1098-T Tuition Statement Overview

The 1098-T tuition statement is a mandatory form for every student paying tuition or parents who need to file their tax returns.

The primary purpose of Form 1098-T is to claim tax deductions. On the pdfFiller blog, we review every tax form. That’s why it’s high time to discuss IRS Form 1098-T. All students paying tuition, and/or parents that paid qualified tuition and college-related expenses during the tax year, must file this form with the IRS.

In this post, you will learn what has changed in the 1098-T Form 2021, what is the difference between 1098-E vs 1098-T and how to file the tuition statement properly.

Table of contents

- What is a 1098-T?

- IRS 1098-T Form 2021 revision: what has changed?

- 1098-E vs. 1098-T: key differences to consider

- When is the 1098-T Form due?

- How to fill out a 1098-T tuition statement?

- Where to put 1098-T on the tax return?

What is a 1098-T?

Eligible educational institutions must file this form with the IRS for each enrolled student for whom a reportable transaction is made. Taxpayers who paid tuition and have qualified related expenses should receive a copy of Form 1098-T (Copy B) from the educational institution. Information from the Internal Revenue Service Form 1098-T is reported on the student’s tax return or the tax return of the person who paid the tuition and other qualified related expenses.

The purpose of Form 1098-T is for an eligible educational institution to report tuition payments and other qualified related expenses for enrolled students to the IRS. As it relates to the taxpayer, the purpose of the form is to allow the student, or the person who paid the tuition, to claim a deduction for those payments on their tax return.

IRS 1098-T Form 2021 revision: what has changed?

Colleges, universities, vocational schools, and other post-secondary educational institutions may be eligible educational institutions for filing a 1098-T tuition statement for each student who pays tuition.

The form should be completed for each student who is enrolled in your educational institution for any period (semester, trimester, etc.) in 2021, with the exception of:

- Students who attended courses for which no academic credit is offered

- Nonresident alien students

- Students who have their tuition and related expenses paid or waived with scholarships

As a student, you can receive the Form 1098-T electronically along with other documents (admissions, registration, billings, and direct deposits).

1098-E vs. 1098-T: key differences to consider

Depending on the situation, it’s possible to get both Forms 1098-E and 1098-T. So, the question arises — what is the difference between 1098-E and 1098-T?

Form 1098-E tends to show the amount of student loan interest paid during the year. On the other hand, Form 1098-T displays the amounts the student may have paid to an institution for tuition.

To put it simply, Form 1098-E tends to define a student loan’s interest tax deduction, while Form 1098-T can show any educational credits along with additional deductions.

When is the 1098-T Form due?

Schools should provide the 1098-T tuition statement to students or parents by Jan. 31 of the calendar year following the tax year.

As for schools and colleges, they must file Copy A with the IRS by March 1 (or March 31 if electronically filed).

How to fill out a 1098-T tuition statement?

