The Wages and Tax Statement Form W-2 is used to report employee wages and the corresponding withheld taxes. Employers are required to fill out a W-2 for every employee who receives salary, wages, or other compensation as part of their employment.

This blog will cover one of the most widely used tax forms, the IRS Form W-2. Continue reading to learn what’s new in this year’s W-2 form revision, the difference between the W-4 and W-2 forms, and how to fill out and submit the W-2 form to the IRS.

W2 Form Revision: What’s New?

- Redesigned Forms W-2 (including W-2AS, W-2GU, and W-2VI): Starting with the 2023 tax year forms, which are filed in 2024, you can complete and print Copies 1, B, C, 2 (if applicable), and D (if applicable) of Forms W-2, W-2AS, W-2GU, and W-2VI for recipients. Information entered in one copy will automatically transfer to the others.

Copy A cannot be completed online for filing with the SSA and is available for reference.

Copy D for employers and the Note for Employers previously found on the back of Copy D have been removed from Forms W-2AS, W-2GU, and W-2VI to reduce the number of pages for printing. - Electronic Filing of Returns: The Taxpayer First Act of 2019, passed on July 1, 2019, authorized the Department of the Treasury and the IRS to issue regulations that may lower the mandatory electronic filing threshold. Currently, electronic filing is required when filing 250 returns of one type. If final regulations altering this requirement for 2023 tax returns filed in 2024 are issued, the IRS will issue explanations. Until then, the threshold remains at 250, as stated in these instructions.

- Disaster Tax Relief: Relief is available for individuals affected by recent disasters. For more information on disaster relief, visit IRS.gov/DisasterTaxRelief.

- Increased Penalties: Penalties for failing to file, failing to furnish, and intentionally disregarding filing and payee statement requirements have been adjusted for inflation, resulting in higher penalty amounts. These increased penalties apply to returns required to be filed after December 31, 2023. For further details on penalties, refer to the Penalties section.

What is a W-2 Form?

The IRS form W-2, or the Wage and Tax Statement, is a document that an employer sends to each employee and submits to the Internal Revenue Service (IRS) at the end of the year. Every employer who deals with trade or business and pays remuneration is required to file a Form W-2 for each employee (even if the employee is related to the employer). As an employee, you should receive a W-2 form from your employer at the beginning of the following year.

- The IRS W-2 form provides essential tax information from your employer related to earnings, tax withholding, benefits, and more.

- Form W-2 should be sent to each employee by January 31 of each year and for use in preparing their tax return.

- The IRS uses W-2 forms to track employment income earned during the previous year.

What is the W-2 Form Used for?

So, why is the Form W-2 needed in order to file a tax return? The IRS W-2 form contains the exact amount of money paid to an employee and the amount of taxes paid on their earnings for the year. While an employer fills out the W-2 form, it is sent out to other people for the purposes of income and tax withholding advice. The three parties to receive the form are the Government, the state, and the employee. Even though employees do not fill out the form, they might need it when filling out their IRS Form 1040.

W-4 Form vs. W-2 Form: What’s the Difference?

