Top 5 IRS Disaster Relief Forms: How to Get Individual and Public Assistance Under Major Disaster Declarations

Let’s face it — disaster happens. And when it does, you need to be ready to deal with the consequences. In this blog, you’ll find in-depth information about the Federal Emergency Management Agency (FEMA) disaster declarations and IRS tax relief for disaster situations. Discover the difference between individual and public assistance and look through the IRS Forms that apply to your situation.

This blog will be helpful for individual and business taxpayers who have suffered from a disaster declared by FEMA.

Table of contents

- What is a federally declared disaster?

- How are disasters federally declared?

- Is COVID-19 a federally declared disaster?

- Tax relief in disaster situations

- IRS tax relief for victims of Hurricane Ida

- Individual and public assistance under major disaster declarations

- Top 5 IRS disaster relief forms

What is a federally declared disaster?

Let’s start with the basics — there are disasters that are both declared and non-declared.

Usually, every disaster begins and ends at the local level. However, sometimes local jurisdictions can’t properly deal with the consequences and recovery. In this case, jurisdictions need to ask state and federal officials for assistance. Mind that no matter how impactful a disaster might be on a community, not every disaster results in a Major Federal Disaster Declaration.

Simply said, a Disaster Declaration is a formal statement by a jurisdiction’s chief public official (i.e. Mayor, County Judge, or Governor) that a disaster or emergency situation exceeds their response capabilities. If a community requires a long-term and expensive recovery, there’s a reason for declaring the disaster at the federal level. This way, a major disaster declaration begins the long-term federal recovery programs to help the survivors, businesses, and public entities.

- Federally non-declared disasters don’t fall under the requirements for a Major Federal Disaster Declaration. As a result, there’s no assistance provided for individuals or businesses. However, the Office of Homeland Security and Emergency Management will contact local partners and non-profit organizations to cover the community’s recovery needs.

- Federally declared disasters do fall under the requirements for a Major Federal Disaster Declaration. Thus, disaster survivors, businesses, and public entities can ask for additional help. Declared disasters allow individuals to apply for FEMA assistance.

