The W3 Form Transmittal of Wage and Tax Statements, along with W-2, is sent to the Social Security Administration (SSA) on an annual basis. The purpose is to show the total earnings for all W-2 Forms. You, as the employer, are responsible for filing the W3 Form.

pdfFiller helps you fill out every form and sign them online. After that, you can share, print, or email your completed documents. In this post, you’ll find information about when you need to file the W-3 Form and how to fill it out without any mistakes.

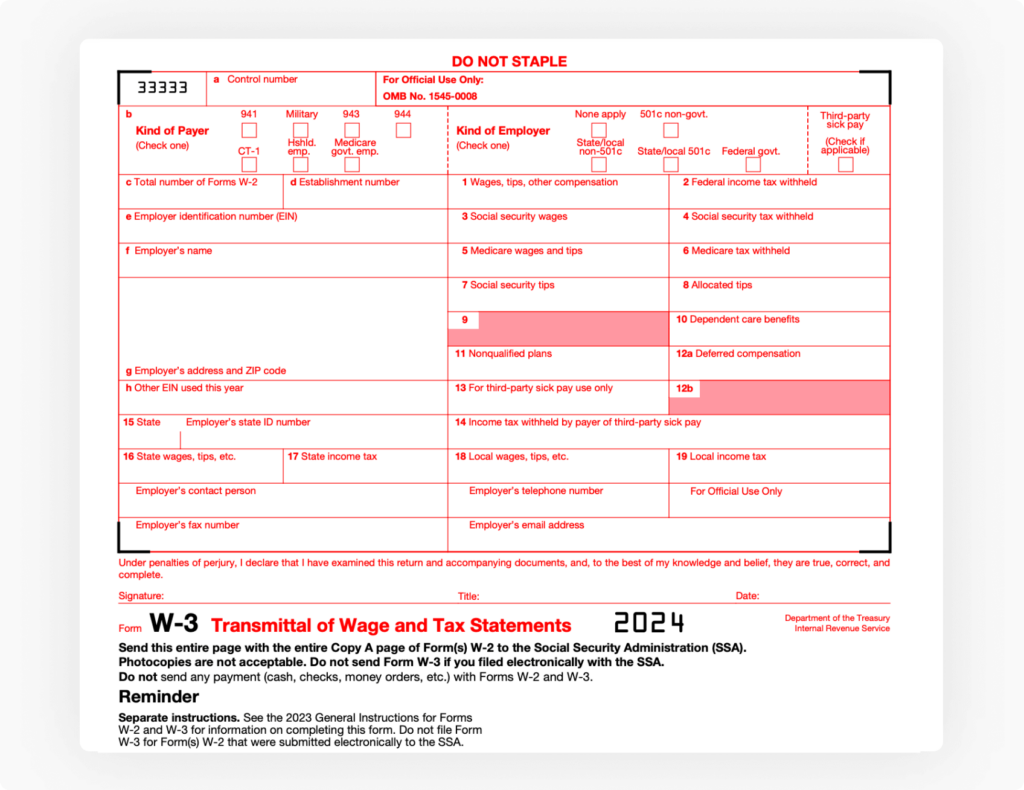

What Is a W-3 Tax Form?

Let’s start with the basics — what is a W-3? IRS and the Social Security Administration (SSA) use Form W-3 to complete and submit an employee’s W-2 Forms.

Tax Form W3 Transmittal of Wage and Tax Statements tends to show total earnings, Medicare wages, Social Security wages, and withholdings for all employees encompassing the entire year.

W3 Form includes:

- Employee’s total income and salary paid by an employer

- The part of a payroll that’s subject to Social Security and Medicare taxes

- The total tax (both income and FICA) withheld from a payment

Employers required to file Form W-2 must also file an IRS Form W-3: Transmittal of Wage and Tax Statements Form. Employees must file W-3 with the Social Security Administration with Copy A of Form W-2.

IRS W3 Form Revision: What Has Changed?

You may have a discrepancy when reconciling Forms W-2 and W-3 to Forms 941, 941-SS, 943, 944, CT-1, and Schedule H (Form 1040) if you utilized any of the COVID-19 tax relief. See Pub. 15 or Pub. 51, the instructions for your respective employment tax form, and the Caution under Reconciling Forms W-2, W-3, 941, 941-SS, 943, 944, CT-1, and Schedule H (Form 1040), for more information.

What Are the Differences Between the W2 vs W3 Forms?

There are a bunch of various “W” IRS forms. To avoid misunderstandings, we’ve compared the W2 vs. W3 Form. At first glance, it may seem that they report similar information, but there are several differences.

The key difference between these two forms is that W-2 shows information like wages and taxes withheld for each employee. On the contrary, Form W-3 reports the wages, taxable wages, and taxes withheld for an employer.

Form W-3 collects information about several employees from their W-2 Forms. As a result, each employee must fill out a W-2 Form, while the employer files a W-3 Form once for multiple employees.

When is W3 Form Due?

You must file forms W-3 and W-2 with the Social Security Administration by January 31 of the calendar year following the tax year. Of course, it’s possible to mail or electronically file these forms. For example, you can file and submit these forms via pdffiller.com.

Note: It’s required to send copies of W-2 Forms to your employees by the same deadline.

How to Fill Out W-3 Form

To file W3 Form without any mistakes, you should keep in mind details about your business along with total wages, total taxable wages for Social Security and Medicare, total income tax withheld, etc.

Watch the video below to get step-by-step instructions on how to complete Form W-3:

When filling out the W-3 Form, you need to complete the following boxes:

- Box A: A control number box is optional. It’s commonly used for organizing internal records.

- Box B indicates the type of payer and type of employee. If you aren’t sure, check with your accounting department or legal team for what type of payer you are. In most cases, employers pick “941”, referencing IRS Form 941. Small businesses can choose “944” (if they file Form 944). As for the type of employer, select “none apply,” unless your organization is nonprofit.

- Box C: Put the number of W-2 Forms you’re filling out.

- Box D: Since the number of W-2 Forms included in one W-3 can’t exceed 50, you can use box D to show the establishment number.

- Boxes E-H: Identification information such as employer identification number (EIN), employer’s name, and employer’s address and ZIP code.

- Boxes 1-19: All the income and tax information from Forms W-2, you add to Form W-3.

How to Submit W3 Form?

You can fill out the W3 form online using pdfFiller. It allows you to fill out any tax form on any desktop or mobile device. Once you’ve finished filing the form, share it in a few clicks. It’s possible to send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.

Other W3 Form filing options include:

- E-Filing via SSA’s Business Services Online portal

Use the SSA’s Business Services Online (BSO) portal for a faster, more accurate, and secure filing experience. There are two methods available on the BSO portal:

- Create a fillable form online and print copies for submission.

- Upload wage files from your tax or payroll software, and BSO will generate Form W-3 automatically.

For online payments of annual withholding and FICA taxes, Electronic Federal Tax Payment System (EFTPS) is recommended. If using tax software, like Wave, opt for Electronic Funds Withdrawal (EFW) to e-file and authorize payments simultaneously.

- Mailing a paper copy of your W3 form

Small businesses can choose to mail Form W-3, along with all W-2 forms and tax payments. Paper copies of Form W-2 and W-3 must be ordered from the SSA, as they cannot be downloaded from the IRS website. Mail the completed forms and payments to the following address:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

For overnight deliveries to meet deadlines, use this address instead:

Data Operations Center

ATTN: W-2 Process

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997