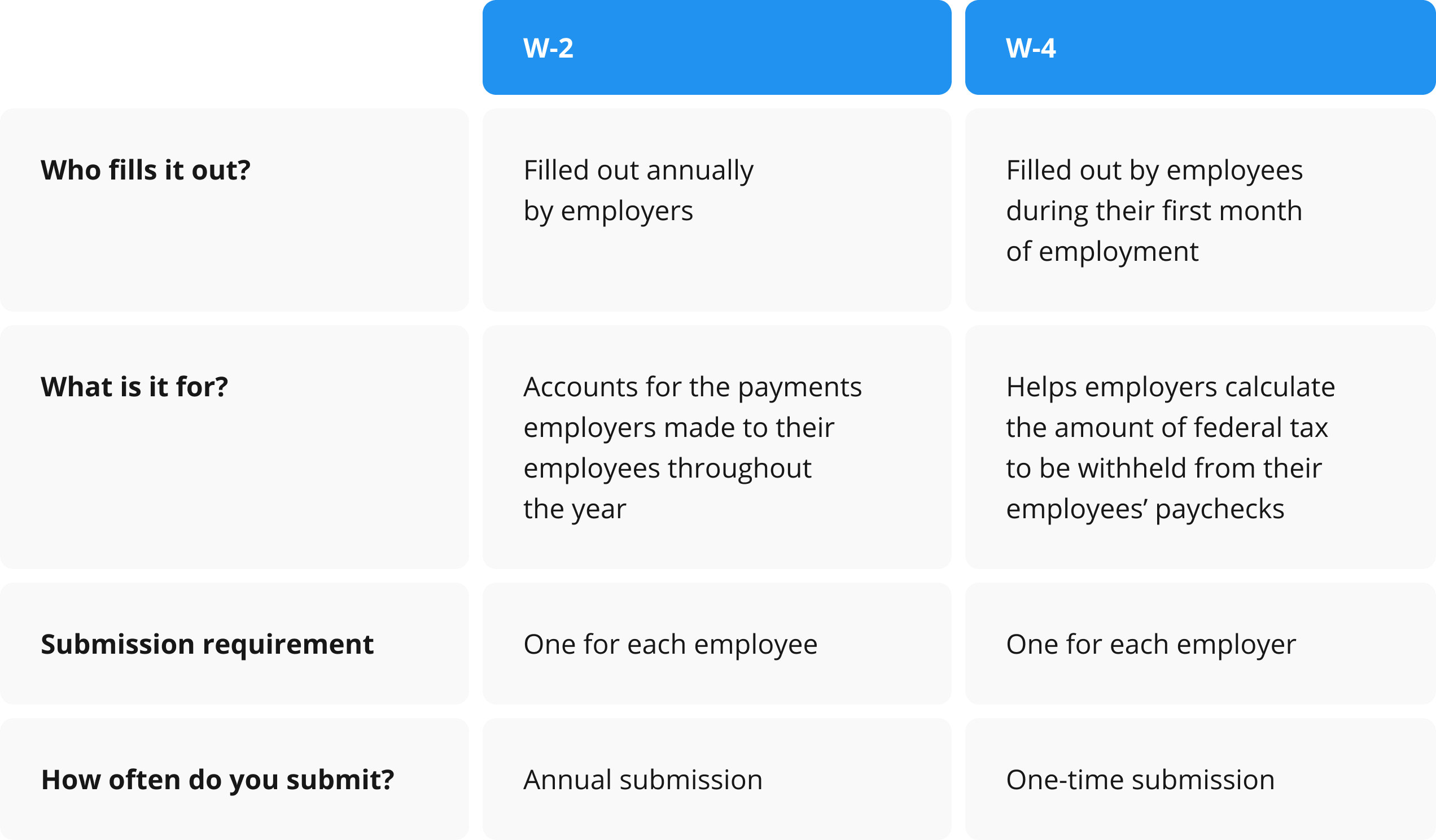

There are a bunch of various “W” IRS forms. To avoid any confusion, we’ve compared the IRS form W-4 and the IRS Form W-2. At first glance, it may seem that they report similar information, but there are several differences to be aware of:

- IRS form W-4: employees need to complete a W-4 within their first month on the job.

- IRS form W-2: employers submit a form for each employee to the IRS at the end of every year.

To sum up the similarities and differences between forms W-2 and W-4, see the comparison chart below:

When is the IRS Form W-2 Due?

You must file Form W-2 with the Social Security Administration by January 31 of the calendar year following the tax year. Of course, it’s possible to mail or electronically file these forms. For example, you can file and submit these forms via pdfFiller.com.

Take note: Sending copies of W-2 forms to your employees by the same deadline is mandatory.

W-2 Form: Extension of Time to File

In particular cases, taxpayers can request for an extension of time to file the IRS Form W-2. According to the IRS instructions, extensions of time to file the W-2 form with the Social Security Administration are not automatic. It’s possible to request one 30-day extension to file Form W-2 by submitting a complete application on Form 8809 (Application for Extension of Time to File Information Returns), indicating that at least one of the criteria on the form and instructions for granting an extension applies, and signing under penalties of perjury.

You must send your application to the address indicated in the Form 8809. Most importantly, you must request the extension before the due date of Forms W-2. If the IRS grants your request for extension, you will have an additional 30 days to file. The IRS will only grant the extension in extraordinary circumstances or catastrophe, such as natural disaster or fire destroying the books and records needed for filing the forms. No additional extension of time to file will be allowed.

Employers submitting the W-2 form can request the extension of time to furnish Forms W-2 to employees by faxing a letter to the following address:

Internal Revenue Service Technical Services Operation

Attn: Extension of Time Coordinator

Fax: 877-477-0572 (International Fax: 304-579-4105)