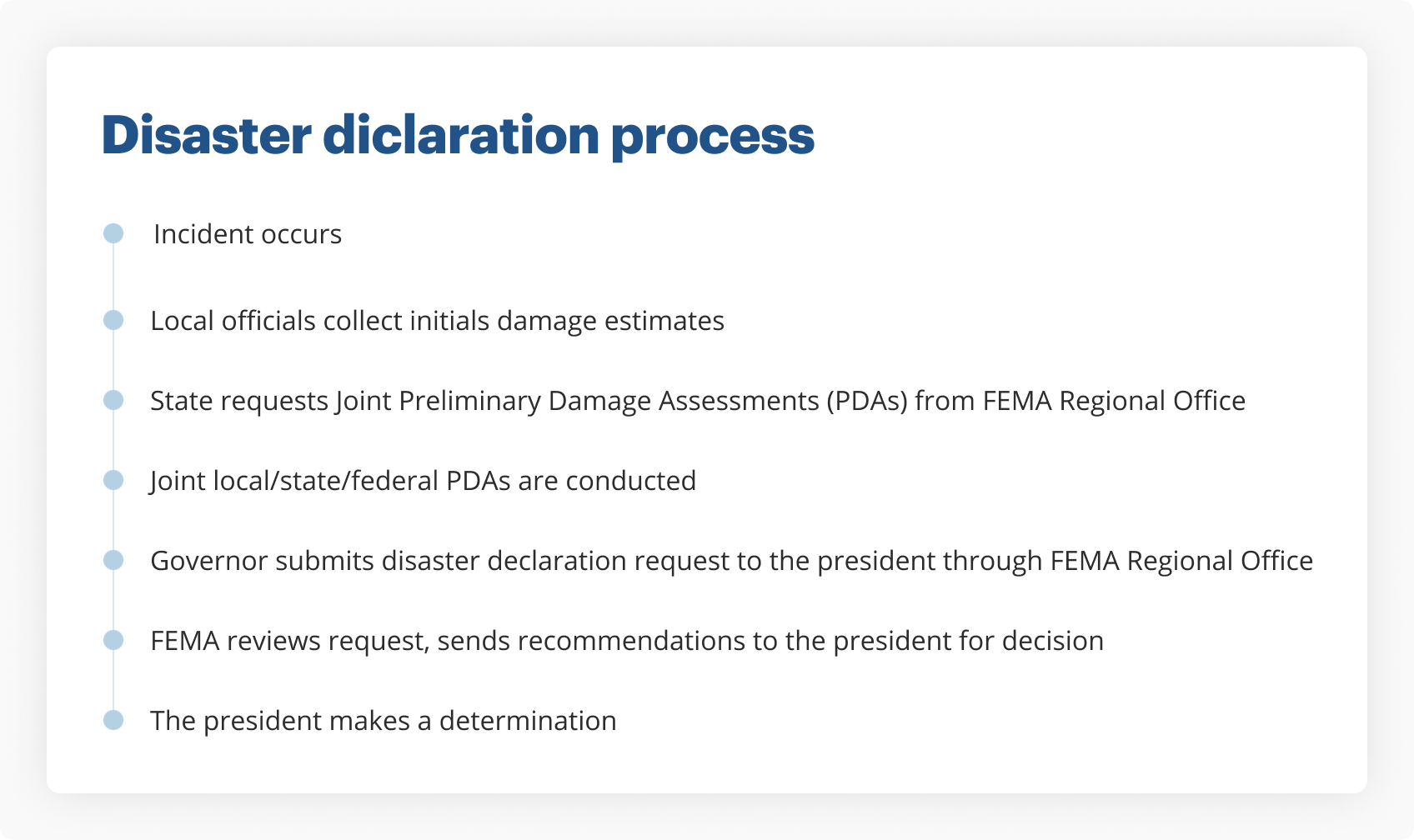

How are disasters federally declared?

FEMA has a complete guide on how a disaster is declared. It covers the steps local governments should take after a disaster strikes:

- Step 1. The U.S. state, tribe, or territory must identify the disaster.

- Step 2. A damage assessment is made to determine the magnitude of damage and impact of disasters.

- Step 3. Government officials review the damage and determine if federal assistance in the form of the FEMA Individual Assistance, Public Assistance, or other federal programs may be necessary.

- Step 4. The governor decides if the state, tribe, or territory has enough resources to respond to the disaster. If not, they determine the type and amount of federal assistance needed.

- Step 5. After that, a major disaster declaration request is submitted to the President of the United States using a special form and a cover letter template.

- Step 6. The President reviews the request and determines whether the state and local governments will need federal assistance to recover from the disaster.

- Step 7. Once the request is approved, and the disaster is declared, FEMA begins to support disaster response with funding, supplies, and personnel. FEMA and local authorities work together to help communities respond, recover, and rebuild.

- Step 8. At the same time, people can start claiming assistance. There are three major types of assistance — Public Assistance (PA), Individual Assistance (IA), and the Hazard Mitigation Grant Program (HMGP).

It needs mentioning that not all programs are activated for every disaster. The most common are Public and Individual Assistance programs:

- Individual Assistance covers assistance to individuals and households.

- Public Assistance covers assistance to state, trivial, local governments, and certain private non-profit organizations.

You can find further information about the assistance types in this post.