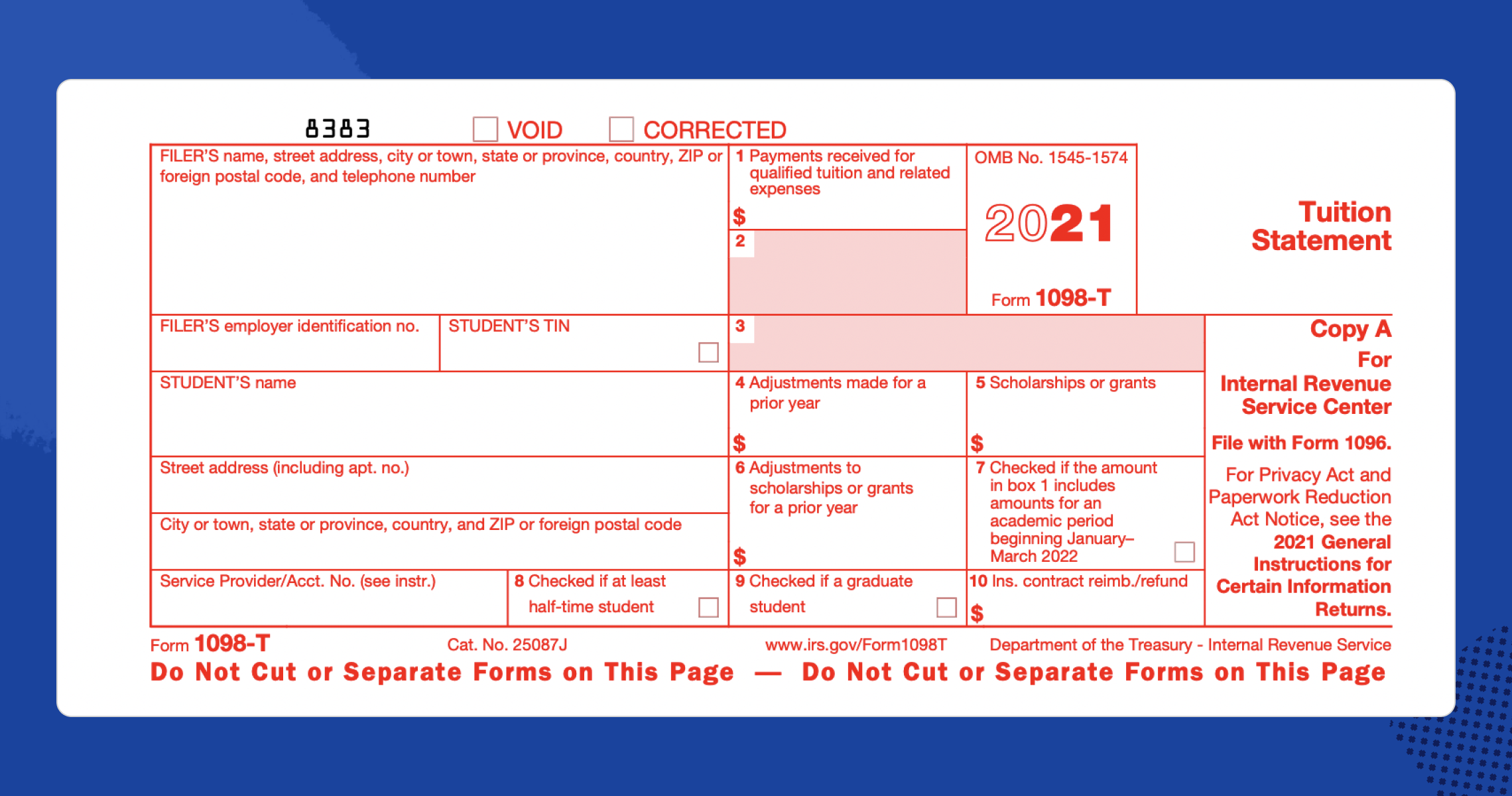

Form 1098-T is short — containing only ten boxes and basic identifying information. However, it can be a struggle to fill out the form. There are 1098-T instructions for each box:

- Filer information. On the left side of the page, it’s required to complete the school’s information including the name, address, phone number, and tax identification number.

- Student information: Below the filer information, it’s necessary to fill out the student identifying information (name, address, and tax identification number).

- Box 1: Payments received for qualified tuition and related expenses from the student.

- Boxes 2 and 3 are no longer used, they’re reserved for future use.

- Box 4: Adjustments made for a prior year by the institution (if any).

- Box 5: Amount of scholarships and grants received by the student.

- Box 6: Adjustments to scholarships or grants for the prior year.

- Box 7: The school checks the box regarding the amounts for an academic period for the future year (for example, a payment made in December for future tuition).

- Box 8: Check the box if at least a half-time student.

- Box 9: Check the box if a graduate student.

- Box 10: Insurance contract reimbursement or refund of qualified tuition and related expenses.

Where to put 1098-T on the tax return?

The primary purpose of Form 1098-T is your tax return. This form helps you calculate two significant educational credits — the American opportunity tax credit and the lifetime learning credit.

Before claiming the education credit, it’s better to study the requirements and ensure that you don’t claim credits twice (both your parents’ return and yours).

You can fill out and send all the required documents with pdfFiller. You can easily fill out any tax form on any desktop or mobile device. Once the document is completed, it’s possible to share it in a few clicks. You can also send a PDF by email, text message, fax, USPS mail, or notarize it online — right from your account.

YOUR DIGITAL WORKFLOW AT ITS BEST!

Start your free 30-day trial of pdfFiller’s fillable form builder, PDF editor & eSignature solution

Originally published February 16, 2016, updated July 19, 2021