax season.

When you file IRS Form W-7, begin by indicating the reason you’re applying for the ITIN and the type of application by checking the corresponding boxes. Next, provide your full name, mailing address, foreign address, date and place of birth, gender, type of U.S. visa, country of citizenship and foreign tax ID number. Indicate what identifying documents you’re submitting along with the application. It may be a passport, USCIS documentation or driver’s license.

Once you finished filling the application, prepare all supporting documents that will allow the IRS to establish your identity or foreign status. They are the following:

- Passport

- Foreign military identification card or driver’s license

- Medical records

- National identification card

- Foreign voter’s registration card

- Birth certificate, and others

Where to Mail IRS Form W-7?

When your IRS Form W-7 is ready for submission, mail it to the Internal Revenue Service. You may use private delivery services or file IRS Form W-7 in person.

To eliminate mistakes and make the process of completing your W-7 easier, use PDFfiller’s online document editor along with the range of powerful features it offers. Simply search for your form in the document library, open it, fill in all the required fields and file Form W-7 in minutes.