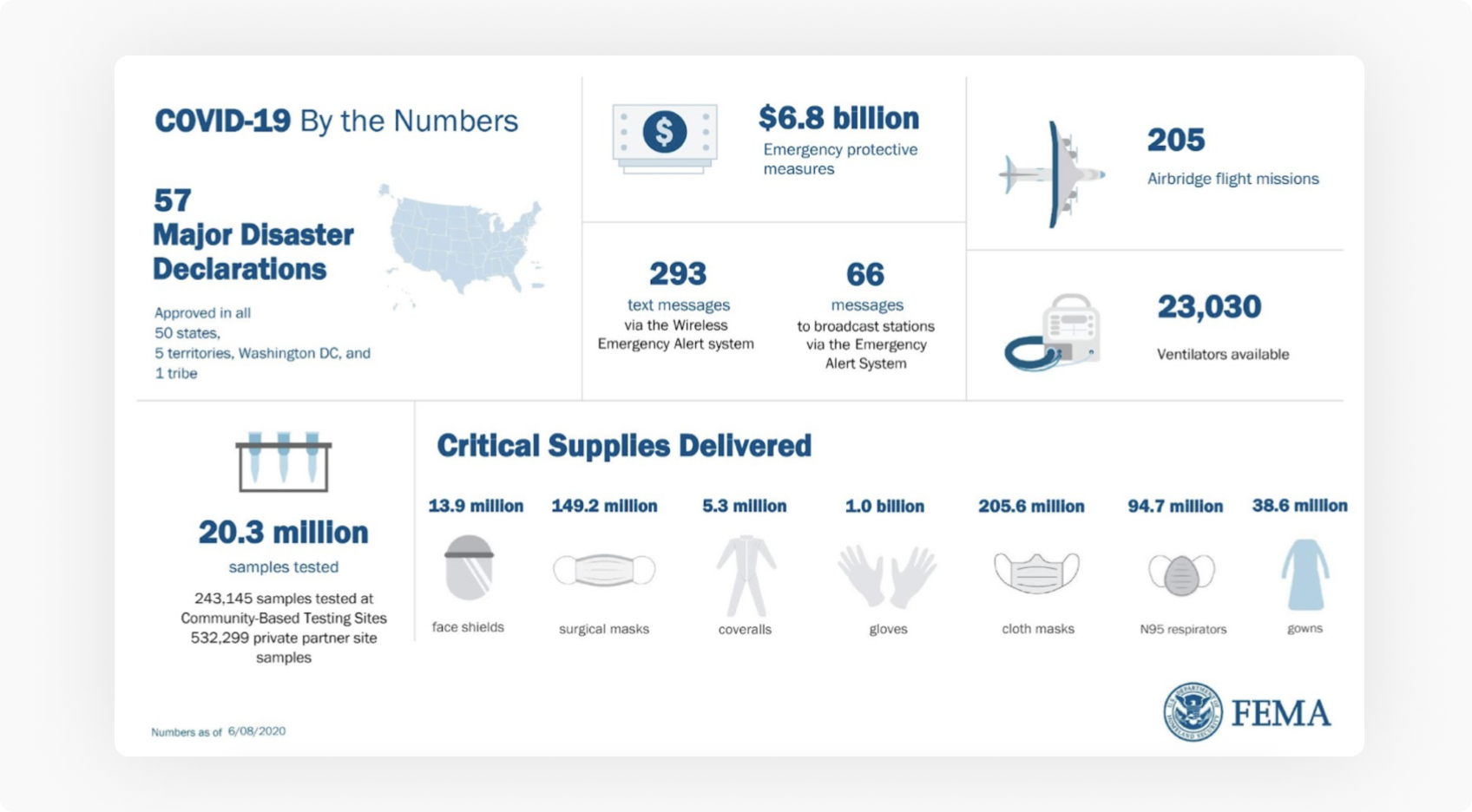

Is COVID-19 a federally declared disaster?

The COVID-19 pandemic is a federally declared disaster, as defined by section 165(i)(5)(A) of the Internal Revenue Code. On March 13, 2020, President Trump declared a national emergency in the wake of the COVID-19 pandemic, according to Sec. 501(b) of the Stafford Act.

A “qualified disaster relief payment” is defined by section 139(b) of the Internal Revenue Code to include any amount paid to or for the benefit of an individual to reimburse or pay reasonable and necessary personal, family, living, or funeral expenses incurred as a result of a qualified disaster. Qualified disaster relief payments do not include income replacements such as sick leave or other paid time off covered by an employer.

All 50 states, the District of Columbia, and 5 territories are approved for major disaster declarations to assist with any additional needs caused by the nationwide taxes emergency declaration for COVID-19.

In total, $3,460,620,398 in Hazard Mitigation Grant Program funds have been authorized for the Coronavirus 2019 (COVID-19) major disaster declarations.

Tax relief in disaster situations

The IRS provides complete instructions for tax relief in disaster situations on its website. You can find the most recent tax relief provisions for taxpayers affected by disaster situations. The IRS provides a natural disasters list, so you need to choose a year and a disaster to apply for your tax relief.

The IRS has also created the Disaster Resource Guide for Individuals and Businesses, feel free to check it. You can also visit the FEMA website to look through the list of areas warranting public or individual assistance programs.

Moving on with IRS disaster assistance, you can deduct the loss or partial loss of personal and business use property on your individual federal income tax return for the year you incurred the loss. If you paid taxes in the tax year immediately preceding the tax year in which the federally declared disaster occurred, you can elect to deduct your loss on IRS Form 1040X (Amended U.S. Individual Income Tax Return) for the prior year instead of waiting to file your current year’s return.