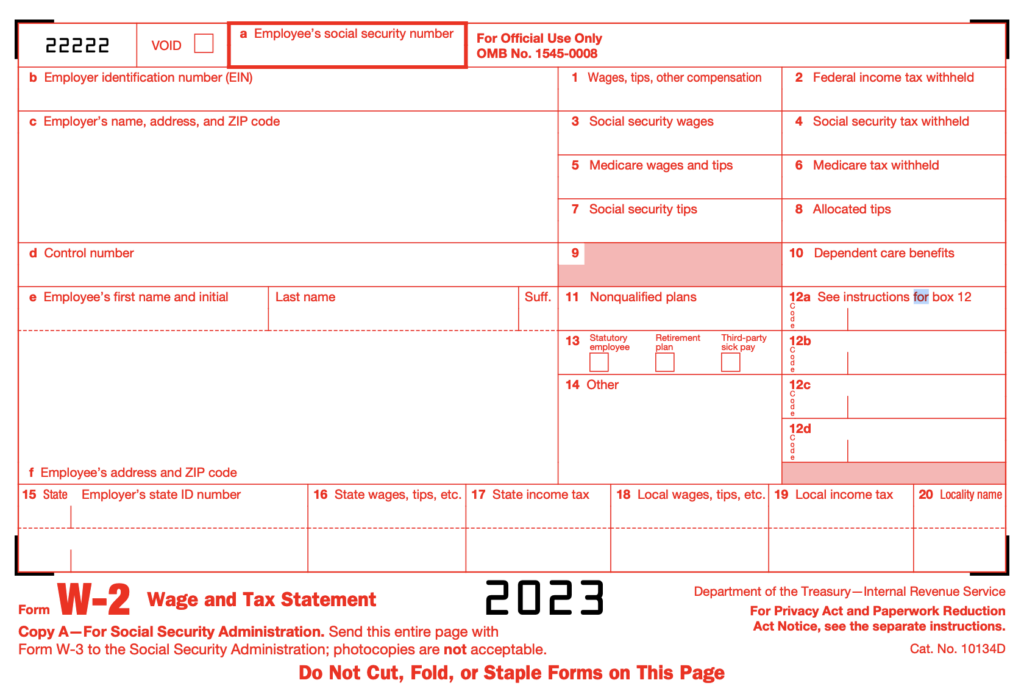

How to Fill Out W-2 Form?

To fill out the IRS form W-2 without any mistakes, make sure you have all the necessary details about your employees available. These include their EIN, names, addresses, social security numbers, and so on.

When filling out the W-2 form, you need to complete the following boxes:

- Box A. Employee’s social security number

- Box B. Employer identification number (EIN)

- Box C. Identification information about the employer such as their company name, address, and contact information

- Box D. Control number

- Box E. Identification information about the employee such as their name, address, and contact information

- Box 1-20. Information about actual wages and taxes paid, e.g., social security wages, Medicare wages and tips, social security tips, federal income tax withheld, and more.

Watch the video below to see the step-by-step process of filling out the W-2 form in pdfFiller:

Special Reporting Situations for Form W-2

The IRS instructions list a number for special reporting situations for form W-2, as follows:

- Adoption benefits – Amounts paid or expenses incurred by an employer for qualified adoption expenses under adoption assistance program are not subject to federal income tax withholding and are not reportable in Box 1 of the form. However, these amounts are subject to social security, Medicare, and railroad retirement taxes, and must be reported in Boxes 3 and 5.

- Agent reporting – An agent who has an approved Form 2678, must Employer/Payer Appointment of Agent, should enter the following in box c in form W-2:

(Name of agent)

Agent for (name of employer)

Address of agent - Archer MSA – An employer’s contribution to employee’s Archer MSA is not subject to federal income tax withholding or social security, Medicare, or railroad retirement taxes if it is reasonable to believe at the time of payment that the contribution will be excludable from the employee’s income.

- Clergy and religious workers – For certain members of the clergy and religious workers who are not subject to social security and Medicare taxes as employees, boxes 3 and 5 of Form W-2 should be left blank.

- Deceased employee’s wages – If an employee dies during the year, you must report the accrued wages, vacation pay, and other compensation paid after the date of death. Also report wages that were available to the employee while he or she was alive, regardless of whether they were actually in the possession of the employee, as well as any other regular wage payment, even if you may have to reissue the payment in the name of the estate or beneficiary.

- Designated Roth contributions – Under section 402A, and participant in section 401(k) plan, under a 403(b) salary reduction agreement, or in a governmental 457(b) plan that includes a qualified Roth contribution program, may elect to make designated Roth contributions to the plan or program in lieu of elective deferrals. Designated Roth contributions are subject to federal income tax withholding, social security, Medicare and railroad retirement taxes, and must be reported in boxes 1, 3, and 5.

- Educational assistance programs – Employer-provided educational assistance up to a maximum of $5,250 is excludable from an employee’s wages only if assistance is provided under an educational assistance program under section 127.

- Election workers – Report on Form W-2 payments of $600 and more to election workers for services performed in state, country, and municipal elections. File Form W-2 for payments to less than $600 paid to election workers if Social Security and Medicare taxes were withheld under Section 218 (SSA agreement).

- Employee business expense reimbursements – generally, payments made under an accountable plan are excluded from the employee’s gross income and are not reported on Form W-2. Payments made under an accountable plan are subject to federal income tax withholding, social security, Medicare and railroad retirement taxes, if applicable.

- Health savings account (HSA) – An employer’s contribution to an employee’s HSA plan is not subject to federal income tax withholding, social security, Medicare and railroad retirement taxes (or FUTA tax) if it’s reasonable to believe at the time of payment that the contribution will be excludable from the employee’s income.

For more information on special reporting situations for Form W-2, please see the General Instructions for Forms W-2 and W-3.

How to Submit a W-2 Form to the IRS?

Submit your completed W-2 form PDF to the Social Security Administration at the following address:

Social Security Administration

Data Operations Center

Wilkes-Barre, PA 18769-0001

You can also fill out the W-2 form online and submit it to the IRS using pdfFiller. It allows you to fill out any tax form on any desktop or mobile device. Once you’ve finished filing the form, share it in a few clicks. It’s possible to send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.