Tax evasions cost the U.S. government approximately $460 billion per year and is an illegal activity in all developed countries. “Forgetting” to report income could result in a prison sentence. In this blog post, we’ve collected 10 examples of some of the largest tax crimes in American history.

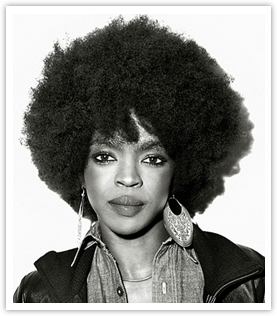

In May 2013, Grammy-winning singer Lauryn Hill was sentenced to 3 months in a minimum security prison in Danbury CT. She was accused of failing to pay taxes on her income of more than $1.8 million for the period of 2005 to 2007. Ms. Hill claimed she was going to report her income but couldn’t afford to because of needing money to raise her 6 children.

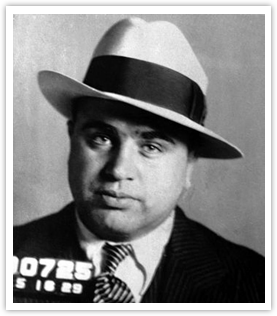

When Americans hear the name Al Capone, the first thoughts that come to mind are that of violence, theft and tax evasion. Also known as Scarface, Capone was indicted for evading more than $270,000 (over $4 million in today’s dollars) of taxes and sentenced to 11 years in prison in 1931. Capone spent most of his sentence at the then-new Alcatraz federal penitentiary.

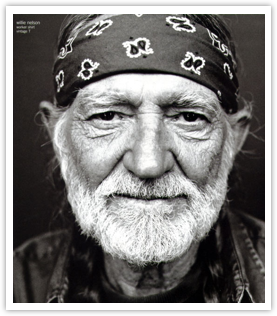

In 1990, the IRS claimed that American music icon Willie Nelson owed about $32 million in unpaid taxes. He paid this debt in part and released the album called The IRS Tapes: Who’ll Buy My Memories?.

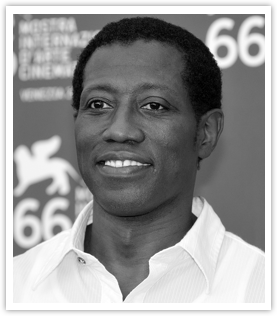

Having earned more than $38 million, Wesley Snipes failed to report his income and what is more, claimed a $12 million bonus refund. He cheated the IRS out of approximately $7 million and was sentenced to 3 years in prison and was ordered to pay a $17 million fine. He completed his term at McKean Federal Correctional Institution in Pennsylvania.

In 1996, Ty Warner, owner of Beanie Babies toys, deposited about $80 million in an offshore bank account in Zurich, SZ. For the next 12 years Warner evaded taxes on his income of more than $25 million that he earned from that deposit. The punishment was a $53 million fine plus an additional $16 million in back taxes. Additionally, the Chicago court sentenced him to probation and community service.

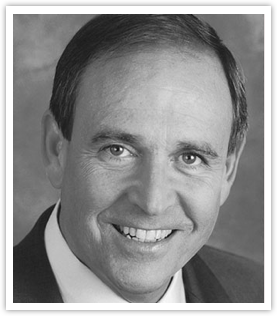

O. J. Simpson, football player/actor

O. J. Simpson, football player/actor

O. J. Simpson was sentenced to prison for 33 years (9 of which without parole) for kidnapping and armed robbery in Nevada. While serving his term at the Lovelock Correctional Center he was accused of tax evasion. Simpson owes more than $1.4 million to the IRS in back taxes.

In April 2012, Lindsey Von, American World Cup alpine ski racer, was accused of failing to pay $1.7 million in taxes. Ms. Von avoided being imprisoned by paying off the entire bill to the IRS. Despite the controversy, Von didn’t stop participating and winning multiple competitions.

In 2005, entrepreneur Walter Anderson was indicted for evading taxes. The income that Anderson failed to report for a 5 year period approached $500 million. This tax cheat was the biggest case against an individual in the history of the United States. Mr Anderson spent 2 years in the Washington, D.C. jail.

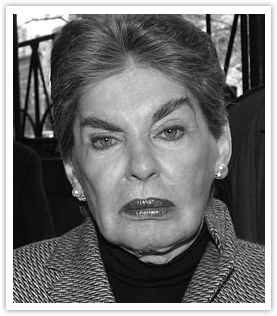

Before going to jail, Helmsley Hotels owner Leona Helmsley said that she didn’t pay taxes because “only the little people pay taxes”. Ms. Helmsley evaded $1.2 million in taxes and was convicted of tax law violations in 1989. Leona served only 21 months of her original 4 year sentence.

Michael Oluwasegun Kazeem, Nigerian citizen

Michael Oluwasegun Kazeem, Nigerian citizen

In November 2017, the list of the biggest tax cheat cases in American history added another name to its annals. A 24 year old Nigerian was indicted for tax crime and sentenced to 7 years in federal prison. Michael Oluwasegun Kazeem was accused of stealing more than $11 million from the IRS.