You can also contact the IRS from Monday through Friday to get an explanation on filing and payment relief that may be available by the IRS to disaster survivors. Call the Disaster Assistance Hotline at 1-866-562-5227.

Mind that to determine the amount of your casualty loss, you must:

- Determine your adjusted basis in the property before the casualty.

- Determine the decrease in the fair market value of the property as a result of the casualty.

- From the smaller amounts you determined in steps one and two, subtract any insurance or other reimbursement you receive or expect to receive.

IRS tax relief for victims of Hurricane Ida

To give you a hint, here is some information about tax relief for victims of Hurricane Ida, one of the most recent natural disasters. The IRS has announced that victims of Hurricane Ida now have until January 3, 2022, to file various individual and business tax returns, and make tax payments. This relief extends to any area designated by the Federal Emergency Management Agency (FEMA) as qualifying for Individual or Public Assistance.

Mind that the IRS automatically identifies taxpayers located in the covered disaster area and applies for filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

Individual and public assistance under major disaster declarations

As was mentioned, not all programs are activated for every disaster. The program solution is based on the types of assistance specified in the Governor or Tribal Chief Executive’s request and the needs identified during the joint PDA. There are two primary programs — Individual Assistance and Public Assistance.

#1. Individual Assistance

Individual Assistance is available for individuals and households who suffered from a declared disaster. This assistance may include:

- Individuals and Households Program

- Crisis Counseling Program

- Disaster Case Management

- Disaster Unemployment Assistance

- Disaster Legal Services

- Disaster Supplemental Nutrition Assistance Program

There are several Individual Assistance declaration factors:

- State fiscal capacity and resource availability.

- Uninsured home and personal property losses impacted. There should be a high concentration of damages to individuals. For example, destroyed or damaged housing.

- Disaster impacted population profile special populations. FEMA takes into account the impact of a disaster on special populations such as low-income, the elderly, the unemployed, and so on.

- Impact on community infrastructure. Also, large-scale disruption to normal community functions and services is taken into account (e.g. extended or widespread losses of power or water).

- Casualties. FEMA considers the degree of trauma to the community with attention to many injuries and deaths.

- Disaster-related unemployment. In case of unemployment caused by a disaster, the assistance rendered may be higher or lower.

#2. Public Assistance

As for Public Assistance, it covers the assistance rendered to state, tribal, and local governments and certain private non-profit organizations. It is usually used for emergency work and the repair or replacement of disaster-damaged facilities, including the following:

- A – Debris removal

- B – Emergency protective measures

- C – Roads and bridges

- D – Water control facilities

- E – Buildings and equipment

- F – Utilities

- G – Parks, recreational, and other facilities

There are several public assistance declaration factors:

- Estimated cost of the assistance. FEMA evaluates the estimated cost of federal and non-federal public assistance to give some measure of the per capita impact. FEMA needs a per capita amount to indicate whether a disaster is severe and wide-scale enough to warrant federal assistance.

- Localized impacts. FEMA evaluates the disaster impact at the country and local government levels, as well as at the American Indian and Alaska Native Tribal Government levels. It allows for providing assistance in case of a high concentration of damage, even if the statewide per capita is not met. For example, there can be critical facilities such as major roadways, bridges, public buildings, and more.

- Insurance coverage in force. FEMA takes into consideration the amount of insurance coverage that is in force or should have been in force as required by law and regulation at the time of the disaster. FEMA reduces the amount of federal assistance by that amount.

- Hazard Mitigation. In order to recognize and encourage mitigation, FEMA considers the extent to which mitigation measures contributed to the reduction of disaster damages.

- Recent multiple disasters. To evaluate the impact, FEMA reviews the disaster history of the state within the last twelve-month period.

- Other federal agency assistance programs. Of course, FEMA takes into account the programs of other agencies since they may be more appropriate to the current situation and needs.

#3. The Hazard Mitigation Grant Program (HMGP)

Hazard mitigation refers to any action that reduces or eliminates the long-term risks to people or property from future disasters. FEMA tends to provide funding for eligible mitigation measures that reduce disaster losses. It also:

- Reduces the vulnerability of communities to disasters and their effects.

