Fifty years ago, psychologist Jean Baudrillard brilliantly proved that people don’t necessarily pay for the usefulness of a product as once thought. But rather, they tend to be more concerned about its “outer shell.” This means that consumers tend to pay for the prestige they believe the product gives them, rather than for the quality of a product itself. In other words, regardless of how much money consumers make, they very often seem to spend money just for the sake of spending money.

Surprisingly, many enterprises, especially startups, spend and manage their budgets on the same principles as consumers do. Business owners will invest money back into a company, without closely examining the best way to invest it. They operate on the principle that if they invest money anywhere in the company, regardless if it’s needed, then automatically, they will see a quick return on their investment.

This can lead to a company running into financial difficulties. Many business owners will usually blame, for example, the economy or other reasons outside of their control, for their financial troubles. What they forget to take into account is the intricate psychological relationship that consumers and business owners have with money.

Typical patterns of thinking

Psychologists have been able to distinguish at least two personalities people can have in regards to spending and earning money. First, there are those who are more inclined to only spend money. The second group consists of those who know how to both properly spend and earn it.

Over the past few years, new research has given us a deeper understanding of the relationship between what we earn monetarily, and how that makes us feel psychologically. Economists and psychologists from all over the world have observed the links between income and happiness and have come to the following conclusion. People with higher incomes, on the whole, feel like they make more satisfying purchases than those who are struggling financially. But it is more complicated than that. If we dig a little deeper, the findings become a bit more surprising.

Lasting Effect

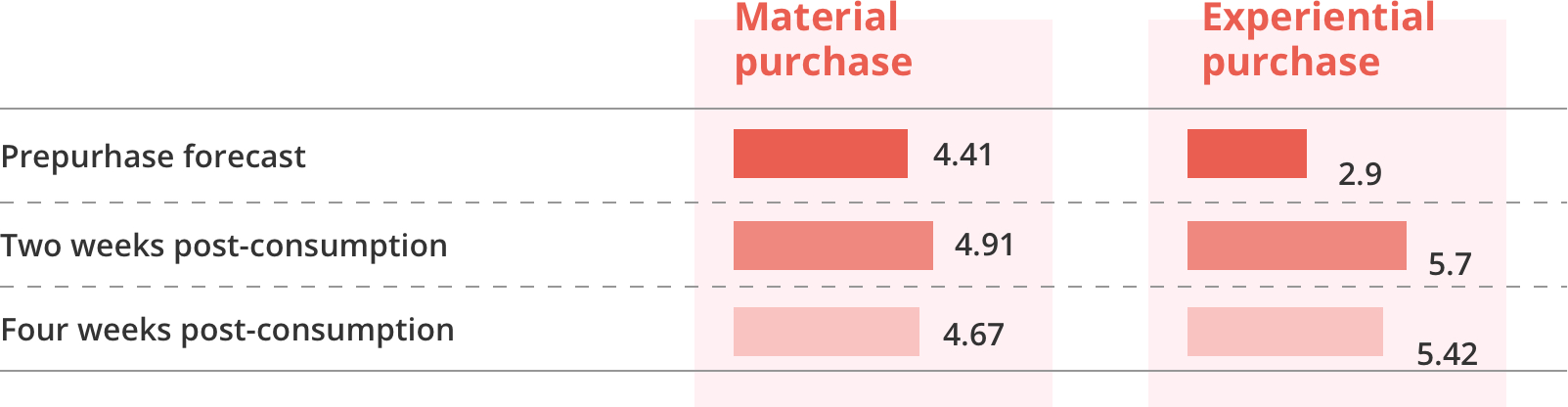

People often fail to accurately predict the economic benefits of experiential purchases compared with material ones, according to one study.

Did you feel your money will be/was well spent?

(1 = not at all; 7 = very much)

Source: The Journal of Positive Psychology, The Wall Street Journal

Later on, researchers were able to coin the term known as the “vicious circle of money shortage.” This is when an individual, even one who is constantly earning more, is not able to build an intelligent relationship with money. Very often, earning more money simply causes the consumer to increase spending and consumption, with little emphasis on saving or investing.

Sometimes, even with businesses and business owners, the situation is just the same. One study revealed that a surprising majority of entrepreneurs incorrectly invested into their businesses once they start making a good profit. They just invested their money into their business at random, without doing the proper due diligence.

There was a common pattern of business owners investing in their business with no clearly defined goal or purpose. They were just investing for the sake of investing. By doing so, they expected to see a quick return on investment and that the value of their business would grow. In reality, the expenses increased and profits fell.