- Promotes individual and community safety and their ability to adapt to changing conditions as well as withstand and rapidly recover from disruption due to emergencies (resilience).

- Promotes community vitality after a disaster.

- Lessens response and recovery resource requirements after a disaster.

- Results in safer communities that are less reliant on external financial assistance.

If you want to know more about hazard mitigation assistance, please see the official guidance on the FEMA website.

Top 5 IRS disaster relief forms

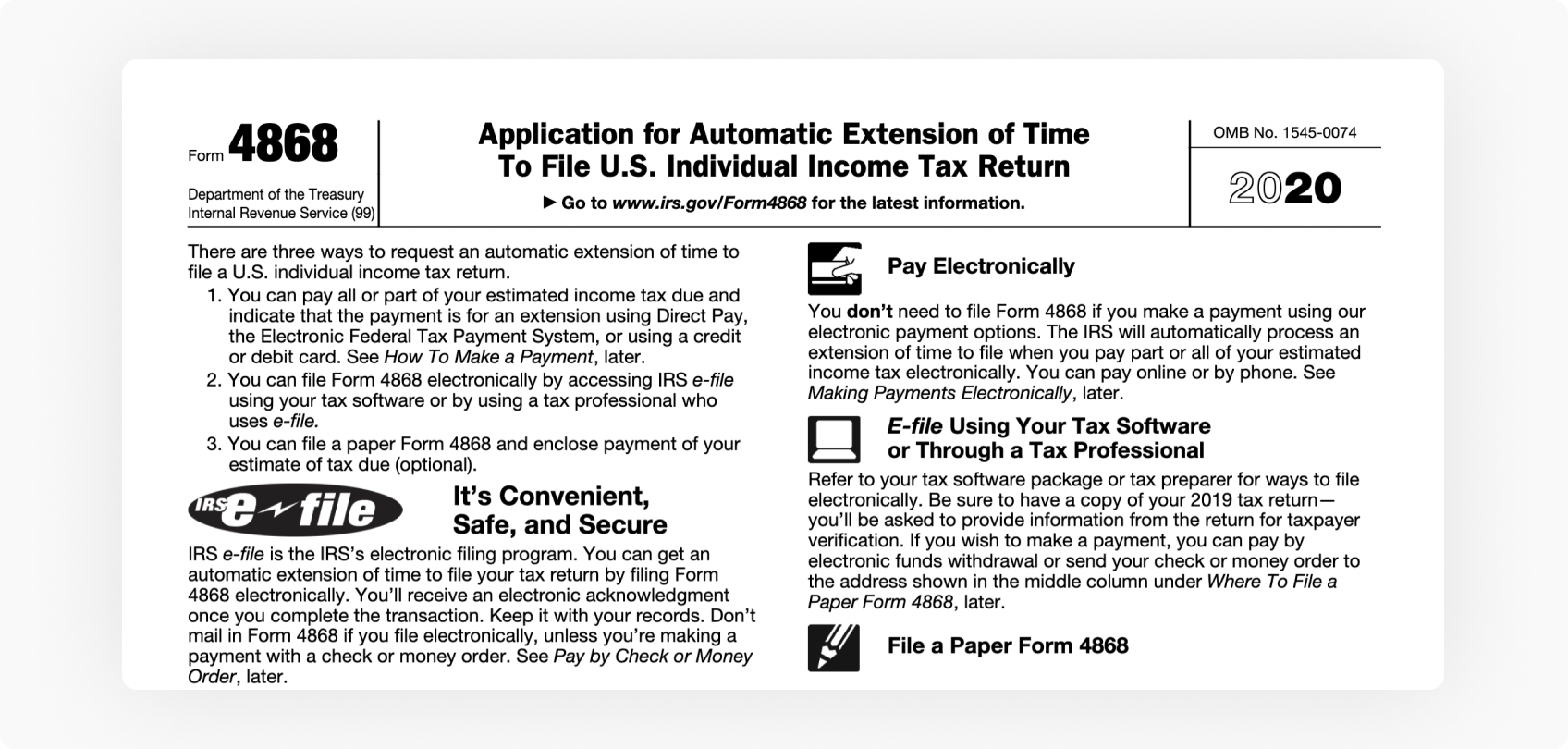

- IRS Form 4868 is filled out by individuals and sole proprietors to apply for an automatic extension for filing an individual tax return. You need to complete and submit Form 4868 before April 15, the regular submission deadline for tax returns. The form consists of two parts — Identification and Individual Income Tax, where taxpayers need to provide their personal information and estimate their tax liability.

- IRS Form 8822 is also known as the Change of Address or Responsible Party Business Form. You need to file this when the mailing address of your business is changed. The form may be used to not only notify the IRS of your business address change but also about the change of the identity of your responsible party.

Watch the video below to learn how to fill out the IRS Form 8822:

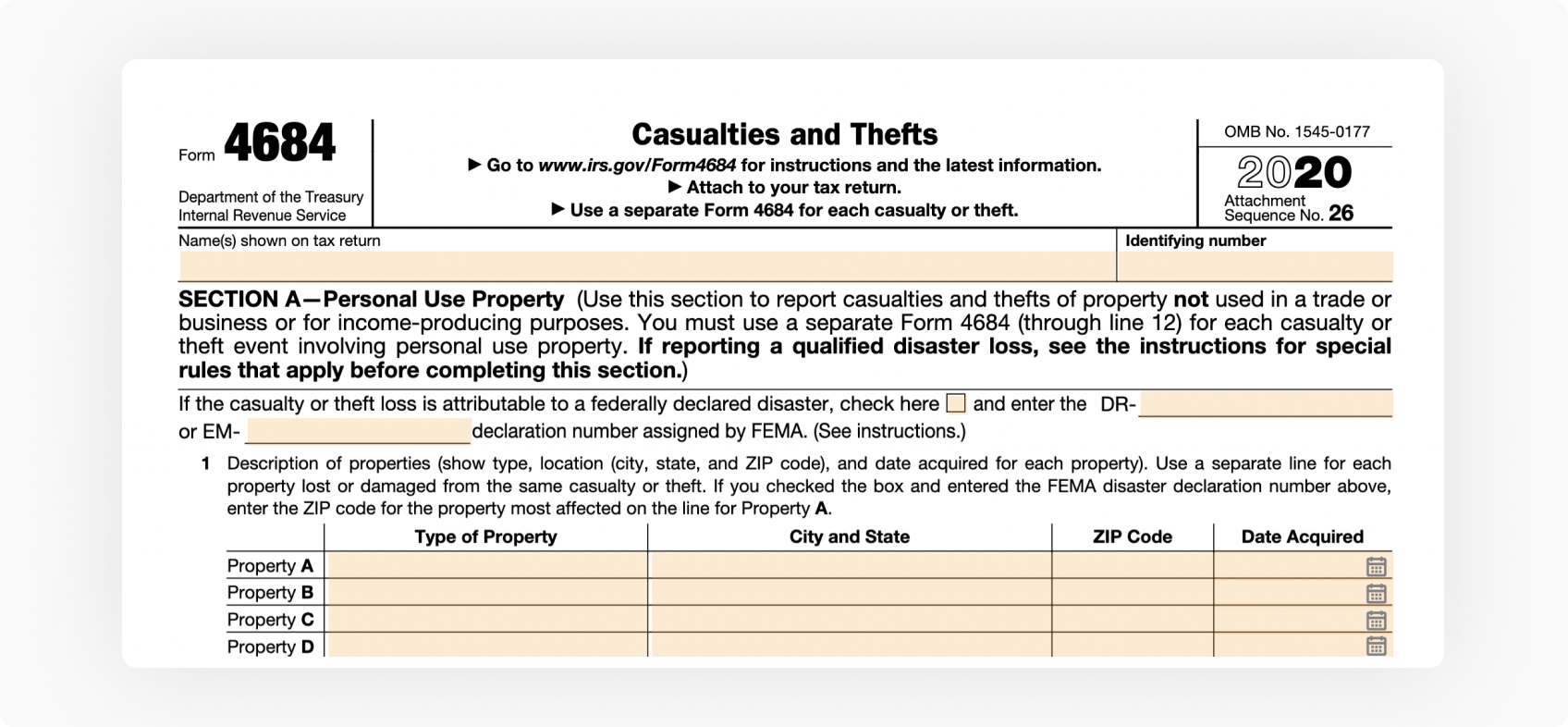

- IRS Form 4684 is filled out if you have a loss attributable to a federally declared disaster occurring in an area identified by FEMA as qualifying for public or individual assistance (or both). Using Form 4683, you can elect to deduct that loss on your return or amended return for the tax year immediately preceding the disaster year.