Help your business by cutting costs firsts

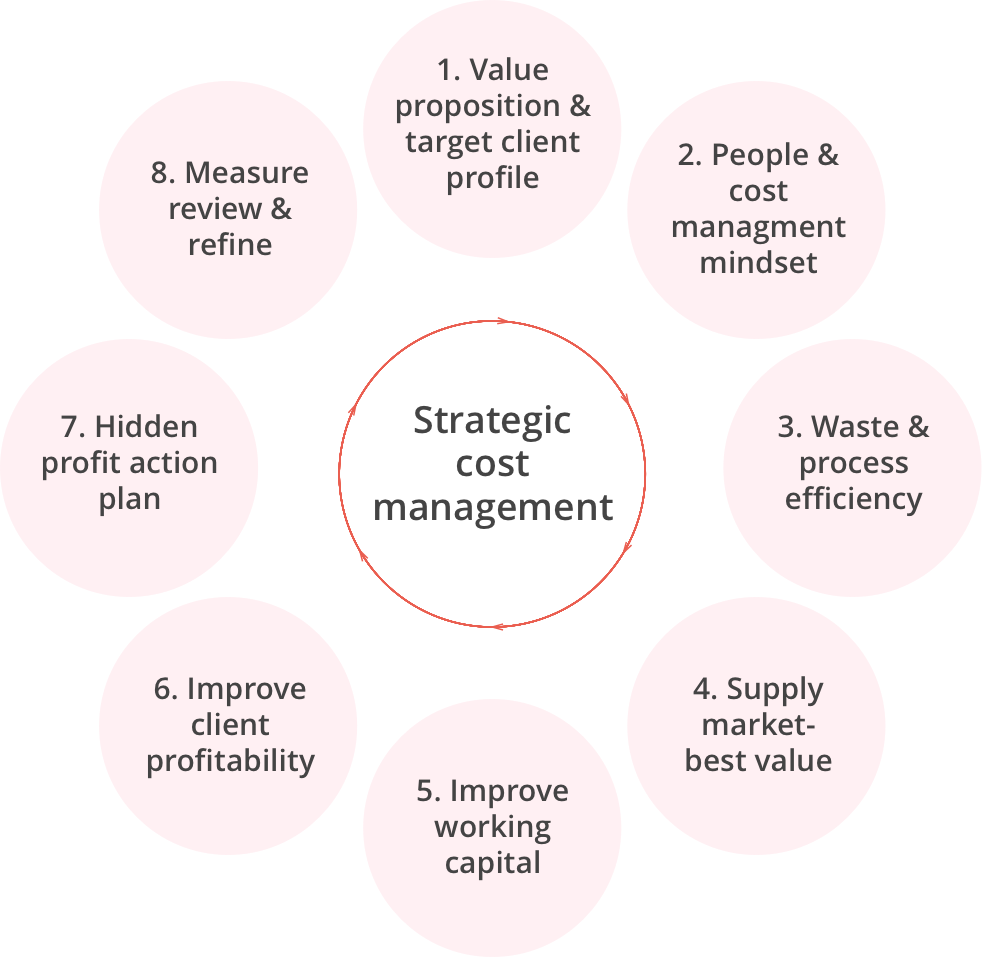

In the beginning stages, one of the main goals of a business owner is to cut costs and eliminate losses as best you can. Classify your costs into clearly marked categories. For example, the different classifications could be divided into the cost of raw materials, labor, production and other general economic expenses. Focus on the most significant costs and find which ones can be either reduced or eliminated entirely. This will help you successfully plan and start cost reduction.

Here are nine effective approaches to reducing costs:

Know what you need: Do not spend more than what your business actually needs. Only invest profit back into your business if you have a clearly defined plan and target.

Concerning new or old partners: Make sure you know when to stay with your current partners and when you need to find new ones. Do your best to stay on good terms with suppliers, contractors and other partners. This is especially important if you have worked with them for a long time. If this is not possible, find a new partner who is more open to cooperation.

Horizontal integration: Develop horizontal integration. This usually involves joint purchases with another buyer from one supplier. For example, two trading companies could come together to receive a discount for a large volume of needed good or materials.

Vertical integration: Develop vertical integration. This involves developing close relationships with suppliers. A good relationship can make a supplier more prone to cut the cost of materials and services when renegotiating prices.

Buying or producing: Find out what your company can produce by itself (such as raw materials) and what is cheaper to buy from other manufacturers.

Renting or owning: Discover if it is more profitable to buy or rent (offices, warehouses, equipment, etc).

Different forms of payment: Look at the most helpful payment options that are available to you when purchasing goods, materials, services etc.

Tightening control: If you set up a tighter control over your expenses, you’ll start to notice those that are useless or redundant. You can then cut those expenses and use the money saved for a more practical purpose.

Process optimization: Check how you can save money and capital through improving your workflow and better organizing other processes in your organization. For example, this could be done by automating workflow and reducing the costs of creating, distributing and signing contracts and invoices.

Use PDFfiller’s complete digital workflow solution to help you save time and significantly cut administrative costs.

Get a 30-day free trial