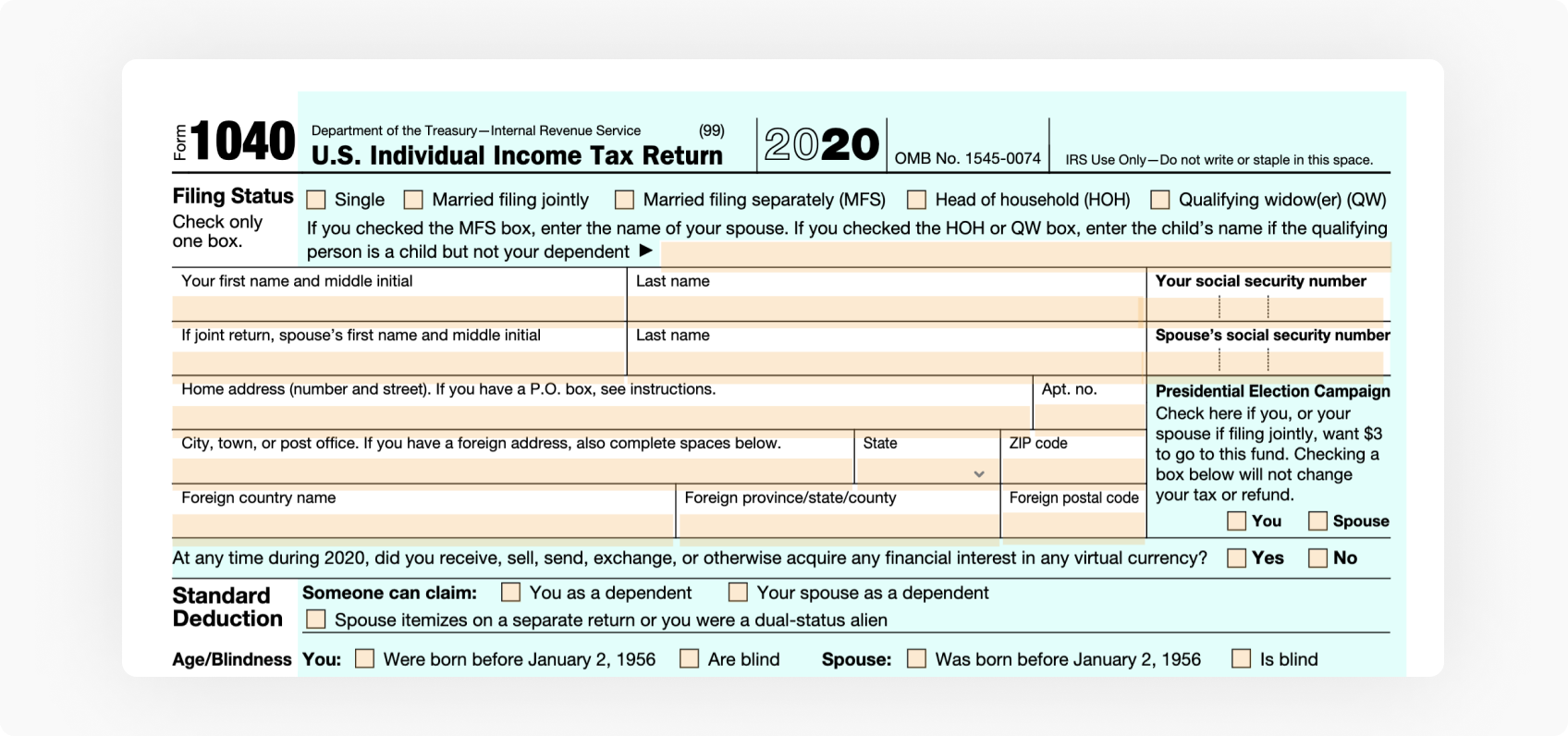

- IRS Form 1040 is filled out by individuals or sole proprietors filing a federal income tax return. You have to use this form to calculate your adjusted gross income (AGI) and taxable income.

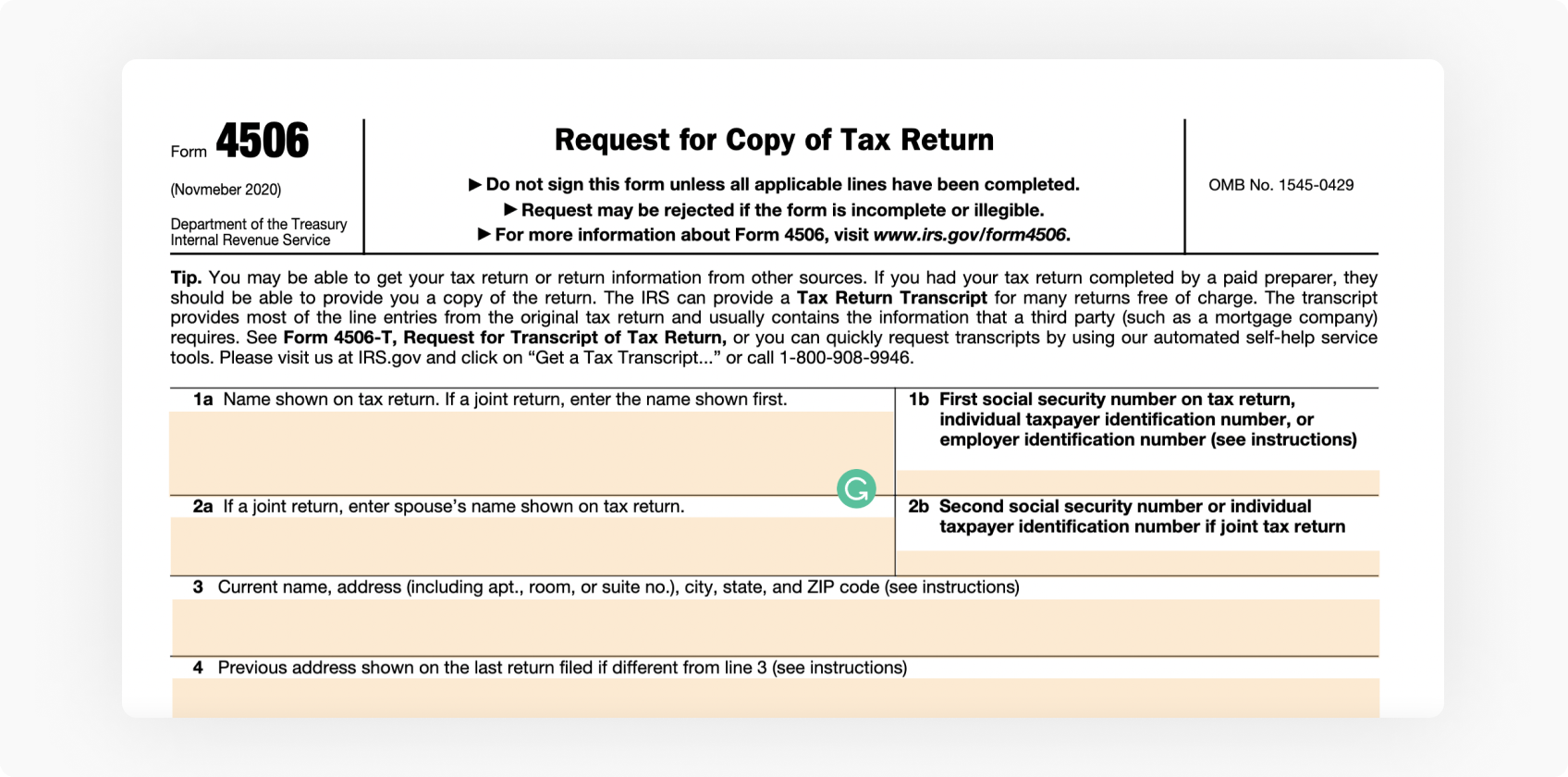

- IRS Form 4506 and IRS Form 4506-T are filled out to obtain an expedited copy of a tax return or tax return transcript. You can use this form to restore tax data that was lost after a disaster. Remember to write the appropriate disaster designation, such as “HURRICANE HARVEY,” in red letters across the top of Forms 4506-T and 4506 to expedite processing and waive the normal user fee.

You can fill out IRS disaster relief forms electronically using pdfFiller. The solution allows you to fill out any tax form on any desktop or mobile device. With pdfFiller, the process of tax relief in disaster situations is fast and easy. Once you’ve finished filing the form, share it in a few clicks. It’s possible to send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.